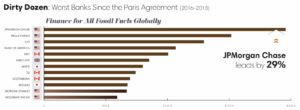

Retail banks are exposed to many climate-related risks through the diverse range of sectors they finance to generate profit. Despite alarming evidence of climate risks increasingly having a negative effect on companies, many global banks continue to finance carbon-intensive activities and show no signs of transitioning to a low-carbon economy. A recent study shows that some banks have even increased their financing of fossil fuels, a key contributor to climate change, every year since the Paris Agreement.

Increasing the financing of fossil fuels exponentially decreases the time available to avoid irreversible damage to the planetary climate system. Further, it quickly increases the risk of high-carbon assets becoming much less profitable. While many banks still have not implemented or even announced plans to implement any climate change strategy at all, it is clear that there is an opportunity for banks to play a positive role by actively financing a low-carbon transition.

Related Topics: Financing the Sustainable Development Goals – Greenwashing in Finance – Diversity and Inclusion in Fintech – Business Sustainability

Bank Start to Take Action and Adopt Climate Strategies

Although many banks do not go beyond vague statements about taking climate action, some recognize that climate change is, in fact, a major business issue. These banks have committed to implementing plans that enable a forward-looking assessment and disclosure of climate-related risks and opportunities. These initiatives are driven in large part by the TCFD recommendations, which were developed to help banks and investors make more informed decisions by guiding organizations to improve reporting on their exposure to and management of carbon risks and opportunities.

The UNEP Finance Initiative began a pilot project to implement the TCFD recommendations with 16 of the world’s leading banks. This project works to publish scenarios, models, and metrics. Its goal is to create a “harmonized, industry-wide approach to the TCFD recommendations” as banks worldwide begin to adopt and build upon them. The pilot project includes a commitment of the 16 participating banks to publish an initial TCFD disclosure report by mid-2019, with Citi and ANZ’s examples already available on the UNEP FI website. At first glance, one may assume that the adoption of the TCFD recommendations for climate-risk disclosure is indicative of climate change strategy becoming a strategic priority for banks. However, some participating banks in the pilot project are also the world’s largest financiers of fossil fuels. For example, Citi is among the top 3 financers of fossil fuels globally, with over $150 billion financed since the Paris Agreement.

To minimize climate-related risks, some banks have tried implementing strategies separate from the TCFD recommendations. Bank of America, for example, has committed $125 billion to low-carbon financing and sustainable business activities by 2025. They have also recently announced that they will mobilize an additional $300 billion in capital by 2030, as they claim to be on track to achieve the 2025 goal six years ahead of schedule. Despite this, Bank of America is still the 4th largest financier of fossil fuels since the Paris agreement, undermining their own efforts to support the transition to a low-carbon economy.

Recent studies highlight the regional disparity between effective climate strategies in banks. A large number of European banks are taking significant action to reduce their carbon-footprints through policies that limit their involvement in fossil fuels. In fact, 80% of European banks have already undertaken climate-risk assessments. Proving their position at the forefront of change, many European banks prohibit all financing of coal projects, which is significant as coal is the most carbon-intensive energy source.

Editor’s Pick:

More Needs to Be Done

Still, if the goals of the Paris Agreement are to be met, more banks must be proactive. Strict policies are needed to phase out fossil fuel financing and increase financing of renewable sources. Though there is progress in the implementation of climate-relevant strategies, the embedding of climate change as a strategic priority for banks has been slow. More action is needed to take advantage of opportunities for low-carbon banking products and services.