In a venture capital space where the norm is too often to just invest in what is seen as safe and has been tried and tested, there has emerged a bias against women and people of color-led companies, as they are seen as “new and risky” to hegemonic institutions. Eric Collins is the CEO of ImpactX, a venture capital firm. He and his team, comprised of titans of industry, have come together to combat the systemic prejudices that are disadvantaging women and people of color in business.

What was the initial impetus for you behind founding ImpactX?

Eric Collins: I’ve been in the Venture Capital space for 20-25 years on both sides of the Atlantic. When I started out less than 1% of Venture Capital went to black entrepreneurs and less than 4% went to women.

Twenty years later, that same number still persists. The reason ImpactX exists is that we cannot keep looking at this as a problem that is academically interesting or policy enticing. Instead what we need to do is to solve the problem and ImpactX was designed to put our money where our mouth is and get a team together to focus on where there are disparities and to then begin investing. Ultimately the goal is to create the world we want to see.

Can you walk me through your sustainable investment theory?

E.C.: We have a very clear thesis that most of the challenges we know in the world today need to be redressed with an infusion of resources, of which capital is a very important factor. As you look around the world we know that there are a lot of people who have accumulated capital in relatively short order. We know that a lot of these organizations have been technology-driven and have been built in the last 20-25 years.

This means they don’t have a basis in an old world and are actually very disruptive. We know that these are very valuable companies that create opportunities, they create jobs, they create policy and are influencing a lot of social norms and behaviors.

We want to make sure we are using these levers that are already in place to challenge the social norms and behaviors and decided capital was the best way to do this. However, we understand capital alone is not enough, because if we look at these technology companies, they are still burdened by the troubles of companies of the old world. There are very few women and people of color who are in key decision-making roles, particularly black people. Moreover, of the wealth that is being generated, not much is going to black individuals, whether that be investors or employees.

ImpactX’s thesis is twofold: we believe that we need to have a sustainable fund, and by sustainable we mean we need to be returning enough capital to attract additional capital so that in future we can get more people to invest.

Secondarily we are focused on job creation and we want to make sure that those in the C-Suite, board members, and in P+L effecting roles are properly represented by women and people of color.

Once those opportunities are created people can grow in those jobs and then take those experiences to other jobs with great pedigree or they can start their own companies. This virtual circle will then allow Limited Partnerships to be paid back very quickly, whilst also enabling founders to gain a foothold in the business world. This will generate a flywheel effect as the first wave invests and create an opportunity for the next generation of women and people of color in business.

One of the focus points for investment at ImpactX is technology, how much does it worry you that women and people of color are so underrepresented in this supposedly forward-thinking sector?

E.C.: It keeps me awake at night that what we are doing is immortalizing and institutionalizing the systemic racism and sexism in the general population, in these disruptive organizations. These are supposed to be the most innovative organizations in the world that can solve intractable problems.

Yet at their DNA there is something going on which makes these organizations say that the only people that we trust to make good decisions and build these types of disruptive organizations are the people who have built the longstanding hegemonic institutions.

ImpactX is looking at which industries can we fix that will have the largest impact on other institutions.

Technology is an area that is being used by all these institutions and if they do not rely on it yet they will in the future, we have seen this with remote work during the Covid-19 pandemic. So, if we can increase the number of women-led and people-of-color-led companies in the tech industry, we can begin to reform the representation in other industries also.

If we can hire the right sorts of people in technology companies and create the right DNA, we can create a significant influx of jobs in a relatively short period of time.

How can we move away from the “Who you know not what you know” mentality that exists in venture capital?

E.C.: The combination of network and pattern recognition are intrinsically and inextricably linked, and people view this thought process as the only way to make a decision.

It is often the case that the only people they can trust and the only people they know are people who look like them. Those two factors combined make a Gordian knot and it is incredibly hard to address this access issue. However, what you can address is the prejudice or at least the preference toward people of a certain background. Take universities for example, in the UK the university scene is dominated by two universities, they are seen as the most powerful and desirable and this causes a very narrowly educated group of people.

When you look at these places and look at who is teaching and even more closely at who is attending, you find that only 22 black students matriculated at one of these universities last year, despite there being thousands of places offered annually. Then you look at the fact that it has become generally accepted that if as a black student you did not make it, then it was because you were not talented enough to make it into this narrow pool of acceptance and that if you did you are the exception as opposed to the rule, the situation appears intractable.

