It is somewhat unfathomable to think that a traditional brick-and-mortar retail store could see unprecedented growth in an era where physical markets are increasingly transitioning to digital. Nevertheless, this is what the world saw as GameStop (NYSE:GME) grew to a staggering $24.24 billion market cap in late January 2021 when it previously demonstrated a less than $1 billion market cap in December 2020. This unique situation arose when Wall Street gamblers had taken out massive short positions on GameStop hoping to profit from its demise. To everyone’s surprise, this bluff was called out by a band of ordinary retail investors on the r/WallStreetBets subreddit who subsequently challenged the market elites by launching a synchronized buying spree of GameStop stocks. The shorts were squeezed, forcing hedge funds to liquidate billions of dollars in losses and spelling disaster for some of them. With financial power consolidated amongst the kings of American finance, do the Reddit vigilantes have enough steam to maintain their momentum?

A quintessential David and Goliath story has seen ordinary and pandemic-stricken people using the forces of the internet and social media from the comfort of their homes to challenge the market’s status quo. The financial elite now knows that their monopoly over market manipulation is left exposed, and is thus willing to do anything necessary to regain control from the likes of you and I who collectively pose a very dangerous threat to their territory.

Let the people trade.

— Robinhood (@RobinhoodApp) March 23, 2016

In a desperate bid to offset the tumult, certain entities strongarmed Robinhood Markets, a popular trading platform that pledged to liberate retail investors, into restricting the purchase of GameStop positions. “Let the people trade,” a tweet that had embodied Robinhood’s overall pursuit in democratising finance for all, now leaves a sour taste after their decision had only barred the same retail investors Robinhood claimed to promote whilst protecting the heavily invested short positions. Regular investors have effectively been punished for configuring a new way of manipulating the market, despite the employment of such tactics by those on Wall Street for decades.

Though it had originally made its reputation through serving independent investors, Robinhood remains within the larger financial conglomerate of Wall Street. The unprecedented levels of trading witnessed has unveiled the conflicting priorities Robinhood and other brokers face between its loyal users and the realities of operating within the industry. It is important to identify that for Robinhood, users are not considered as customers, but rather as assets. Data on the behavioural psychology of its users is sold on to hedge funds, enabling the elites to better inform their trades.

Citadel, a previously undisclosed ally of Robinhood, bailed out Melvin Capital who was one of the many hedge funds to suffer substantial losses from shorting GameStop stock. Considering the clear conflict of interest between Robinhood’s allies and their users, enacting regulations that only protected the “big guy” came as little surprise. Robinhood has ironically saved the “rich” whilst gutting the “poor,” triggering a flurry of criticism from its loyal supporters who expressed feelings of betrayal from a decision that was made without any notable cause or consultation.

Growing tension from observers crying “foul” has mounted pressure on the Securities and Exchange Commission (SEC) to investigate and unveil the truth behind GameStop. However, since members of the SEC board have historically either participated or had relations with those on Wall Street, it is a rarity to see prosecutions against industry insiders. The influence and power Wall Street has is, in most cases, insurmountable for us. Wall Street elites have their hands in almost all domains of American business and politics, making it seemingly impossible for government bodies to remain impartial when dealing with market players. Even when litigations do proceed, cases almost never reach a judgement or criminal conviction. The SEC was specifically devised to safeguard the investing public from market exploitation, yet with these relations held, sufficient accountability has become ever less probable.

Wall Street elites hold all the levers of power. Their stronghold on the market enables them to operate as powerful oligarchs that enforce the policies they want, without any external support, through the power and influence that large sums of money can buy. The GameStop frenzy is only a slight insight into the extent of the cabal taking place within the heart of American finance.

Related Articles: How to Talk to the Other Side: Environmentalists vs. Wall Street | Will Wall Street Have a Crypto-Market?

A class action lawsuit now faces Robinhood, yet, for most legal proceedings against Wall Street affiliates, fines are often settled and considered as given costs to doing business. It is in the best interest for market makers, such as Robinhood, to accept SEC fines of millions in exchange for saving billions with its Wall Street allies.

