The evidence is in: Global banks don’t fight climate change, they support climate disaster. Despite the warnings coming from scientists on the Intergovernmental Panel on Climate Change (IPCC), they continue to invest in the fossil fuels industry.

Yet warnings have intensified in the last two years, starting with the October 2018 IPCC report on the devastating impacts our world will face with 1.5° Celsius of warming — let alone 2°C. The IPPC report also set out the emissions trajectory the world needs to keep to if we are to have any chance of staying within that 1.5°C limit. By 2030 — only ten years away — carbon dioxide emissions will have to be cut by 45 percent below 2010 levels. By 2050, net emissions must be at zero.

With banks behaving the way they do, it will be very difficult – if not impossible – to stay within that 1.5°C limit. Banks provide all the support the fossil fuels industry needs for its expansion plans in total disregard of the Paris Climate Agreement. The banking sector as a whole is simply aligned with Trumpian climate-denier policies. This is the case in every country, even in China in spite of the government’s declared support for containing CO2 emissions.

The evidence comes from the latest annual report of the Rainforest Action Network (Ran.org) that tracks fossil fuel finance. This is the 10th edition of the fossil fuel finance report card, and it is greatly expanded in scope. For the first time, it adds the lending and underwriting from 33 global banks to the fossil fuel industry as a whole. It reveals the paths banks have taken in the past three years since the Paris Agreement was adopted.

The findings are stunning: Canadian, Chinese, European, Japanese, and U.S. banks have financed fossil fuels with $1.9 trillion since the Paris Agreement was adopted (2016–2018), with financing on the rise each year.

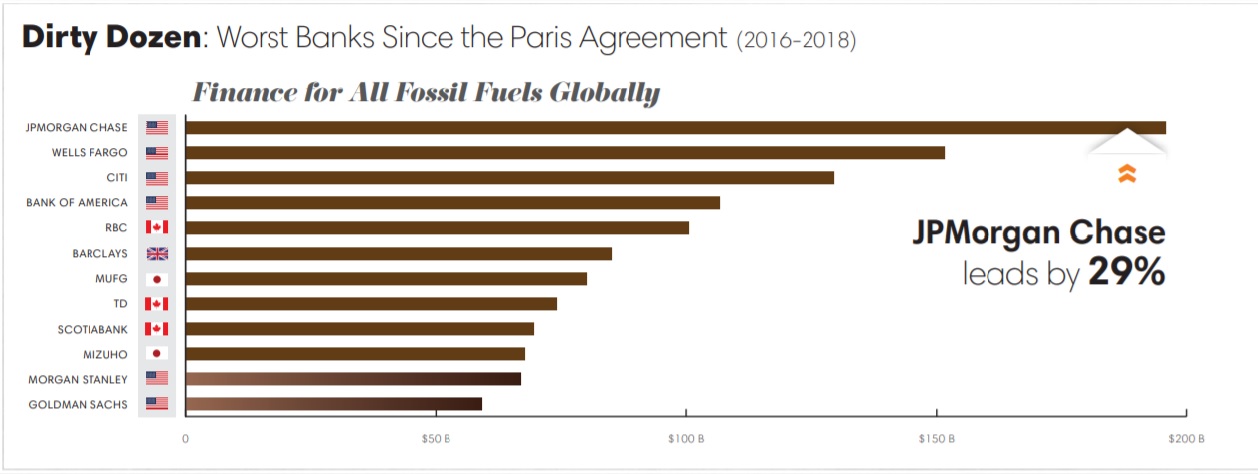

Fossil fuel financing is dominated by the big U.S. banks, with JPMorgan Chase as the world’s top funder of fossil fuels by a wide margin – pouring $196 billion into fossil fuels between 2016 and 2018, nearly a third more than the second-worst bank (also American), Wells Fargo (the bank famously fined$3 billion by the US government for its fake accounts scandal).

In other regions, the top bankers of fossil fuels are the Royal Bank of Canada (RBC) in Canada, Barclays Group in Europe, MUFG in Japan, and the Bank of China in China.

Source: Fossil Fuel Finance Report Card 2019, Ran org.