What we are doing at ImpactX is removing the need for a warm introduction or a network, and we are saying here is a link to send us your business idea. You will still need to pass the criteria we have set out for companies we want to invest in, product-market fit, previous revenue, who else has come to the table, but you don’t need to have gone to school with myself or any other venture capitalists in order to even get your foot in the door.

I challenge any of your readers to try and “cold” meet a venture capitalist, it is not easy, and that is why breaking down these networks and making capital more inclusive is so important, especially for women and people of color.

People of color-led companies have been reluctant in coming forward for grants during this COVID-19 pandemic. How have you approached this with your portfolio companies?

E.C.: Our portfolio is very impact focussed and the focus on job creation means it is very important that they are able to weather COVID. So, what we did at the very beginning of COVID working with each one of our teams to make sure that we had a plan for surviving but more importantly for thriving.

Most of our companies did not see the government programs as fit for purpose. By this, we mean that some of the elements associated with schemes such as the Future Fund, The Job Retention Scheme, and the Bounce Back Loans Programme, had an implicit bias.

Let’s take the Future Fund, for which only one of our Companies applied for; they were successful. One of the contingencies for applying to this scheme is that you have to have raised £250,000 of private equity investment in the past five years. We know that almost no black entrepreneurs in the UK have ever raised that kind of money so this then sets a bar which is too high for most black organizations. Therefore, regardless of whether they are reluctant to come forward, they do not fit the basic criteria.

Then if you look at the Bounce Back Loans Programme, it is administered by banks, an institution that is under the impression that the status quo actually works. So, the idea that you are coming in with new ideas and you do not have a huge amount of capital and that you’re going to be making capital in the future, they don’t lend like that.

If these are the institutions the government has put in charge of the recovery, then the issues of the past just perpetuate, and layers upon layers of systemic racism and systemic inequity continue to build up. The key problem is that the people creating these problems called the same people they always call and asked, “How do we go about solving this”. Therefore, the same injustices in the past which have led to a broken system are being repeated. We need to treat this as the crisis that it so clearly is, on the same level as global warming, on the same level as poverty and starvation.

Related Articles: How To Make Investing In Green Finance Easier? | Root Capital and DFC Invest in Rural Women Through the 2X Challenge | Black Women Matter: How U.S. Court Systems Should Respond to Intimate Partner Violence | We Stand Against Racism Everywhere | Environmental Racism: Why Does It Still Exist?

With the accessibility of ImpactX how much attention have you attracted from entrepreneurs and what results are you seeing?

E.C.: We have had 700 applicants now, 21 committed and 17 closed and we are taking in over 100 inbound a month, so there is a huge demand. I would say the results are encouraging and extremely discouraging.

It is encouraging that there is so much demand and that we are able to put money into companies that we believe are going to change the world.

What is distressing is that I hear a lot of lip service, particularly when George Floyd was murdered in the United States and we had a very active news cycle around the fact that we have to do something. Early on there were a number of commitments from organizations in the United States, SoftBank committed US$100million to help Black and LatinX communities for example. However, there has not been any commitments in the UK, so we have people talking about making a change but then not following it up with decisive action.

Black business is not treated as a crisis in the same way as a pandemic. A diversity panel I was privy to recently, said that we had to survive the downturn in business that has arisen as a result of the pandemic before we can start to think about inclusion and diversity. In the minds of the wider population, this is still a luxury, they can wait, they do not see the crisis going on around them. If the house were on fire around you, would it still be a luxury? Or would it now be a crisis?

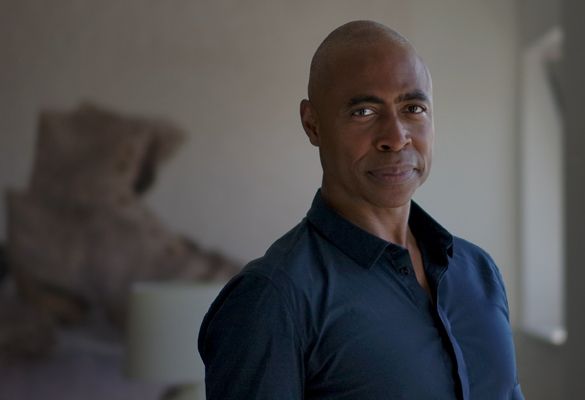

In the cover picture: ImpactX Team. Photo Credit: ImpactX.

Editor’s Note: The opinions expressed here by Impakter.com contributors are their own, not those of Impakter.com