To all our other global economic and political ills, there are now prospects of America failing to raise its debt ceiling. To be clear: If the US defaulted on its debt, this would threaten the value of the American dollar as well as bonds and equities – and rattle global markets.

This Damoclean sword looms as the US House of Representatives leadership, seemingly captive to a very vocal minority of the Republican party, expresses intentions to do so, unless there are agreements to very problematic conditions.

On Thursday, US Treasury Secretary Yellen told Congress it had started taking “extraordinary measures” to continue paying the government’s debt obligations. But a resolution is not at hand, and the path to one is likely to be long and arduous.

It is worth noting at the outset that the United States is one of only two countries in the world with a debt ceiling set at an absolute amount rather than a percentage of GDP. The other is Denmark: Since 1993 when day-to-day responsibilities for the public debt were transferred from the Ministry of Finance to the National Bank, a debt ceiling was set as a constitutional waiver.

In the United States, it is more complicated: A separate legislative approval is required to raise the national debt limit. While there have been past years where the US debt ceiling has been threatened, a way through the maze has been found.

But we are in different times: A US-triggered global recession is possible; global financial structures are under threat; globalization is being questioned as greater multipolarity is on the rise; China, the second largest economy is in the midst of an uncontrolled COVID pandemic; we are facing increasingly severe and multiple weather events; and the Russian war in Ukraine has turned into a nightmare affecting economies virtually everywhere.

Further, the emergence of new technologies, such as digital currencies employed by central banks, represents a new and undetermined factor in the conundrum of international financing relationships.

