The record-breaking wildfires and hurricanes of 2020 may not stand out as the worst catastrophes in a year defined by compounding crises. But these natural disasters are among the long list of physical climate hazards becoming more frequent and intense. Globally, natural disasters caused $210 billion in damages in 2020, $95 billion in the United States alone.

Scientific evidence tells us these trends will only worsen as global temperatures rise, taking a toll on human life, infrastructure, economic activity and financial stability — especially if risks continue to go underpriced. By 2100, climate change could cost the global economy hundreds of trillions of dollars.

For businesses, these hazards can cause financial losses from property damage, disrupted supply chains and more. Effectively managing physical climate risks requires that companies and financial organizations first understand them.

The problem is that they may lack the right supporting resources to do so.

WRI analyzed available physical climate risk reporting guidance for businesses from six leading providers, such as the Task Force on Climate-related Financial Disclosure (TCFD) and Sustainable Accounting Standards Board. We found that the guidance doesn’t cover all physical climate hazards; five kinds of hazards — such as ocean acidification and dust storms — are not covered in any of the guidance documents, while others — such as landslides and extreme precipitation — received low levels of coverage.

Related Articles: How to Secure Land Tenure for Women | What Gender-Responsive Adaptation Teaches Us About an Equitable Recovery

Nor does the guidance refer to a comprehensive set of metrics for quantifying physical climate risk. This suggests a lack of a common understanding and approach to identifying and assessing physical climate risks. It’s clear that further work is needed to help bridge science and the private sector on issues of climate impacts.

What’s Missing from Physical Risk Assessment Guidance?

While the field of physical climate risk assessment is still nascent, there are various resources to help companies and financial organizations account for these risks alongside existing risk-management processes. These include analytics services from commercial climate data providers, as well as guidance from voluntary sustainability disclosure initiatives. The ultimate purpose of the disclosure initiatives is to facilitate standard disclosure and greater transparency. To that end, they also provide guidance for measuring and assessing sustainability issues.

We reviewed physical climate risk assessment guidance from six leading disclosure initiatives: CDP, the Climate Disclosure Standards Board (CDSB), the EU Non-financial Reporting Directive (NFRD), the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-Related Financial Disclosures (TCFD).

We looked at how well guidance documents align with the latest climate science and whether they provide robust methodologies to inform assessment. Our analysis, which we present in a new working paper, reveals several important gaps:

- Ambiguous depiction of building blocks for physical risk assessment: The latest climate science from the Intergovernmental Panel on Climate Change (IPCC) tells us that physical climate risk is determined by the probability of a given hazardous climate event or trend occurring, combined with a business’s or financial organization’s level of exposure and vulnerability to the hazard. These three factors — probability of a hazard occurring, level of exposure and vulnerability — are the building blocks of physical risk assessment. Corporate disclosure guidance, however, does not always clearly distinguish between key terms like risk or hazard, or provide a clear, science-based framework similar to the IPCC’s climate risk function for assessing physical climate risk. This may leave companies and financial organizations without a clear understanding of the relationship between the key factors that determine risk.

- 5 hazards are totally excluded: Absent from the six initiatives’ guidance documents are any references to dust storms, ocean acidification, ice melt/permafrost melt, tornadoes or hail. Companies and financial organizations that rely on the initiatives’ guidance to inform their physical climate risk assessments may limit their analysis only to hazards referenced by the initiatives. In that case, they would have a blind spot to potentially costly hazards. For example, hailstorms already cause billions in damages to homes, vehicles and businesses; in April 2020, widespread damage from a series of hailstorms across the U.S. Midwest cost $2.9 billion. Meanwhile, ocean acidification puts some of the most profitable commercial fisheries at direct risk, potentially shrinking global mollusk production by $100 billion by 2100.

- 4 hazards are underemphasized: Other hazards are only included in some guidance documents. Only two initiatives reference extreme precipitation, while only one initiative includes extreme sea level (storm surge), extreme winds and landslides. These risks can be material as well. For example, in 2011, rebuilding from severe landslides in Brazil that killed 647 people cost an estimated $1.2 billion.