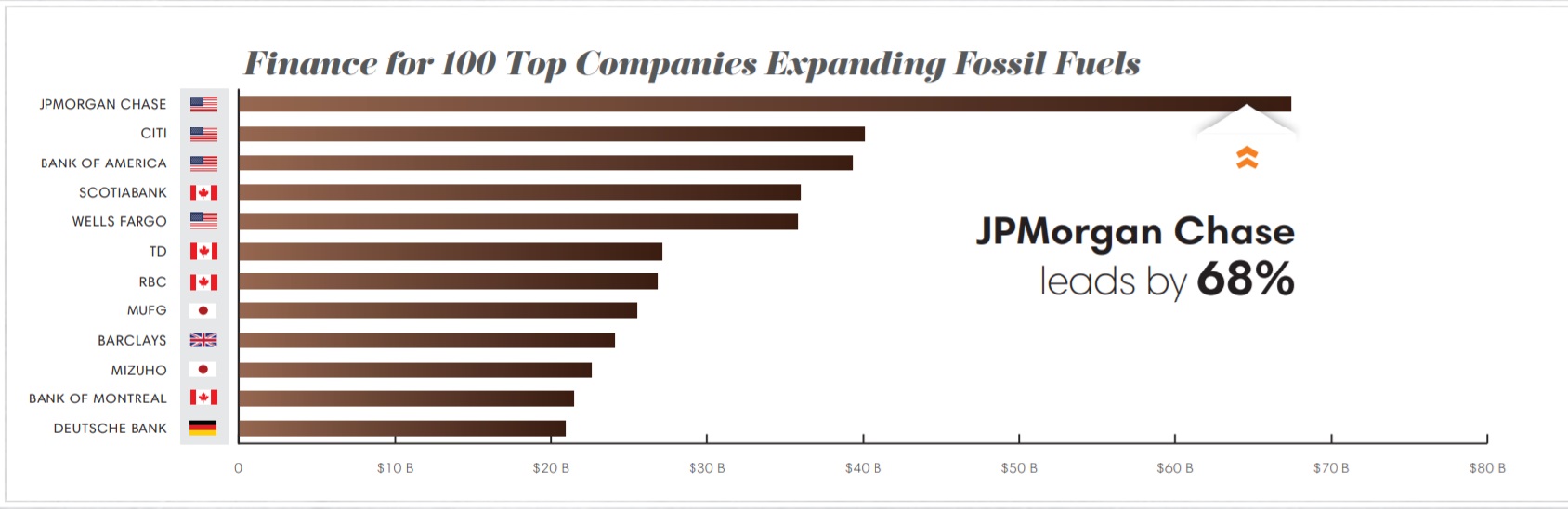

The report card also sheds a light on the banks’ support for 100 top companies that are investing in new fossil fuel extraction, infrastructure, and power. Those companies are expanding fossil fuels, even though there is no room for new fossil fuels in the world’s carbon budget. And yet banks kept supporting these companies with $600 billion in the last three years.

JPMorgan Chase is again on top, by an even wider margin, and North American banks emerge as the biggest bankers of fossil fuel expansion as well. Here, as the report card notes, JPMorgan Chase “sticks out even more as the worst of the worst: the bank’s $67 billion in finance for expansion over the past three years was a stunning two-thirds higher than the second-biggest banker of fossil fuel expansion (Citi).”

Source: Fossil Fuel Finance Report Card 2019, Ran org.

