As part of its annual list update, S&P 500 cut Tesla from its ESG index, the globally recognized sustainability index that ranks companies in terms of their environmental, social and governance (ESG) standards.

Other notable changes in the S&P 500 ESG index update, effective May 2, include the addition of oil refiner Phillips 66 (PSX.N) and Twitter Inc (TWTR.N), which is soon to be controlled by Tesla’s CEO Elon Musk.

Johnson & Johnson, Delta Air Lines and Chevron Corp, among others, were removed from the updated index alongside Tesla. Here’s who else is no longer part of the S&P 500 ESG index:

Why Tesla was removed from the ESG Index

Why Tesla was removed from the ESG Index

As Head of ESG Indices Margaret Dorn explains in a blog post, Musks’ electric automaker has been removed from the index “due to its low S&P DJI ESG Score”, which reflects Tesla’s (lack of) low carbon strategy and (poor) codes of business conduct.

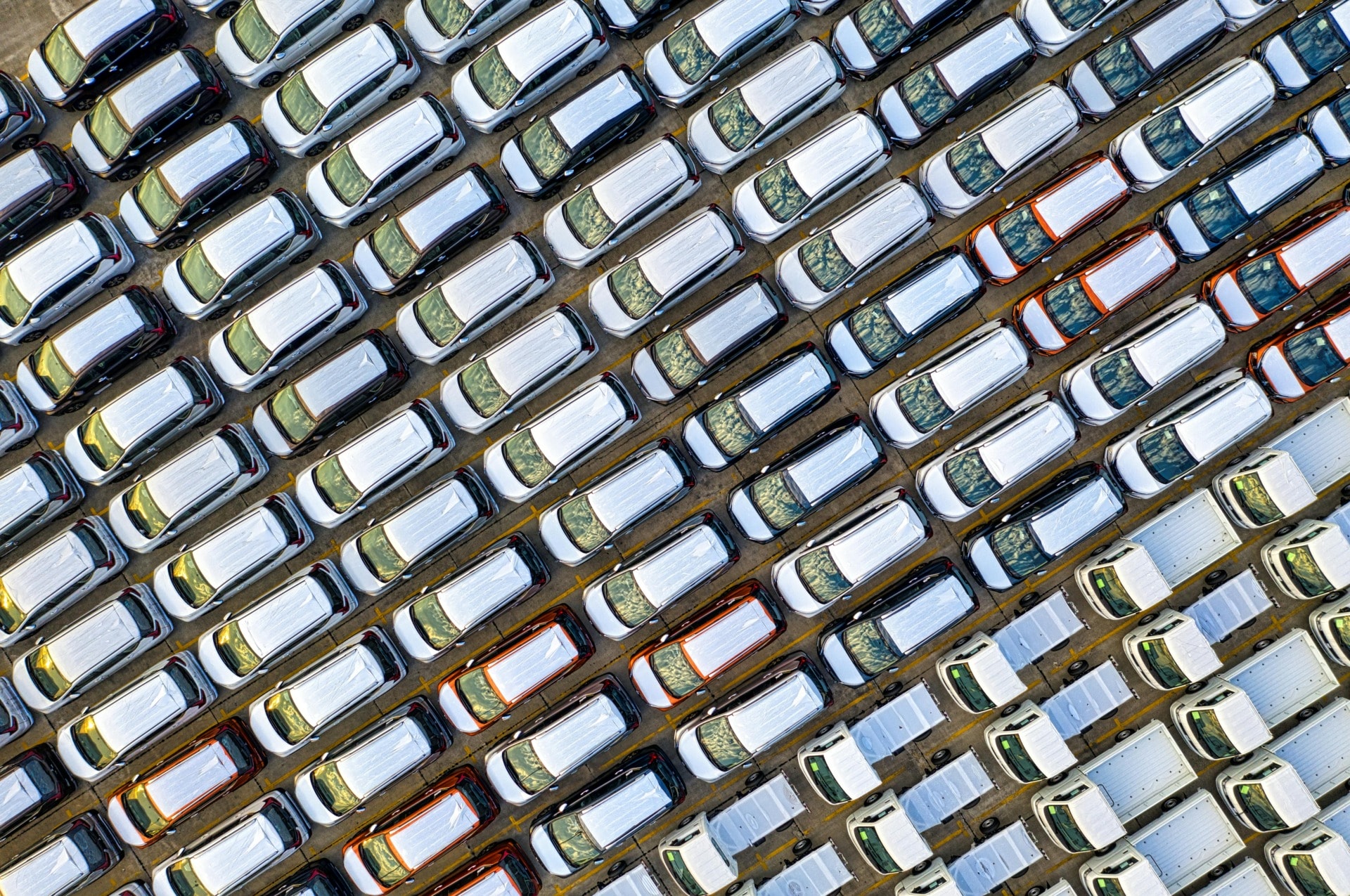

Now, according to Dorn, Tesla’s S&P DJI ESG Score hasn’t actually deteriorated. In fact, it has increased on average and has remained “fairly stable year-over-year.” But while Tesla’s score in this field increased at one, stable pace, the score of Tesla’s industry competitors, as well as the industry group as a whole, have both improved more quickly, pushing Tesla to the bottom 25% of its industry group (automobiles and components).

