Carbon Equity is a climate venture capital and private equity investment platform. Since its inception in mid-2021, Carbon Equity has enabled 400+ investors to invest over €90M across its various climate funds. Most recently, its Climate Tech Portfolio Fund I closed in December 2022, exceeding its target size by raising €42M, 60% above its original €25M goal.

Last week, Carbon Equity launched its new fund, Climate Tech Portfolio Fund II, with a target of €75M.

According to Carbon Equity says Fund II will enable investors to:

- Gain exposure to a portfolio of 150+ climate tech companies across climate sectors such as energy production, industry, food & land use, transport, buildings, and the carbon economy.

- Invest alongside 7-10 world-class climate funds in North America and Europe (early-stage venture capital and later-stage growth and buyout funds).

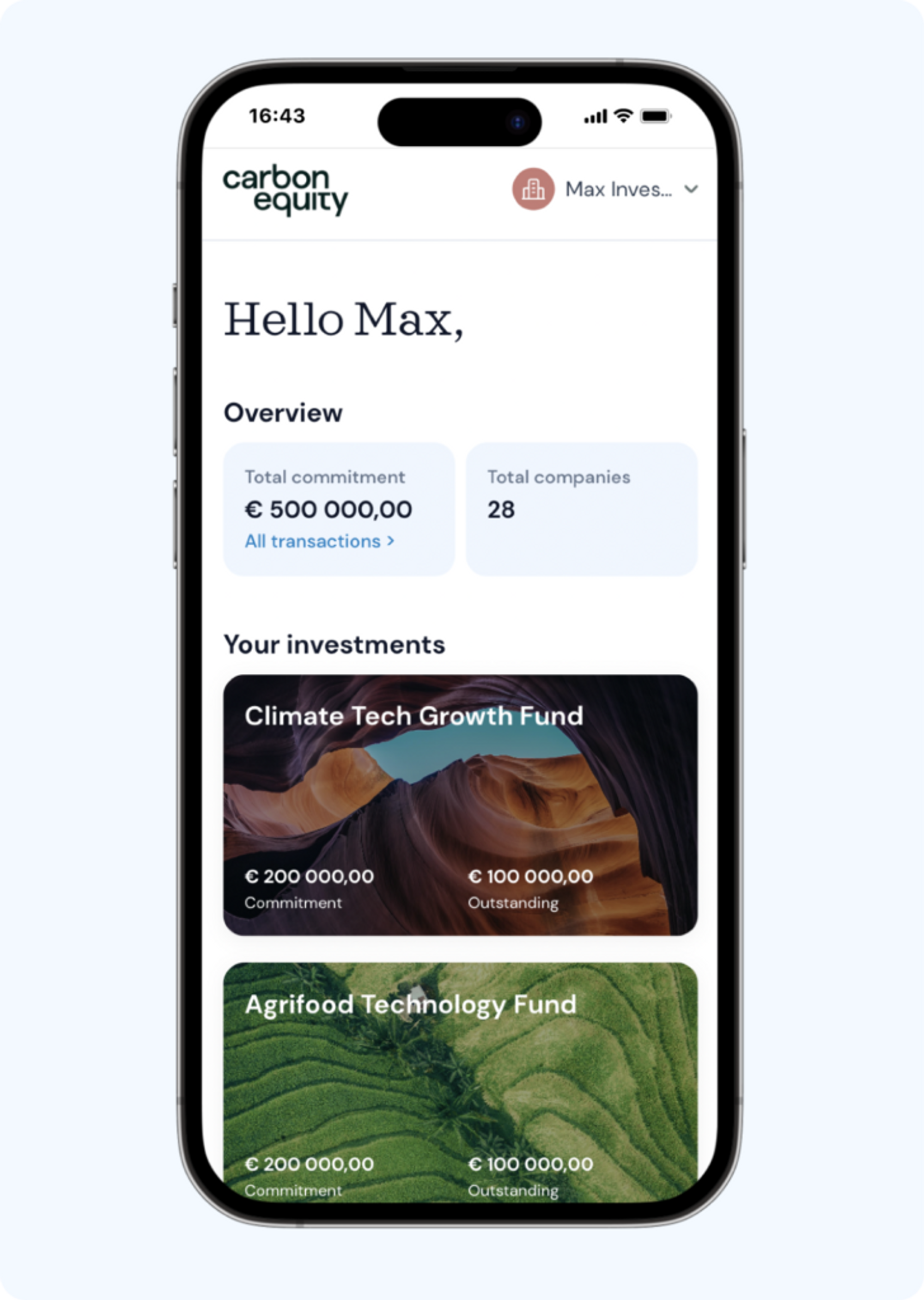

- Track portfolio companies in real time through its app.

Carbon Equity’s Climate Tech Portfolio Fund II is open to investors and will continue fundraising through 2023 or until it is subscribed fully. Jacqueline van den Ende, Co-founder and CEO of Carbon Equity, says, “In the decade ahead, demand for carbon-free alternatives from consumers, companies, and governments will drive a major wave of innovation across all sectors.”

Climate technology has cemented itself as a macroeconomic topic and growth driver for the coming years.

RELATED ARTICLES: What Is Green Finance and Why Does it Matter so Much? | Is $100 Billion in Climate Finance Enough to Offset Climate Damage? | What You Might Not Know About Impact Investing, and How It Can Help Stop the Climate Crisis |

Most individuals have been kept out of private climate investing until now

A report from HolonIQ reveals that climate tech experienced an 89 percent YoY increase in venture capital, totaling more than $70B in 2022.

However, due to high investment thresholds, private investors previously had limited access to venture capital and private equity funds. The Dutch platform aims to bridge this gap for private investors. It will do so by lowering the minimum ticket sizes and simplifying the complex private equity and venture capital space.

“By empowering millions of investors with access to unparalleled climate investing opportunities, Carbon Equity aims to mobilize billions in private capital toward much-needed climate solutions,” says van den Ende.

Through the Carbon Equity platform, investors can invest in world-class funds such as:

- Energy Impact Partners

- Lightrock

- 2150

- Astanor Ventures.

They could also invest in breakthrough climate tech companies such as:

- Form Energy (producing grid-scale batteries)

- Biomason (decarbonizing cement with biotechnology),

- Sunfire (industrial electrolyzers for hydrogen and e-fuel production)

- Current Foods (making fresh seafood made from plants)

Some key facts about Carbon Equity

Carbon Equity was founded by Jacqueline van den Ende, Lara Koole, Jeff Gomez, and Liza Rubinstein. Based out of Amsterdam, Carbon Equity allows regular investors to invest along with experts in top climate venture capital and private equity funds, with a minimum as low as €100,000, and soon €50,000.

With its platform, the company aims to grow a highly motivated community of investors ready to fight climate change with their capital.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — In the Featured Photo: Carbon Equity’s team. Featured Photo Credit: Carbon Equity.