Robinhood CEO, Vlad Tenev, refuted allegations that market pressure had led to their decision. Yet, Barstool’s David Portnoy accused Tenev of lying and stated that, “there is no rational explanation on why they would do what they did without outside pressure.”

Misinformation from Wall Street has plagued mainstream media for very long, however. Jim Cramer, host of Mad Money on CNBC, once infamously detailed the dirty tricks hedge funds employ to ensure profits through manipulating stock prices by manufacturing “their own truths.” Indexer co-founder, Anton Gordon, proclaimed that “fake news in the financial market has been a problem for a long time, we just didn’t call it fake news.” For instance, financial media detailed mass interest in silver being the next short squeeze with the hope of diverting attention away from GameStop. Analysis of the r/WallStreetBets subreddit clearly demonstrated no real interest at the time as reported. Palpably designed to sway public opinion and fabricate a narrative, the dissemination of patently false reports through select media outlets has repeatedly been practiced to influence the direction of the market.

MA Secretary of State, William Galvin, came on CNBC to contest that the whole GameStop frenzy had undermined the honesty and reliability of the marketplace. “When the market is engaging in this type of conduct, it is very problematic,” said Galvin. Paradoxically, speculation has always reigned over financial markets. Investor brokers like Robinhood have only perpetuated this reality through acquiescing this conduct – that is more akin to gambling – to the masses. Though it has its dangers, ordinary people now have the platform to compete with the elites, allowing for transparency within the market that could lessen the likelihood of exploitative cases – like the financial crash in 2008 – from ever happening again. “[Hedge funds] now run a new risk that these social media vigilantes are going to squeeze you as a short, and it’s going to make a lot of hedge funds think twice before they try to go short stock,” said American businessmen Kevin O’Leary.

It is important to understand that calls for regulations across the board to prevent situations like GameStop reoccurring would be highly unlikely. Manipulative tactics, be it through speculation or informed insights, have been used for profit making since the stock market’s inception. The only difference now being that the market’s strings are being pulled by those beyond the realms of the elite. Why, then, are ethical bounds transgressed when regular people utilise manipulative tactics for profits, which, in GameStop’s case, have been grounded upon genuine positive insight? It is not an issue with the system, but rather a bitterness towards it being capitalised on by ordinary people.

When hedge funds manipulate markets, when Wall Street requires billions of dollars in bailouts and floats from the federal reserve, there isn’t any call for regulations.

— Saagar Enjeti, Host of “Rising with Krystal & Saagar.

GameStop represents much more than a physical retail store, but a struggle between the many versus the few. The fact that regulations would and have been enacted upon retail investors reveals how market elites effectively operate within a system of their own. Yet with GameStop stocks still remaining as lucrative investments, only time will tell whether elitist power will prevail, or if we have turned into a new era of trade. If you’re wise enough, you’ll already be looking into other investments such as robinhood gold.

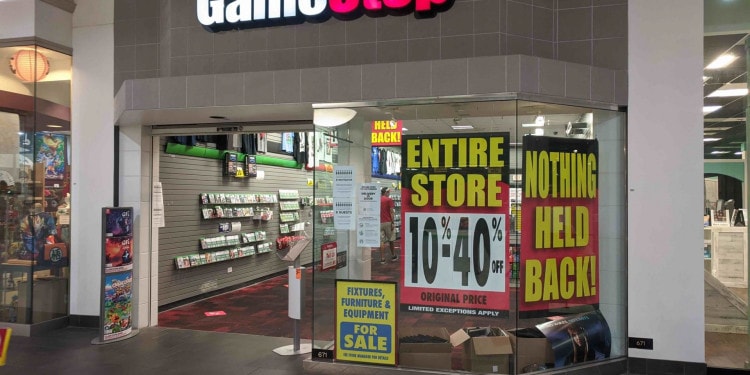

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com. —In the Featured Photo: A GameStop Being Liquidated, Melbourne, FL, 2020. Featured Photo Credit: Wikimedia Commons.