“A few of the factors contributing to [Tesla’s] 2021 S&P DJI ESG Score were a decline in criteria level scores related to Tesla’s (lack of) low carbon strategy and codes of business conduct”, writes Dorn.

The decline in Tesla’s codes of business conduct, according to the S&P’s Media and Stakeholder Analysis, “a process that seeks to identify a company’s current and potential future exposure to risks stemming from its involvement in a controversial incident,” is rooted in claims of racial discrimination and poor working conditions in Tesla’s factories.

Related Articles: Do S&P 500 Companies Align with ESG Criteria from MSCI and Impakter’s Index? | Twitter in Elon Musk’s Hands: What It Means

For instance, when the California Department of Fair Employment and Housing sued Tesla over anti-Black harassment and discrimination in its Fremont car plant, the agency found evidence that “Tesla routinely kept Black workers in low-level roles at the company, gave them more physically demanding and dangerous assignments and retaliated against them when they complained about racist slurs.”

This, Reuters writes, added to claims made in several other lawsuits.

In addition to racial discrimination and poor working conditions, Dorn highlights Tesla’s handling of the NHTSA investigation into the multiple deaths and injuries related to its autopilot vehicles as another component negatively impacting Tesla’s S&P DJI ESG score and, subsequently, its overall ranking.

“While Tesla may be playing its part in taking fuel-powered cars off the road, it has fallen behind its peers when examined through a wider ESG lens,” Dorn concludes.

Tesla’s response

Although the company representatives declined to respond to Reuters’ questions, Tesla’s CEO didn’t refrain from sharing his views. In his tweet (below), Musk pointed out that Exxon made the top 10 of the S&P 500 ESG index while Tesla didn’t; he called ESG a “scam” that is “weaponized by phony social justice warriors” and added that S&P “has lost its integrity.”

Exxon is rated top ten best in world for environment, social & governance (ESG) by S&P 500, while Tesla didn’t make the list!

ESG is a scam. It has been weaponized by phony social justice warriors.

— Elon Musk (@elonmusk) May 18, 2022

In an earlier tweet from early April, Musk had similarly written that he was “increasingly convinced that corporate ESG is the Devil Incarnate.”

I am increasingly convinced that corporate ESG is the Devil Incarnate

— Elon Musk (@elonmusk) April 3, 2022

Tesla has also criticized modern ESG measurements as a company. Already in the forward of its Impact report 2021, published May 6, the carmaker writes:

“Current ESG evaluation methodologies are fundamentally flawed. To achieve acutely-needed change, ESG needs to evolve to measure real-world Impact.”

The report starts by saying that the current ESG reporting “does not measure the scope of positive impact on the world” but instead focuses on “measuring the dollar value of risk/return.”

“Individual investors – who entrust their money to ESG funds of large investment institutions – are perhaps unaware that their money can be used to buy shares of companies that make climate change worse, not better,” the report adds.

Tesla then provides an example from the automotive industry, where companies, as the report claims, can achieve higher ESG ratings as long as they continue to “slightly decrease emissions of its manufacturing operations while churning out gas-guzzlers.”

Looking at the updated S&P 500 ESG index, where an oil and gas company ranks higher than an electric automaker, Tesla’s concerns with the current ESG evaluation methodologies don’t appear entirely unjustified. After all, according to the updated ESG index, Exxon and Amazon would be two of the world’s top 10 best-performing companies in terms of ESG.

Even if Tesla’s products help cut harmful emissions, certainly more so than a company like Exxon, it is important to remember that ESG reflects efforts to achieve sustainable development as a whole, not just environmental sustainability.

Even if Tesla’s products help cut harmful emissions, certainly more so than a company like Exxon, it is important to remember that ESG reflects efforts to achieve sustainable development as a whole, not just environmental sustainability.

As such, the ESG index takes into account companies’ social and governance standards just as much as it considers their environmental impact. A company that fails or refuses to address accusations of unfair and unequal employee treatment should therefore not expect to rank high on a score that considers social and governance standards, regardless of how well the company performs when it comes to environmental impact (a reminder that Tesla has been evaluated as lacking low-carbon strategy).

As the head of S&P ESG Indices put it, “You can’t just take a company’s mission statement at face value, you have to look at their practices across all those key dimensions.”

But you can’t neglect a company’s mission statement either, especially when it is anti-sustainability by default. A company whose core activities (and purpose) are directly linked to global warming, such as the extraction and sale of fossil fuels, should not be able to rank high on any environmental index, no matter how many of these ESG dimensions have been met.

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com — In the Featured Photo: Telsa logo. Featured Photo Credit: Flickr.