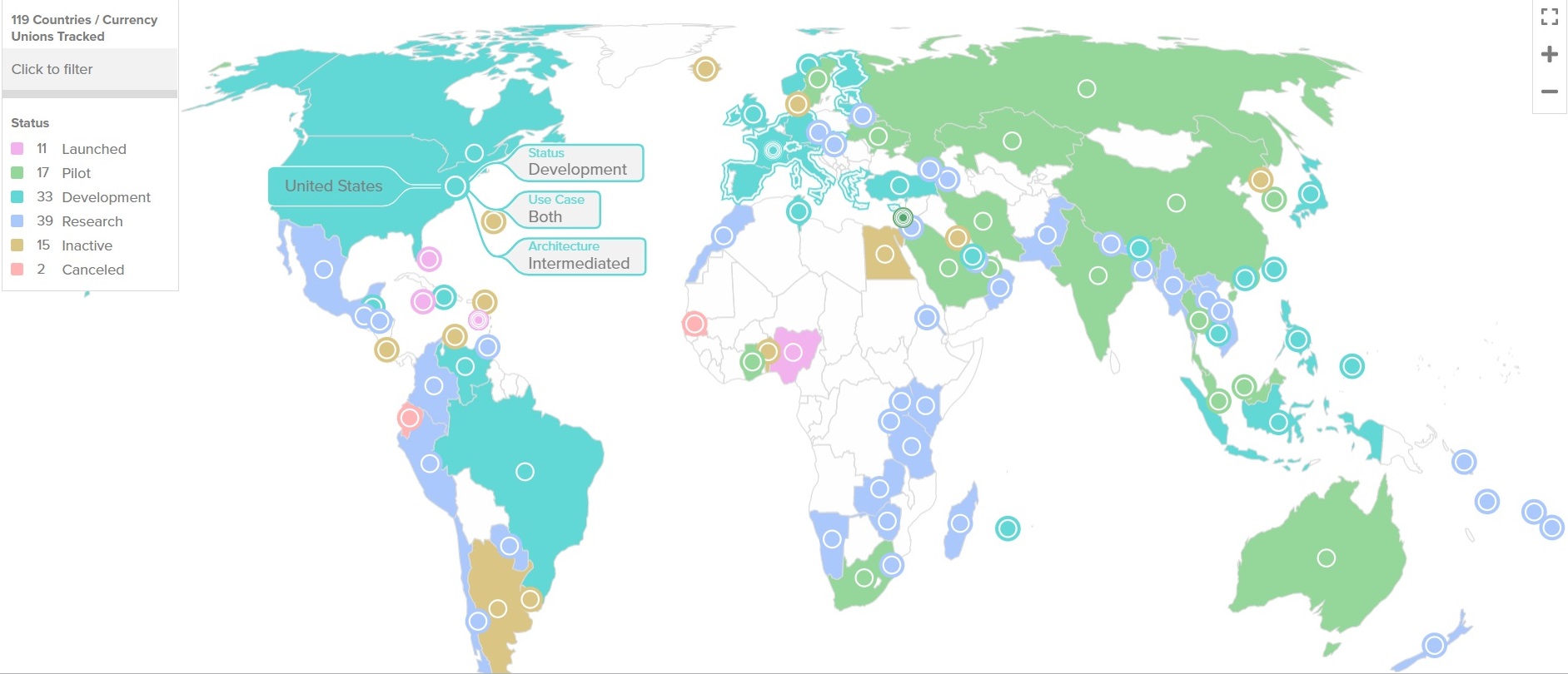

According to the Atlantic Council’s Central Bank Digital Currency tracker, one hundred and nineteen countries are exploring digital currencies, representing 95% of the global GDP:

Some countries including India, Nigeria, and the Bahamas have already rolled out digital currencies.

India’s experiment with digital currencies is a particularly interesting one to watch, given the size of the country. India’s digital rupee allows its citizens to transact in a way that could bypass traditional banks. This shows, potentially, a way for central banks to transfer money to commercial banks.

All this is to say that we are in a very different place than we were in an earlier decade, but we can still learn from the past.

From whatever perspective, the last thing needed is another manmade and avoidable event that can add to exacerbating existing economic problems the world is facing. This is certainly the case for low and middle-income countries struggling with slowing economies, growing national debt, and populations without food security or jobs.

And let me be clear: the aim of this article is not to pretend to delve into the macro and micro economic issues that are far better left to experts, but to turn a bit of a spotlight on potential action by one (big) government that can have spillover effects on many.

While we are in a very different place now than ten years ago, past experience still has value.

Here, we’ll take a brief look at the impact a US delay in raising the debt ceiling had the last time it happened, in 2011, recognizing we are now in a more multipolar environment. This will help, in particular, to gather some insights into what it might mean for low- and middle-income countries.

In this regard, it is worth noting that 66 countries peg their currency to the U.S. Dollar.

Here is a perspective on the effects of possible brinkmanship by the U.S. Congress or, worse still, if it should result in an actual default.

A US Suspension of its Debt Limit

If the U.S. Treasury runs out of borrowing room it would be unable to meet its ongoing government operations and default on legal obligations.

This would raise serious doubts about the nation’s creditworthiness, sap the confidence of lenders, call into question the dollar’s place as a reserve currency, and increase federal borrowing costs. Even going to the brink of default would seriously harm the economy.

The 2011 Debt Suspension Experience

The 2011 debt limit threats had multiple short and longer-term consequences.

China, the then largest foreign holder of United States debt, questioned whether the US dollar should continue to be the global reserve currency, and called for international supervision over the issue of the U.S. dollar.

The downgrade started a sell-off in every major stock market index around the world, threatening a stock market crash in the international markets.

G7 finance ministers scheduled a meeting to discuss the global financial crisis that concerns all countries. The crisis sparked the then most volatile week for financial markets since the 2008 Lehman Brothers bankruptcy and did not recover for half a year.

As was the case then, in the 2011 threat debt ceiling case the cost of borrowing for corporations, government, and non-profits, jumped substantially. That made it both more expensive and more difficult for companies to borrow to make new investments, and similarly, for the public sector to pay for basic services.

It was not a trivial event in any sense, and while albeit not easily measurable per se, devastating for low- and middle-income countries looking for external investors and access to funds to handle ongoing responsibilities.

All this arose essentially from a U.S. domestic political spat but it affected countries everywhere.

Observers generally agree that 2011 is the right analog for analysis, but several analysts, right or wrong, expect this crisis to be worse:

What Happens Now

The World Economic Forum 2023 appears not to have addressed the question in any formal meeting though it may have discussed it, directly or indirectly in an informal meeting – or perhaps sidestepped it entirely.

Or again, it could be tied into the prospects of a global recession or any of the other issues on the agenda. of some future meeting of some other global institution.

But given the widespread economic and humanitarian crises so many less-than-the-rich countries are facing, the breadth of potential damage from the U.S. even flirting with a ceiling on its debt will have a rippling effect on those least needing to have another reason for pessimism.

While U.S. politicians will be focused on their constituency needs, they need glasses with a wider lens: Developing countries without diminishing hope turn out to be future national security concerns.

Hopefully, the United States will avoid adding another issue to the global fire. And those attending the World Economic Forum will ratchet up the pressure on the U.S. to do the right thing.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — In the Featured Photo: US Capitol Source: Greg Willis Creative Commons license