The Impakter Index for the Top 100 Financial Institutions in 2020 has just been released. Described as “a practical guide for eco-conscious individuals by empowering them to make better purchasing and investment decisions in their everyday lives”, this particular Index is much more than that. Compared to the first two – covering the Top 100 Global Brands and the Top 100 Global Employers – this is the more important one, potentially a game-changer as it deals with the world’s big banks and thus, inevitably, politics.

The question the Impakter Index seeks to answer has to do with the survival of our planet and our civilization: Are the big banks following Environmental Social Governance (ESG) policies and practices? Or more concretely, are they only pretending to follow the UN Sustainable Development Goals while engaging in unashamed greenwashing?

Money is power and bankers have always played a key role in guiding our society. Historically they have been the allies of ruling elites. Nathan Mayer Rothschild famously financed in 1813-15 the British war effort against Napoleon. But bankers don’t always finance military spending. Their investments can also jumpstart societal change, as was the case with the Florentine banking families – and notably the House of Medici whose bank was founded in 1397 – that quite literally financed the Renaissance.

So can we expect our big modern banks to finance the transition to a more just and sustainable world, helping us to avoid the worst of climate change?

Time is running out on us and the latest UN/International Panel on Climate Change leaves no doubt in this respect. If nothing is done, if banks go on with business-as-usual, giving support to industries that cause environmental catastrophes and social inequities, there is little chance that humanity will be able to save itself.

The banks have a unique role to play: They can help us put behind the legacies of the industrial revolution and prepare for a more sustainable and just future. But they don’t appear to be doing that.

We recently got an inkling of what they are up to when the fossil fuel finance report for 2021 was published by the Rainforest Action Network (ran.org). The report, strikingly titled Banking on Climate Chaos, analyzes fossil fuel financing from the world’s 60 largest commercial and investment banks and found that they poured a total of $3.8 trillion into fossil fuels from 2016 to 2020. Last year’s drop (9%) was merely the result of the pandemic-caused recession. In its executive summary, the report notes: “… 2020 levels remained higher than in 2016, the year immediately following the adoption of the Paris Agreement. The overall fossil fuel financing trend of the last five years is still heading definitively in the wrong direction…”

The Impakter Index covers more than just the 60 largest banks – Impakter uses the S&P Global list for the top 100 financial institutions. So, does the broader coverage change the findings? Or are the banks headed “definitively in the wrong direction”?

The Impakter Index Confirms Banks Headed in the Wrong Direction

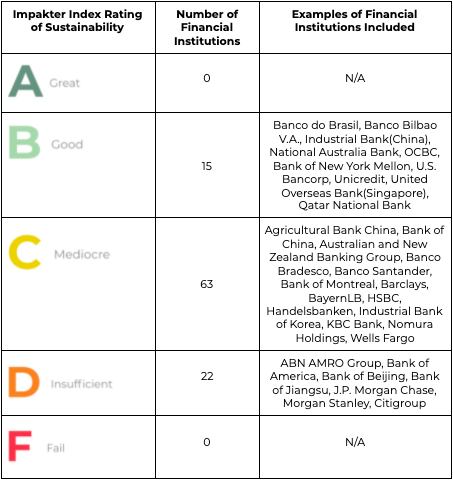

The findings are disheartening: Out of 100 major financial institutions only 15 were found to be on track, helping to bring on a more sustainable and socially equitable world, and not a single one was found to be “great”. We do not have any bank acting as a real leader, ahead of the pack, setting the example.

* For the full list of global financial institutions, see the Impakter Index, click here.

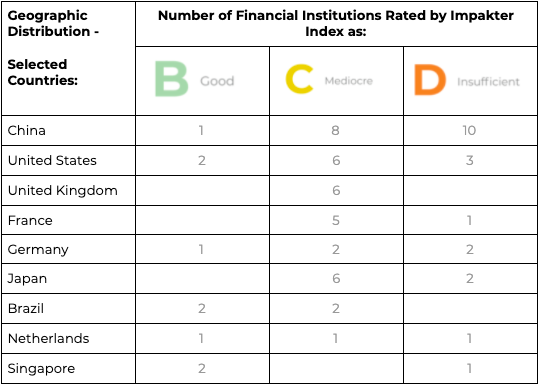

In short, the vast majority – 85 out of 100 financial institutions – were not on track, on the contrary. They either did nothing or paid lip service to efforts to preserve the environment and apply ESG practices. Some of the worst offenders could be found in China and the United States. With China cranking up investment in carbon-intensive projects, it comes as no surprise. And of course, the United States has suffered a 4-year Trumpian setback on its road to sustainability, although now one may expect it to recover the lost ground fast.

Yet even some countries with a sterling reputation and a commendable track record like the Netherlands, Japan, the U.K., Germany or France – countries that adhered to the Kyoto Protocol and supposedly worked to limit carbon emissions since the 1990s – did not always do as well as expected and had some of their best-known banks drowning in a sea of greenwashing. The following table tells the story:

Note: The numbers in this table are for selected countries and do not add up to the totals presented in the preceding table

Most disconcerting are the banks rated “C” (mediocre) by the Impakter Index. The pattern of behavior is repeated for nearly every financial institution found in the C class: 9 out of 10 banks claim to align themselves with the UN SDGs and to work for social justice and the environment. But they do very little of it and report even less. Even when a bank can show that it has financed green industries for an apparently hefty sum – the case for example, of China’s Zheshang Bank that reported financing green industries for a total of some RMB 6.7 billion in 2018 – there is no follow-up in the reporting. In fact, in 2020, the Zheshang Bank provided no accurate ESG or sustainability information and indicated no targets. Hence a well-deserved C.

Another example is the American behemoth Citigroup that was rated D despite an impressive array of ESG activities, planned or carried out. Among them, the remarkable commitment of $1 billion over the next three years to their Action For Racial Equity Project aiming to bring better banking and credit access to communities of color, increase investment in Black-owned businesses, expand Black homeownership, and advance anti-racist practices in the financial industry. One billion dollars is a sizeable sum for a great goal. But it pales against the total $237.477 billion it has invested in the fossil fuel industry since the adoption of the Paris Agreement. So again, a well-deserved D.

In most cases, what happens is that banks spend a few million dollars (or equivalent) on ESG and sustainability; at the same time, they spend upward of tens of billions of dollars in the fossil fuel industry. A difference of a thousand to one – and rarely, in the best cases, ten to one.

The gap is shocking: Our banking system is at the heart of the fight to save our civilization and the planet, and yet, despite claims to adhere to the UN Sustainable Development Goals, it is squarely on the side of the industries causing the disaster.

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com. — In the Featured Photo: Green buildings – Deutsche Bank Responsibility Creator: Marburger / Helbig