The recently concluded BRICS Summit in South Africa ended with a bombshell: The announcement that six more countries are set to join it by next year: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates.

There’s no denying the hype that engulfed the announced BRICS expansion, as every news outlet competed to report it and every pundit expounded on it.

But how justified is this excitement?

First, consider the breathless claims about an expanded BRICS and how it will change the world:

- The new BRICS will be more important than the G7 since its combined GDP is larger — a point made by none other than the famous economist Jeffrey Sachs in a recent interview, see the video below;

- The new BRICS is set to be an economic game changer thanks to:

- A new currency to be created by Russia that will displace the US dollar and become the world currency of reference in international trade;

- An expansion in its New Development Bank, with its President, Dilma Roussel announcing (August 22) that “5 new sovereign investors [are] expected”; seen as a “historic landmark” at its creation in 2015, the bank is withholding projects in Russia in line with sanctions requirements, but it hasn’t lived up to expectations: the hoped-for $100 billion in paid-in capital, that in principle would enable significant sustainable investments in the Global South have yet to materialize and so far, only a relatively modest $32.8 billion have been approved to finance 96 projects, notably in Brazil and China;

- The new BRICS signals the end of American dominance and the rise of a new Global South led by China and India;

- It also rings in the demise of Western values and ideological dominance as they no longer serve as terms of reference in international relations and international law; this will entail in particular:

- A reset of the role of the United Nations and its cousin organizations, the IMF and the World Bank is in order: They will need to toe the line drawn by BRICS or disappear;

- A fundamental change in the global human rights regime: Built on the Universal Declaration of Human Rights (UDHR), adopted in 1945 in response to the atrocities of the Holocaust, will be replaced by an alternative set of norms based not on “human rights” but on the “right to development” – a concept promoted by China

There is no denying that an expanded BRICS can (potentially) shake the international order, tilting the balance in favor of China (to the dismay of India).

Saudi Arabia and the United Arab Emirates, while US allies, have long been champing at the bit and would like to expand their role in the Middle East and Asia, free from US oversight: now that they have achieved an agreement to restore diplomatic relations with Iran mediated by China (but not approved by the US), the way is open for them to join the BRICS.

So what we may see if Saudi Arabia decides to join (not a done deal yet) is an economic bloc that contains the world’s biggest oil exporters (Saudi Arabia and the UAE) with the world’s biggest oil importer (China); plus Russia, which, along with Saudi Arabia is a member of OPEC+, a group of major oil producers, thus enabled to better coordinate oil output.

As to the other candidates, they also see it as a win-win:

- Iran, a long-time pariah on the international stage with a weak economy hit by sanctions, hopes to gain new friends, aside from Russia (happy to get its drones) and China (happy to get its discounted oil);

- Egypt and Ethiopia, with economies that have tanked, suffering from a dollar shortage and tired of their dependence on the US are actively looking for new partners (and already have strong ties to China);

- Argentina, facing the worst economic crisis in decades with annual inflation over 100%, is desperately looking for new markets and new financing venues like the BRICS New Development Bank, hoping to avoid the IMF.

A new world order? Not so fast

So we are witnessing something of a shake-up in the international order, but that doesn’t mean a big shift, not by a long shot. Certain fundamental geo-political facts remain unchanged and will inevitably govern relations between BRICS member countries even if their leaders meet regularly in an international forum and smile for the press:

- The China-India rivalry is set to continue, with no likely let-up in its border disputes: The problem is an ill-defined, 3,440km (2,100-mile)-long border that both countries dispute; the two countries are also competing to build infrastructure along the border and the latest Chinese map, just issued, only poisons matters further as it includes an Indian state:

- Relations between Iran and Saudi Arabia (and its ally the UAE) are still tense: the two countries are on opposing sides of a more than 1,000-year-old argument at the heart of Islam — between Sunnis and Shia. Iran is largely Shia Muslim, while Saudi Arabia sees itself as the leading Sunni Muslim power;

- Economic links to the West will persist and economic crises only increase dependence as the IMF and investors in the West that continue to act as lenders of last resort: Affected countries find they cannot avoid traditional bailouts from “Western” finance, something Argentina, Egypt and Ethiopia will soon find out, if they haven’t already.

- BRICS institutions cannot replace the equivalent Western institutions: The new BRICS currency doesn’t exist (and probably never will, more about that below); likewise the New Development Bank is a fledgling operation, still very far from rivalling the World Bank.

- One BRICS member – Russia – is engaged in a war in Ukraine that is viewed as illegal under international law and by a clear majority of UN member countries (141 out of 193 members): The UN – and its peace mechanism, the UN Security Council – was set up after World War II to prevent all future wars and its members are not meant to go to war with each other – the fact that some have done so in the past cannot be used as a justification for Russia.

Broadly speaking, these are the five main issues BRICS is facing. You’d expect the BRICS Summit to be the place to address these issues and seek to solve them – yet, remarkably, they generally don’t appear as such on the agenda.

For example, you won’t find any discussion of the border disputes between China and India, even though it is one of the most fundamental war-and-peace issues facing BRICS. But you do find discussion about economic issues. Right now, the biggest concern is the economic consequences of the war waged by Russia.

A top issue for BRICS: The sanctions against Russia

Sanctions placed on Russia following the invasion of Ukraine have continued to be a challenge for BRICS members torn between morality (innocents are killed!), commercial interests (trade is threatened) and remnants of dependence on the West.