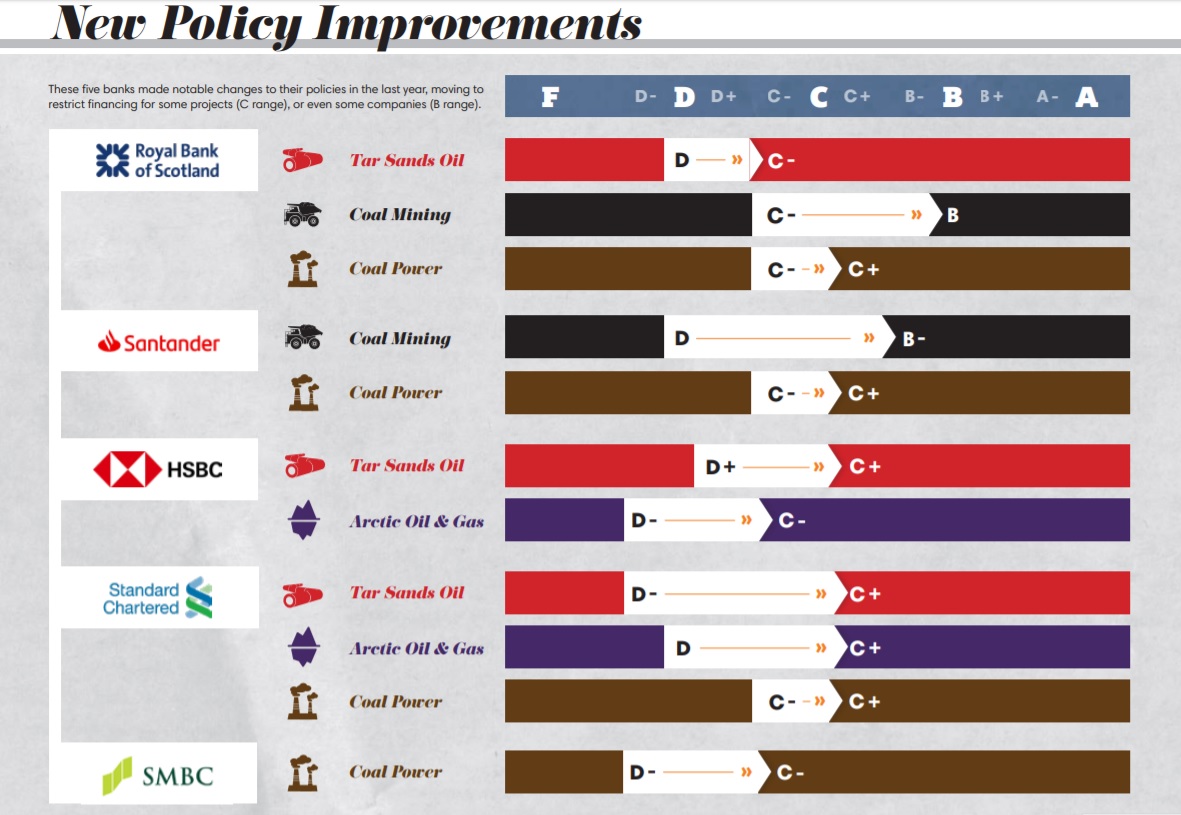

Banks’ overall future policies regarding fossil fuels were also assessed to see whether they planned to restrict financing support for fossil fuel expansion and showed any commitment to phase out fossil fuel financing in line with a 1.5°C trajectory as recommended by the IPPC.

Some banks were found to have taken important steps but overall major global banks were reported to have “simply failed to set trajectories adequate for dealing with the climate crisis”. The report card gave a passing grade to only five banks, none of them American. They were moved from a D grade to a C grade in the 2015-2018 period, indicating a move to restrict financing for some projects and, in a couple of cases (Royal Bank of Scotland and Santander Bank), a B grade, as they cut back on financing some companies in the coal sector:

Source: Fossil Fuel Finance Report Card 2019, Ran org.

As in past editions, this fossil fuel finance report card also assessed bank policy and practice around financing in certain key fossil fuel subsectors:

» Tar sands oil: Here RBC, TD bank, and JPMorgan Chase are the biggest bankers of 30 top tar sands producers, plus four key tar sands pipeline companies. In particular, these banks and their peers support companies working to expand tar sands infrastructure, such as Enbridge and Teck Resources.

» Arctic oil and gas: JPMorgan Chase is the world’s biggest banker of Arctic oil and gas by far, followed by Deutsche Bank and SMBC Group. Worryingly, financing for this subsector increased from 2017 to 2018.

» Ultra-deepwater oil and gas: JPMorgan Chase, Citi, and Bank of America are the top bankers here. Meanwhile, none of the 33 banks have policies to proactively restrict financing for ultra-deepwater extraction.

» Fracked oil and gas: For the first time, the report card looks at bank support for top fracked oil and gas producers and transporters — and finds financing is on the rise over the past three years. Wells Fargo and JPMorgan Chase are the biggest bankers of fracking overall — and, in particular, they support key companies active in the Permian Basin, the epicenter of the climate-threatening global surge of oil and gas production.

» Liquefied natural gas (LNG): Banks have financed top companies building LNG import and export terminals around the world with $46 billion since the Paris Agreement, led by JPMorgan Chase, Société Générale and SMBC Group. The report card highlights that “banks have an opportunity to avoid further damage by not financing Anadarko’s Mozambique LNG project, in particular” – hugely tempting with approximately 75 trillion cubic feet of recoverable natural gas discovered in its 17,000 acre LNG facility on the Afungi peninsula in Cabo Delgado province.

» Coal mining: JPMorgan Chase is not the leader here. Coal mining finance is dominated by four major Chinese banks. For example, in 2018, Agricultural Bank of China, Bank of China, China Construction Bank, and ICBC China were responsible for 71 percent of global bank finance for the coal mining subsector, and 55 percent of coal power finance. But the rest of the world is hardly faring better. The report card notes: “Though many European and U.S. banks have policies in place restricting financing for coal mining, total financing has only fallen by three to five percentage points each year.”

» Coal power: Coal power financing is also led by the Chinese banks — Bank of China and ICBC in particular — with Citi and MUFG as the top non-Chinese bankers of coal power. While there were “some positive examples of European banks restricting financing for coal power companies”, the report card went on to highlight that since fossil fuel companies are increasingly held accountable for their negative impact on climate change and human rights, finance for these companies also “poses a growing liability risk for banks”.

The fossil fuel industry has been repeatedly linked to human rights abuses and these include, as noted in the report card, “violations of the rights of Indigenous peoples and at-risk communities” accompanied by “an ever-growing onslaught of lawsuits, resistance, delays, and political uncertainty”.

The conclusion is inescapable: We know what needs to be done to avert the worst impacts of global warming. Banks must align with what needs to be done by ending financing for fossil fuel industry expansion, in particular in those areas highlighted above, from tar sands exploitation to arctic oil, LNG and coal. Time has come for the banks to commit overall to phase out all financing for fossil fuels on a Paris Agreement-compliant timeline.

For more detailed information: Go to Rainforest Action Network’s “Banking on Climate Change”, Fossil Fuel Finance Report Card 2019 (131 pages), click here.

Featured Image: Drilling operation in the Arctic. The Bureau of Safety and Environmental Enforcement (BSEE) approved in November 2017 a new drilling operation in the Arctic with the object of “achieving American energy dominance” – allowing ENI U.S. Operating Co. (note: ENI is Italian) to drill an exploratory well from a man-made artificial island in the Beaufort Sea. Source: BSEE