One of the main attributes of the developed economy is an advanced system of fundraising. Most of the countries, especially those with developing economies do not have an ecosystem that allows attracting investments for SMEs.

I have already written about the IEO concept that can become an option for SME to attract investments worldwide. In this article, we will discuss STO concept.

STO means Security Token Offering – it is an analog of IPO for classic company shares. The main difference between the two concepts is the fact the company allocates security tokens – digital analog of classic shares.

Why STO Can Create Better Conditions for SME?

When the company launches STO it can raise funds from the investors all around the world without intermediaries. Why is that so important?

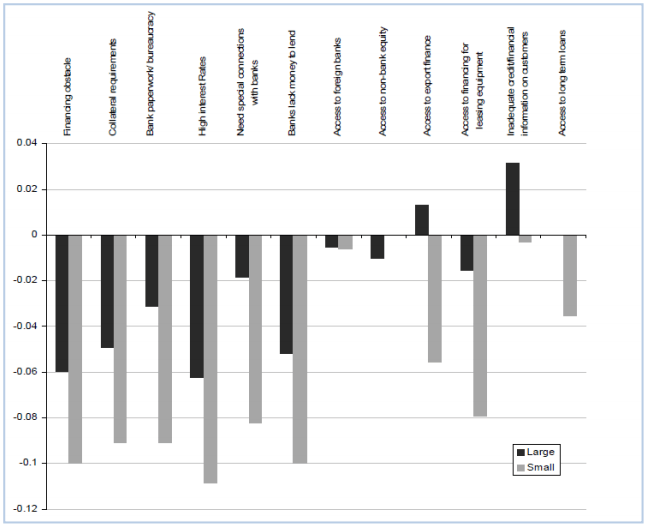

If it comes to corporations, it is rather easy for them to find investments or get loan offers no matter which is the origin country. However, it is much harder when it comes to small and medium businesses.

Most of the developing countries have enforced regulative limitations for SME financing. Banks are more willing to finance large businesses. Thus, it is rather hard to find additional resources for expansion.

Tokenization of assets allows businesses to make more reliable and trustworthy securities that can be traded or transferred in any ways within the fully transparent and immutable network. That means the compliance and regulatory costs decrease dramatically either for the stock exchange, the company and regulator. Today depending on the country and company evaluation it can cost hundreds of thousands of dollars and 12-18 months to go public on the IPO. For STO the costs can be decreased dramatically.

Moreover, unlike with IEO and ICO that are not accepted by institutional investors, STO is a common and preferable concept of fundraising, thus STO can replace ICO for them. And when it comes to institutional investors it comes to billions of dollars that can be invested. However, there can be a number of obstacles for STO raise.

Obstacles to STO Aiding SME

First of all, as security tokens are claimed to be securities they do fall under the regulation of local institutes that deal with financial assets. Thus, it can be demanding to run a proper STO in a country that doesn’t accept this concept properly in the laws.

Thus, there is a probability the majority of SME will choose to get registered in other jurisdictions to launch STOs.

Secondly, STO regulation approaches have not been formulated yet. It appears that this issue is going to be solved together with the major acceptance of cryptos.

At last, STO is still going to cost more than ICO or IEO as the company is still obligated to undergo compliance procedures.

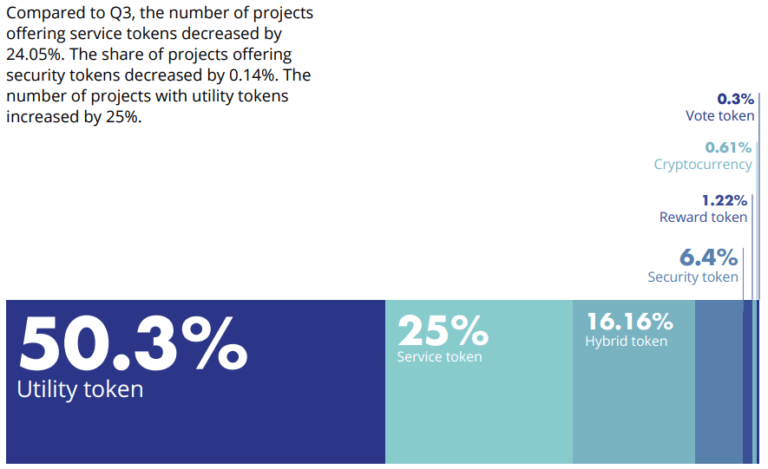

However, all of these issues tend to be solved. The number of blockchain-related projects, choosing STO is somewhere between 6-7% in 2018.

Thus, the broader acceptance of STO is upcoming which is going to have a great social impact on societies all around the world. Today we know there are some countries that are very friendly to STO concept.

Social Effect of STO in Emerging Markets

Acceptance of STO can lead to the democratization of the financial markets for all of us. Now they are mainly accessed by financial institutions and private investors with millions of dollars of turnover. Tokenization of shares can help people build stronger and fairer business relationships. It is going to be much easier to reward workers with tokenized shares for their efforts than to reward them with classic shares.

We can also see the vast development of the sharing economy. The sharing economy is a model that considers the provision of services by individuals to each other rather than by companies. With an ability to tokenize assets and transfer them in a click without the participation of financial intermediaries we can see more p2p services developed.

Editor’s Picks — Related Articles:

Can Cryptocurrencies Ever Become Reliable Means of Exchange?

Successful Social-Oriented Projects That Launched STO

The best evidence of conceptual value are real examples of projects that have brought a benefit to society by using it. Here is a couple of them:

- Gainfy – an inducement-based health care platform. Its investments involve making people healthy and providing convenient access to medical and health resources. Through this platform, users can manage and monetize their medical and health data all in one place. For example, one can get paid for healthy habits.

- Blockport – the original social crypto exchange located in Netherlands. Through its end-to-end platform, issues in crypto trading are being addressed with effective and proven technological, social crypto economic concepts. The company’s goal is to bring the best crypto trading experience possible to users. It aims to make its own Ethereum based token where members can earn when they engage on the platform.

- Nexo – the platform’s functionality allows borrowers to deposit digital assets as a guarantee to obtain credit in the form of fiat currency. The APR begins at 8%, while recompenses can be settled at any time. Even though the Nexo token’s worth was challenged during the crypto winter, it’s lending platform received more than $1 billion in instant crypto credit requests.

Conclusion

Tokenization can make a great impact on the democratization of our society. STO is one more concept acceptance of which is a necessary step in the development of society and economy institutions.

In the Cover Picture: Womna checking up cryptocurrency app. Photo Credit: Unsplash

EDITOR’S NOTE: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com.