This historic peak figure for the US national debt – a whopping $30.01 trillion – was reached on January 31, 2022 according to US Treasury Department data released on Tuesday, and it happened much sooner than expected. The Wall Street Journal was quick to attribute the increase to federal borrowing during the coronavirus pandemic, describing it as “fueled by trillions of dollars spent on aid programs for small businesses, workers and others.”

James Freeman, an assistant editor at the Wall Street Journal, quickly wrote a fiery opinion piece yesterday arguing that the coronavirus lockdown was an unmitigated economic “catastrophe”, topping his article with an arresting close-up of Dr. Anthony Fauci’s face, with the caption: “Dr. Anthony Fauci, who advocated school lockdowns even while admitting he hadn’t studied their impact on children.”

He noted that it will take years to “understand the full cost of this man-made catastrophe”, that we had “hardly begun” to assess the impact of “isolating human beings, denying them opportunities, education and experiences—not to mention disrupting non-Covid medical treatments and myriad other valuable services—and then attempting to simulate the benefits of a functioning society by printing fiat money.”

Strong words. This, however, is a strictly partisan analysis.

Seen from Europe, the story looks quite different as the German television news Deutsche Welle was quick to point out. Their video issued this morning makes it clear that this is only half the story and that it reflects a strictly conservative Republican point of view. The other half of the story is the massive shortfall in US Treasury revenue caused by former President Trump’s 2017 sweeping tax overhaul rewarding the wealthy and corporations the most.

As economists worked out later in assessing the impact of the Trump tax cut, it increased income inequality to such an extent that, stunningly, the richest 400 families in the US paid an average tax rate of 23% while the bottom half of households paid more: a rate of 24.2%. In the words of Tim Dickinson, a Rolling Stone reporter, Trump “took the middle class to the cleaners”, promising “a return to shared prosperity, but the benefits of his economic policies only bubbled up to the richest “.

The impact of Trump’s fiscal reform, as Dickinson points out, was immediate and spectacular:

“In 2018 corporate-tax revenue in 2018 fell by $135 billion compared to baseline projections. Many companies ended up paying nothing at all. Nearly one-fifth of Fortune 500 companies reported profits to shareholders but owed nothing in corporate income tax, including Amazon, Chevron, FedEx, and Starbucks. Wall Street was a big winner too: Over the first two years of the Trump tax code, the nation’s six biggest banks pocketed an extra $32 billion they would have otherwise paid in taxes, according to a Bloomberg analysis.”

In short, Trump’s legacy was “another trickle-down economic disaster”.

And now we see the result: An unprecedented increase in the US national debt.

Should we worry about the increasing US debt?

