Together with new solar and wind energy sites, the EU is aiming to use biomass sources such as agricultural waste as a replacement and looking to build Hydrogen Accelerators to develop necessary infrastructure and storage capacities for the uptake of green hydrogen — produced by an electrolyzer powered with wind and solar energy.

Building a hydrogen market where no such market existed before is a challenge, but with its substantial environmental benefits, it is a huge game-changer.

In the early stages of development, the plan could be implemented in time, but time is of the essence. On Monday, Moscow warned Western sanctions on oil could prompt it to close a major gas pipeline to Europe. The flow of gas to Germany from the Yamal peninsula was suspended on March 4. Fortunately for now, Europe has enough gas in storage for the winter season — storage filling being just under 30%.

EU member states to mitigate impact of rising gas prices on citizens

Alongside transitioning to an independent energy-based model, the EU is also looking at ways to protect citizens from the overwhelming increase in gas prices.

Greek prime minister Kyriakos Mitsotakis wrote a letter to European Commission President Ursula von der Leyen calling for immediate intervention to prevent damage to EU citizens’ living standards.

In his letter, Mitsotakis recommended setting a price cap on wholesale gas, as well as capping electricity providers’ profits — in order to mitigate the consistent increase — which will take into account the previous highest historic gas price before the crisis.

Mitsotakis also called for daily price guardrails to limit fluctuation on the Title Transfer Facility, TTF, the virtual trading point of natural gas in the Netherlands, and emergency price setting on TTF fixed-prices.

EU member states split on plan – European Central Bank’s decision today could change the scenario

As a new plan is in the works to combat price increases and to move away from Russian supplies, different countries have displayed varying levels of support, with some calling for immediate action while others are more prudent and would prefer to wait and see.

Six months ago, Spain had already called for emergency price caps to combat inflation due to alarming increases in gas prices. At the time, Germany and other EU nations dismissed this, noting it was too early to make such a decision.

Now, both Greek prime minister Mitsotakis and Spain are clearly in support of the plan including price caps and other methods to combat inflation, but other EU nations still think it is too early to call, noting EU states do not yet know the impact the Ukraine-Russian war will have on the continent. Germany and the Netherlands are at the forefront of nations calling to wait on new financing.

As the EU’s new plan is debated across the continent, if things continue to worsen with the Ukraine-Russian War escalating, an agreement between all EU member states will be required to reduce dependency on Russia and combat the horrendous effects of inflation.

Related Articles: Ukraine-Russia War: The News as it Develops | Behind Putin’s Smile: What Sanctions Against Russia Are Doing to Its Economy and People

The European Central Bank’s decision today is however a crucial element in deciding which direction the EU leaders meeting in Versailles will take, since the Bank signaled, in view of rising price inflation caused by the Ukraine war, that it would not abandon the quantitative easing policy (injecting liquidity in the economic system) that had been put in place to fight the pandemic-induced recession.

The European Central Bank published an announcement today stating that interest rates would remain unchanged and it would continue its asset purchase program (APP) for the coming months. Furthermore, the decision was also taken to extend the Eurosystem repo facility for central banks (EUREP) until 15 January 2023. EUREP will therefore continue to complement the regular euro liquidity-providing arrangements for non-euro area central banks.

In short, the European Central Bank stands ready to support whatever plans are decided by the 27 leaders in Versailles later today, always with a view to maintaining financial stability — which stands as its core mandate. With the support of the European Central Bank, any qualms countries may have regarding the additional costs entailed by moving faster in the green energy transition should be put to rest.

On Tuesday, the European Commission published plans to cut ties between the European Union member states and their affiliation with Russian oil and gas. On Thursday, at the 27 EU leaders meeting in Versailles, the EU is expected to follow the US ban on Russian oil and gas imports and impose new sanctions though a total American-style ban is not expected. The main focus will be to try, says Prime Minister Rutte from the Netherlands, to recognize the European dependence on Russian imports and try to reduce it by substituting with green energy sources.

The European Union is heavily reliant on Russian gas and oil with 40% of total gas in Europe coming from the nation. With prices soaring, the daily value of those gas imports has jumped to around €600 million per day (reaching a record 689 million euros on March 2), and factoring in oil, energy imports sent close to €1 billion to Russia last Thursday alone according to calculations by the Brussels think tank Bruegel.

Quick update 🚨 At today – skyrocketing – prices, Europe will pay Russia €600 million for natural gas and €350 million for oil, i.e. around €1 BILLION in just one day https://t.co/LbpX25xroK