- Limited methods for quantifying risk: The market presently lacks standard approaches or metrics for assessing how physical climate hazards may affect a company and its financial performance. It is therefore no surprise that the initiatives’ guidance do not reference a comprehensive set of metrics for assessing the key determinants of risk to the company for each hazard. If they did, they would include metrics or detailed methods to quantify each of the factors in the IPCC’s risk function: the underlying hazard in physical terms (for example, degrees Celsius [temperature], meters per second [wind], millimeter [precipitation]); the entity’s exposure and vulnerability to the hazard; potential impacts of the hazard; and/or a complete risk metric. For most hazards, we did not find a reference to a full set of specific metrics for assessing these factors. For example, within the guidance documents, metrics are only presented for five hazards (flooding, sea level change, sustained temperature rise, water stress and changes in precipitation patterns). The guidance documents do not include hazard metrics for any of the other 13 climate change hazards, and most hazards lack metrics for assessing exposure and vulnerability. While developing these resources may be beyond the mandate of most disclosure initiatives, the fact remains that these resources are not widely available.

What Could Help the Private Sector Respond More Effectively?

Three key actions could strengthen businesses’ ability to identify and assess physical climate risks:

- Better scientific knowledge: If the private sector is to effectively manage climate risks, they need to keep pace with the leading climate science. Currently, few resources are dedicated to tailoring findings from climate science for the private sector. The private sector needs this information in a practical format, with thorough, open-source translations of findings from the IPCC and others presented in their language.

- Better data: Risk assessment is only as good as the underlying data. Many companies and financial organizations simply do not have enough high-quality, open-source, practical data for the physical climate hazards relevant to them. (WRI will soon launch a dashboard of curated data and visualizations on physical climate hazards, accompanied by an explanation of the climate science and potential financial impacts.) Additional work could include translating scientific data into a quantitative hazard index, or downscaling climate models to finer resolutions to enable companies and financial organizations to assess potential exposures across different geographies.

- Better approach: A widely accepted, open-source, science-based framework for physical climate risk assessment — one that’s co-created with private sector actors — could provide common ground for analysis. It should include a standard taxonomy for physical climate hazards and corresponding guiding principles and methods to quantify hazards, exposure and vulnerability. This would parallel the standard frameworks, accounting methods and calculation tools developed by the GHG Protocol for measuring and managing greenhouse gas emissions. These widely used standards are now integral components of emissions-reduction strategies under the Science Based Targets Initiative. A similar approach for physical climate risks would serve as a valuable starting point toward more robust, standardized assessments of these risks and their impacts.

More than Profits at Stake

While financial and economic impacts of climate change often make headlines, the real story of climate change is the human impact. Climate change puts our most basic and essential human needs at stake – from securing food, water and housing, to preserving traditional ways of life. These challenges often fall first and hardest on vulnerable frontline communities who often face structural barriers to effective adaptation.

The task of building more resilient societies and cost-effectively managing the physical climate risks will largely fall on government. But the private sector must play a role, too. To become true agents of climate resilience, firms’ risk-management strategies need to go beyond maintaining business-as-usual. Strategies must consider how to explicitly facilitate benefits for and with local communities.

Developing strategies that meet these objectives requires a more robust understanding of the potential risks from physical climate hazards. Advancing knowledge and capacity around this issue is in the best interest of shareholders and stakeholders alike.

— —

About the Authors: Ariel Pinchot is a Sustainable Finance Associate in WRI’s Finance Center. Lihuan Zhou is an Associate with WRI’s Sustainable Finance Center, where he mainly works on the Sustainable Investing Initiative and conducts research to advance sustainable investment practices in the private sector. Giulia Christianson is a Senior Associate in WRI’s Finance Center, where she leads the Sustainable Investing Initiative.