A few months ahead of the BRICS Summit (in June), China’s leader Xi Jinping loudly complained that Western sanctions are “weaponizing” the world economy. Perhaps one unexpected result of the sanctions on BRICS was the rise of a new trading partner: Iran. The bloc’s trade with Iran grew by a whopping 14%. Hence the invitation to Iran to join the bloc.

To deal with the sanctions problem, the BRICS concluded that a decoupling from the US dollar was in order. The New Development Bank (NDB) was asked to provide guidance on how a potential new shared currency might work, including how it could help shield other BRICS members from the impact of future sanctions such as those imposed on Russia.

Good luck with that!

While we all respectfully wait for the advice, it is already clear that the NDB has been handed an impossible task. It’s structurally a development bank, not a central bank with the task of managing a currency – even if it does some lending in its members’ currencies, notably the Renminbi but also the South African Rand and it is expected to shortly use the Brazilian Real and possibly the Indian Rupee.

But even assuming it could hire the skills to handle the launch of a new currency, the currency itself is more a chimera than a reality: We now know how hard and how long it has taken for the European Union to create the Euro. And how fragile the Euro still is despite all the efforts of the European Central Bank – the reason for this being the absence of common fiscal policies: Every national treasury in the EU tries to go its own way, continually undermining the Euro.

How can the BRICS members think of floating a common currency when their countries are not even contiguous in many cases? Only India, China and Russia share borders for now and we know what that “sharing” means politically for India and China. Likewise, their economies are widely separate, with nothing like the constant and massive flow of goods and people within the European Union.

True, trade with China dominates the bloc and the Renminbi, at first glance, would appear to be a good candidate to play the role of a “BRICS dollar” (for a snapshot overview, see the box below).

| China’s Trade and FDI with BRICS:

Over the past decade (up to 2022), China has been the top trading partner for every BRICS member with the United States coming in second:

Note: In Europe, China likewise plays an outsize role in European countries: For example, in the case of Germany, the EU’s strongest economy, China is Germany’s top partner (9.5%), followed by the USA (7.5%). Same pattern for Foreign Direct Investment (FDI): China plays a key role in all BRICS members (especially in Latin America and Africa). The exception is India:

|

However, whether the Renminbi can ever be used as a substitute for the dollar is not a decision for China or the NDB. Ultimately (as we now know with the Euro venture), it’s a decision for the markets.

And financial markets are likely to be guided by a couple of inconvenient historical truths:

- India has never played along as much as China would like: In 2021-22, following US diplomatic efforts, the US surpassed China to become India’s top trading partner;

- China’s top trading partner has been and continues to be the US and no BRICS member figures in that top list of trading partners. The only BRICS member that shows up there is (inconveniently) India, and it’s on a par with Germany:

|

|

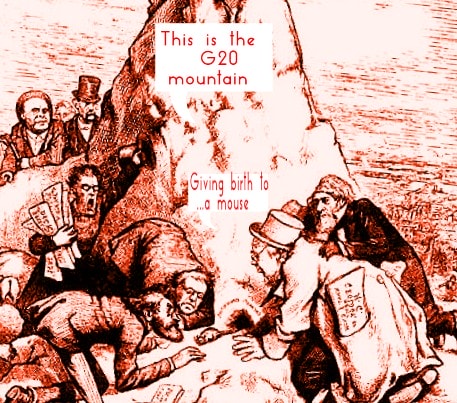

So why are none of the solutions BRICS proposes likely to work? Because so far, BRICS is little more than a forum to air out grievances – it’s far from being the strong international organization needed to address the whole range of problems facing BRICS nations – from economic crises to wars.

What BRICS needs: A permanent secretariat with technical support

BRICS – just like the G7 and G20 – lacks the basic infrastructure needed to function like the United Nations, with a permanent secretariat to organize meetings, coupled with independent technical support.

Such independent technical support – with regular inputs from outside experts – is necessary not only for proper agenda-setting but also, more importantly, for providing the fact-based evidence needed for the BRICS members to make informed decisions.

Every Summit of the BRICS, and likewise the G7 and G20, is organized by the host country’s bureaucrats – not by international civil servants. The technical support is also provided by the host country rather than by an international panel of experts – as is the case, for example, with the UNFCC which relies on a panel of over 1000 climate experts coming from across the world.

So there is a lack of continuity between one Summit and the next. A void is thus created and it is necessarily filled by the country with the loudest voice. In this case, China, though India, of course, won’t have it, and it is also raising its voice equally loudly.

And let’s face it: Even the UN is not working properly, saddled as it is with an unwieldy, inefficient mechanism to avoid war and maintain peace: The UN Security Council which is regularly paralyzed by the veto power of its five permanent members (US, Russia, China, UK and France).

If BRICS is serious about changing the world and giving a strong voice to the Global South, it should adopt a broader vision, taking the best from the UN model and improving on it where it has most notably failed — with the UN Security Council in the area of conflict management.

But is the BRICS really serious about what it wants to do, or is it just one more of China’s diplomatic ploys to expand its markets? The latest Chinese maps enclosing Indian and Russian territory do not augur well for the future.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — In the Featured Photo: Official Photo of the BRICS Leaders taken on 08.23.2023 – From left to right: President of the Republic, Luiz Inácio Lula da Silva, President of the People’s Republic of China, Xi Jinping, President of South Africa, Matamela Cyril Ramaphosa, Prime Minister of India, Narendra Damodardas and Minister of Foreign Affairs of Russia, Sergei Lavrov. Sandton Convention Centre, Johannesburg – South Africa. Featured Photo Credit: Ricardo Stuckert/PR (Flickr).