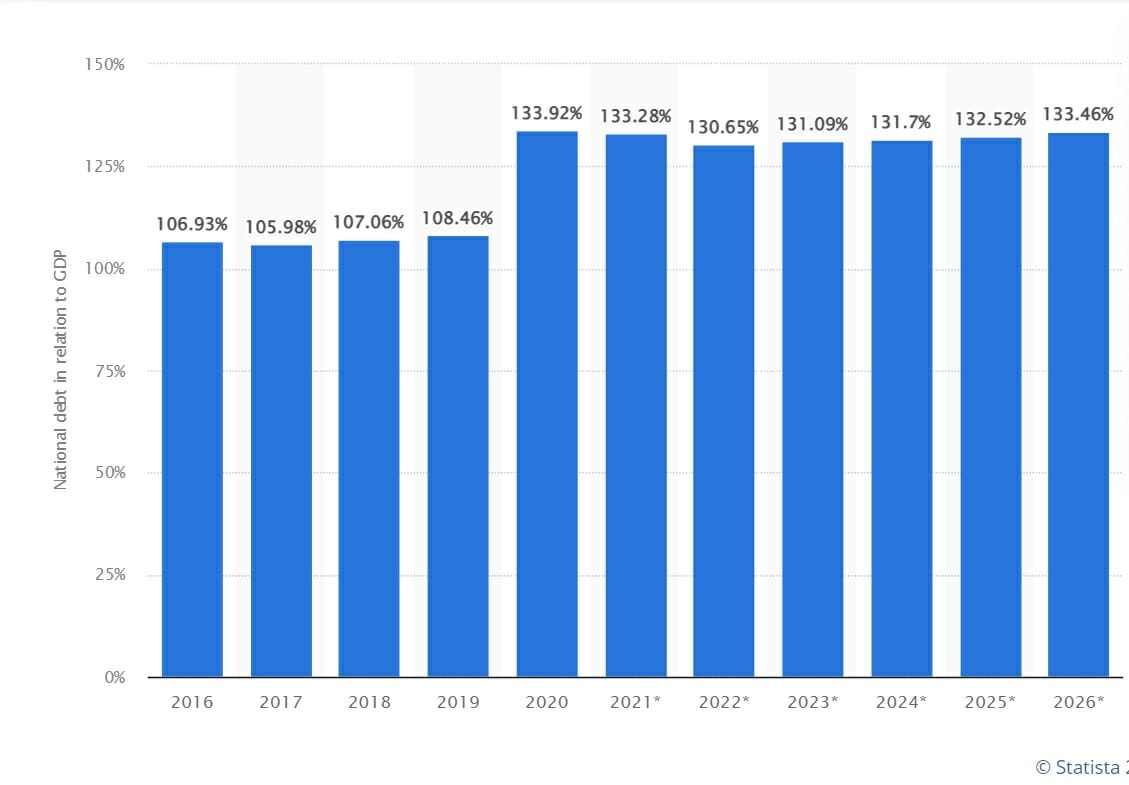

As pointed out by Steven Beardsley, the DW business editor, to understand what such a number means for both the borrower and creditors, one needs to set it against the economic strength of the debtor country – and in this case, we are dealing with the biggest economy in the world. The US debt, however big-sounding, is in fact around 130 % of its GDP:

That figure doesn’t make the US the highest indebted country in the world. That award goes to Japan (note that it is a country that controls its own currency, just like the US does): As of December 2019, Japan had a ratio of 237%, nearly double that of the US.

Reasons for Japan’s uncommonly high debt are generally attributed to a series of crises: Global Financial Crisis in 2007-08, the Tōhoku Earthquake in 2011, the biggest ever in Japan causing, inter alia, the Fukushima nuclear power plant accident, and the COVID-19 pandemic that began in late 2019 and clocked in additional negative fallouts resulting from Tokyo’s hosting of the 2020 Summer Olympics.

Other developed economies with very high debt-to-GDP ratios include Greece, at 207%, and Italy, at 155%. To gain perspective: An 80% debt-to-GDP ratio is the average among the developed economies that make up the Organization for Economic Co-operation and Development (OECD). With the current ratio of 133%, the U.S. is the 4th most indebted OECD country and the 12th most indebted country overall.

A more interesting question to explore is: Who holds the US debt?

According to the US Treasury, $6.5 trillion of the national debt was held in “intragovernmental holdings”, mostly the Social Security Administration, which maintains a trust fund to provide income to senior citizens. Next comes the debt held by the public, $23.5 trillion, held by individual investors as well as the Federal Reserve, large investment funds, and foreign governments.

No foreign country holds more than 5% of the total, and contrary to a widely held opinion, China is not the main holder of US debt: It holds $1.1 trillion compared to Japan’s $1.3 trillion and the UK comes third with $622 billion.

So the US is not about to be challenged, ransomed or otherwise politically blackmailed by any country.

The main problem with the debt is economic: The cost of managing the debt is rapidly rising. In 2021, the US government paid out $562 billion in interest payments on outstanding debt. That is more than the annual budget of every individual federal agency except for the Treasury, the Department of Health and Human Services (responsible for Medicare and Medicaid), and the Department of Defense.

And here is where the interest rates practiced by the Federal Reserve, the US central banking system, matter: If interest rates are kept low, the cost of managing the debt will remain low. This is why during the early part of the pandemic, the federal government’s interest payments fell even as the debt increased because interest rates declined.

But now that the country is facing fast-rising inflation, with citizens complaining of rising prices at the supermarket and gas stations, the Federal Reserve appears set to raise interest rates, perhaps as early as next month. Raising interest rates is central bankers’ preferred tool to control inflation but it will also cause the cost of managing the public debt to rise.

A classic catch-22 situation. Stay tuned for further paradoxical developments. But don’t expect too many surprises. There is a basic fact that, for now, is not likely to change: The American dollar is the preferred national currency utilized by central banks in their mix of reserve currencies. So America is not likely to go bankrupt anytime soon nor are central bankers around the world going to let it happen.

Looking further to the future, people worry that at some point, as the debt keeps rising, it will become unmanageable and a crushing weight on future generations. This concern is especially strong among Republicans. As VoA News reported in its article today, Senator Ben Sasse, a Nebraska Republican, made a classic statement in this regard – a statement that most people are likely to agree with:

“$30 trillion in debt is an obscene number, but what’s even more depressing is the fact that most politicians in both parties don’t really care. Someone is going to have to pay that money when these politicians are long gone, and — spoiler alert — it won’t be paid by them but instead by our kids.”

The implication is clear: A high national debt, if one is to believe Senator Sasse, is an unjust burden on our children, and the children of our children. But that, from an economist’s (or a historian’s) standpoint, is nonsense. Even when the worst scenario comes to pass and the debt results in bankruptcy and collapse, we still should not worry: History shows that the US was “born in debt” and has survived it all, from 1790 to the present – Civil War included.

Moreover, there is plenty of evidence arising from recent European experience that austerity measures taken to control the debt and aim for balanced budgets lead to continuous socio-economic deterioration (higher unemployment rates, a greater tax burden on households, drastic spending cuts in healthcare, social care, education…, drop in consumer spending…) while the government debt-to-GDP ratio continues to worsen, apparently impermeable to such measures.

So perhaps the time has come to worry about far more important problems than the national debt – starting with climate change and income inequality.

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com. — In the Featured Photo: Screenshot from CNBC video: Does The National Debt Matter? | What’s Next For The U.S. Economy – economists discuss the point with Paul Krugman