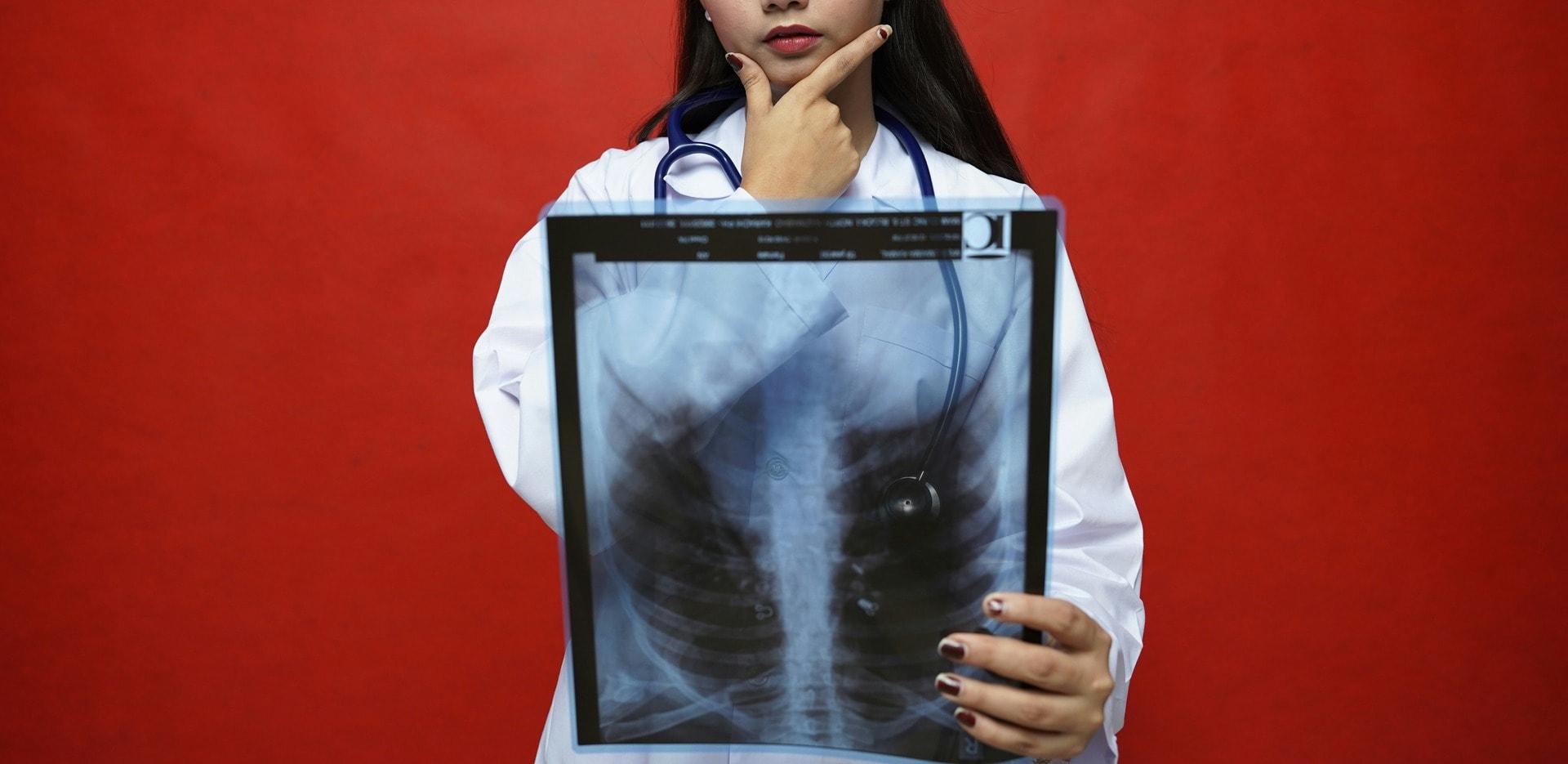

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com. — In the Featured Photo: Dust storms are a hazard of climate change, yet leading financial disclosure initiatives fail to include this and other hazards in their physical climate risk assessment guidance. Featured Photo Credit: amazingsdj.