About two-thirds of the 600 million people living in extreme poverty around the world live in rural areas, and the COVID-19 crisis is exacerbating every challenge they face. Rural communities often lack access to proper infrastructure, health care, markets, education and finance. As the world goes digital in the face of the pandemic, people without internet access and electricity are further left behind.

With a global recession and increasing food insecurity, rural development needs to focus on more than just improving agricultural productivity. Innovative financing is critical to strengthening rural economies in developing countries. In particular, impact investments are particularly suited to address rural inequities in a post-COVID world.

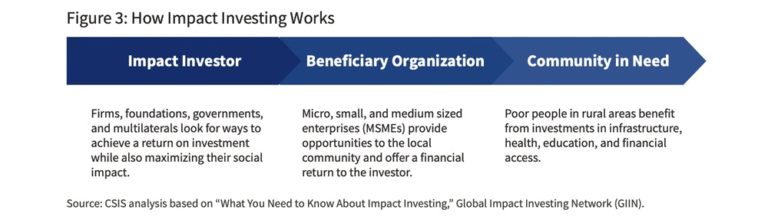

Impact investments are investments in assets like private debt, publicly traded debt and private equity that generate social and environmental impact as well as financial returns. In a Center for Strategic and International Studies report I coauthored, we demonstrate how impact investments can help create a more sustainable model for rural economies going forward.

For example, when investors provide financing for roads, electricity and internet access in rural areas, a number of doors are opened for farmers. Electrification enables cold storage and labor-saving machinery, while roads and internet access connect farmers to a wide range of customers and producer organizations. The effect is that farmers can work more efficiently while raising their incomes and exerting more control over the market. In the long run, the infrastructure allows farmers to move from subsistence farming to entrepreneurship.

Investments in the financial sector provide a similar example. Globally, about 1.7 billion people do not have a bank account or mobile money provider, and many small-scale farmers are unable to access the financial tools they need to be successful or respond to emergencies. Instead, they turn to predatory high-interest loans or informal lending networks. Through rural-focused programs from traditional banks or alternatives like microcredit and financial technology, families gain a reliable safety net in case of emergencies and can further invest in their small businesses and long-term economic prosperity.

At Heifer, we are building on our traditional development projects by using impact investing to provide affordable financing to farmers and cooperatives. Through Heifer Impact Capital, our private investments have supported the growth of enterprises and helped connect them to global supply chains.

In Alta Verapaz, Guatemala, Heifer Impact Capital is investing in a Heifer International program called the Green Business Belt. The program supports 6,250 small-scale producers to sustainably grow and market spices, including cardamom, cinnamon and black pepper, for export. Although the commodities showed high potential for growth, spice farmers in the region were reliant on middlemen to get their products to market. Unable to afford the infrastructure to access markets directly, they were receiving below-market prices and unable to make a livable income.

Heifer Impact Capital is investing in a new spice processing and distribution company based in Alta Verapaz called Nueva Kerala. The company will process and distribute locally grown cardamom, cinnamon and black pepper, selling directly to spice importers such as McCormick & Company in the United States and others around the world. Funds are being invested to provide working capital to farmers at significantly lower rates than local money lenders, and other investments will allow the company to purchase equipment, such as more efficient driers to increase productivity.

Related Articles: The Role Of Impact Investing In Combating Climate Change | Farmers in Ecuador Innovate a Whole New Food System

Once Nueva Kerala is financially independent, Heifer Impact Capital plans to transition its 49% equity stake to farmers, with the company serving as a model for development in areas where agricultural commodities are readily available but access to markets is limited. Heifer Impact Capital is currently looking to significantly increase the scale and scope of efforts like this by partnering with impact investors, financial institutions, donors and other nongovernmental organizations, with the goal of reaching many more families in the future.

The COVID-19 crisis presents opportunities now and in the future for increased investments in rural economies that could create jobs, propel economic development, attract youth to careers and entrepreneurship in agriculture, and contribute to greater food security globally.

Rural development must promote agricultural transformation that modernizes and commercializes agriculture, encourages investments in rural areas, and bolsters private enterprise and investment. Developing farmers as entrepreneurs and strengthening institutions are important steps in addressing some of the inefficiencies of the agriculture industry, which will ultimately support farmers in making a living income from their businesses. Beyond increasing productivity, rural development must focus on enabling small-scale famers to lead a transformation in their communities by earning a living income and thriving, not just surviving.

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com. — In the Featured Photo: Divya Gurung leads goats to a scale at the Naya Sriganshil Cooperative in Dhakeri, Nepal. Featured Photo Credit: Joe Tobiason.