It is hard to ignore that as a global society we are slowly moving away from fossil fuels and other unsustainable practices. There is an opportunity in the market and green finance must be there to help fill the void.

Green Finance is the funding of and investment in environmentally sustainable projects and infrastructure. It first became significant after the creation of the first green bonds in 2007, which are used by governments to raise the funds for green spending. However, it took another eight years for countries to start to show real interest in this area of investment. This culminated in the 2015 Paris Agreement on climate change signed by 197 countries and ratified by 179, and since then green finance has risen exponentially.

Green Bonds

Green bonds are a great way to track the success of green finance globally, as they provide representation for how much a country is willing to borrow in order to invest in green projects such as power plants that run on renewable energy and public transport networks powered by green energy as opposed to fossil fuels.

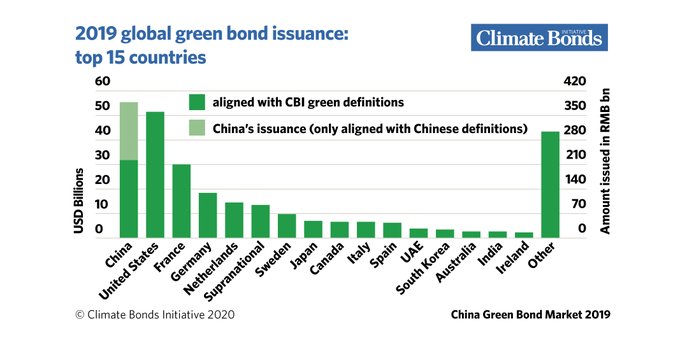

Progress in this area has been significant, in 2019 Global Green Bond Issuance and Green Loan Issuance amounted to US$257.7bn which is considerably larger than the 2018 figure of USD 170.6bn, an increase of 51%.

Europe had a driving force in this accounting for 45% of global issuance, with the Asia Pacific and Northern American regions the closest followers at 25% and 23% respectively.

Not to be ignored was the debut issuances of green bonds by Kenya, Panama, Greece, Russia, Ukraine, Saudi Arabia, Ecuador, and Barbados, showing the geographic diversification that is beginning to take place in the green bond market. Critically these countries are all Emerging Markets, a precursor for green investment being the future?

Important as it is that Emerging Markets are starting to look towards green finance as a development tool, the brunt of the work in the green market is still being done by a selection of leading countries:

USA

The USA still leads the table for the country’s issuance of CBI-aligned green bonds, amounting to US$51.3bn worth in 2019. However, around 50% of these green bonds were Asset-Backed Securities (ABS), which green finance would do well to steer clear of, with worrying memories of the 2008 financial crash still intrinsically linked with these loans.

There were no sovereign bonds issued in the US in 2019, and in all honesty, the government appears to have very little to do with the high rates of issuance.

This is hardly surprising considering Donald Trump’s aversion to climate change, but the US government needs to take note of the private sectors growing interest in the green bond market and help to set an example for other governments, steering the future of investment globally going into 2021.

Related Articles: What Is Green Finance and Why Does it Matter so Much? |Collaboration Can Take Climate Action To The Next Level |Finance Industry Takes a Stand for the Environment |How Honest is Green Finance? A Look into Goldman Sachs |Latest Findings: Impact on Rural Livelihoods, the Case of Peru |Glowee: Lighting Up The Future | Greening The Academy: How Manufacturing, Technology & Individuals Can Help | 4 Alternative Methods of Producing Sustainable Energy

China

China was once again amongst the largest issuers of labeled green bonds in 2019, increasing its amount issued by 33% from 2018. Importantly, China introduced its first municipal green bond in 2019 which shows the willingness of the local government to focus on climate change and green development as a key goal.

Also important is the fact that China’s issuance of bonds overseas has continued to grow rapidly since the first offshore Chinese Green Bond was brought to the Hong Kong Exchange in 2015. The second-largest green bond issuer becoming more open to international investment is a good step toward a greener future.

A drawback to Chinese Green bonds however is that they are not all in line with the CBI green definitions, and some of the money raised is used as general operating capital. If the integrity and transparency of Chinese issued green bonds could be affirmed, then the total number of CBI-aligned green bonds in circulation could be increased drastically.

Europe

France is really leading the way when it comes to green bond issuance. After issuing their first sovereign green bond in 2017 of US$7bn), in order to raise money for a transfer over to the use of cleaner energy, they have gone on to be the 3rd highest issuer globally issuing US$30.1bn to the market.

Germany has the largest economy in the European Union and yet it only comes fourth in terms of green finance. A lot of this is indicative of the fact that the German government has not pushed green finance as much as the likes of France and Switzerland, opting instead to leave it to the private investors. However, this is set to change as the government released a climate package in 2019 recognizing the importance of financial policy in the fight against global warming.

Europe as a conglomerate makes up 44% of the green bond market; however, when this is broken down it is clear there are disparities between the countries. This is understandable as the prosperity of different countries within Europe can be widely different. However, in a recently announced COVID19 recovery fund of €750bn, the EU has declared that 25% of the €750bn will be earmarked for climate action and there will be a ‘do no harm’ clause preventing that money being spent on environmentally damaging investments.

It is important that this influx of green finance is shared amongst the EU not just equally but equitably, there are countries that are in much higher need of a centralized green investment than others.

If Europe can handle this task well it will light a path for future investments, and it will highlight the possibilities that green finance holds.

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com