— Simone Tagliapietra (@Tagliapietra_S) March 3, 2022

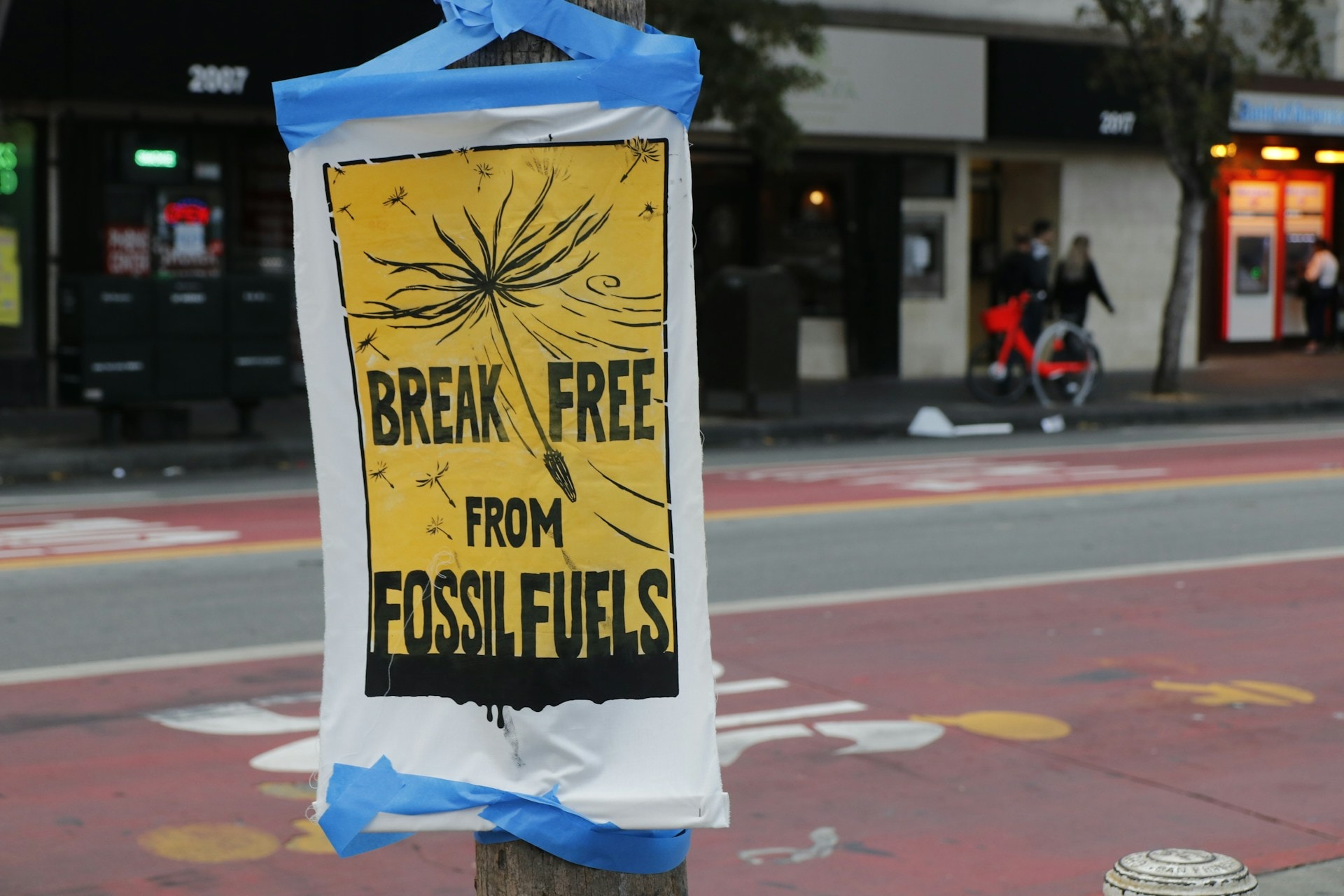

Yet as Russia continues to invade Ukraine and gas prices increase worldwide, the EU is urgently trying to cut ties with Russian oil and gas and scrambling to find a solution to save the EU gas market. The new sanctions on Russian oil and gas make this all the more urgent.

During normal times, supply and demand determine the price of gas and electricity, but times now are far from normal and the EU gas market is suffering. The main burden lies with the citizens, who now have to pay outlandish prices to fill their cars or heat their homes. The eurozone also faces inflation as energy prices rise — everything in itself becoming more costly.

The new proposed plan to cut EU member states’ reliance on Russian gas is intended to cut this dependency by two-thirds by this year.

This is how the EU plans to do it

According to IEA’s 10 point plan to reduce the European Union’s reliance on Russian natural gas, one of the first ways the EU plans to cut this dependency is by finding alternative suppliers.

The European Commission mentioned natural gas (both in pipeline and liquified) from countries like the United States and Qatar could be a suitable replacement — replacing more than a third, 60 billion cubic meters (bcm), of the 155 bcm Europe gets annually from Russia.

As the EU simultaneously negotiates its climate change policies and aims at cutting emissions faster, 30% by 2030, reverting toward green energy is a fitting alternative to Russian gas. Part of the Commission’s ideas to reduce imports of Russian oil and gas and increase domestic clean energy involves the REPowerEU plan.

RePowerEU will diversify our gas supplies, speed up the renewable roll-out, improve energy efficiency and replace gas in heating and power.

It can reduce our demand for Russian gas by 2/3 before the end of the year. pic.twitter.com/kzVNJLPmt6

— Ursula von der Leyen (@vonderleyen) March 8, 2022

The REPowerEU plans include even more ambitious targets than the “Fit for 55” package, which already foresees deployment of 900GW of wind and solar power by 2030 — if the Commission plans on using green energy as an alternative, this can be expected to rise.

The EU is now seeking new wind and solar projects, which could replace 20 bcm of gas demand this year. If they plan on tripling capacity by 2030, adding 480GW of wind and 420GW of solar, they could save 170 bcm a year — proving to be more cost-friendly than the energy system currently in place.

Although green energy as a solution may appear ambitious to countries who are concerned about the fast transition and the change to the economy, the International Energy Agency stated in an article that solar energy would actually benefit many.

“Faster deployment of rooftop solar PV systems can reduce consumer bills. A short-term grant programme covering 20% of installation costs could double the pace of investments at a cost of around EUR 3 billion.”

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com — In the Featured Photo: European Parliament. Featured Photo Credit: European Parliament.