The finance ministers of the G20 and the central bank’s governors are currently meeting – from July 14-18 in Gujarat, India. At the summit, the ministers and representatives are scheduled to discuss poverty reduction plans, multilateral institutions reforms, and the international public debt architecture.

In advance of the summit, the United Nations Global Crisis Response Group released the “A World of Debt” report, which laid out the current debt of developed and developing nations, financing inequalities and a roadmap for sustainable financing.

Furthermore, the report is the UN’s “most detailed picture yet of this unfolding debt crisis, with a wealth of comparisons and context,” said UN Secretary-General Antonio Guterres in a press conference on the launch of the report.

Increase in Public Debt and Poverty Worldwide

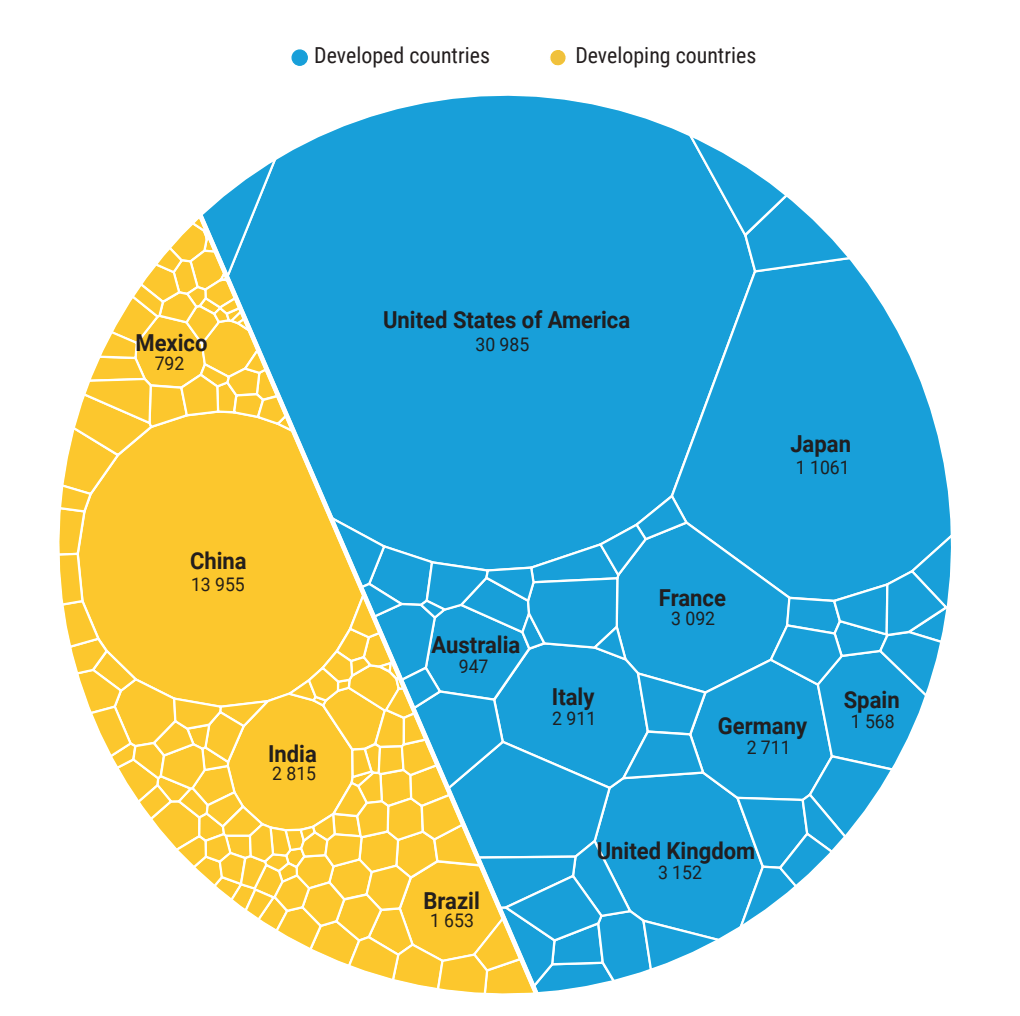

The UN report found that global public debt reached a record $92 trillion in 2022, a figure that is more than five times higher than it was in 2000, with developing countries owing almost 30% of the world’s debt.

According to the UN report, increasing development financing needs and limited alternative financing options are the primary cause of the rising public debt in developing countries.

In addition, the response group highlighted that the rising public debt was further worsened by global crises such as the COVID-19 pandemic, the cost of living crisis and climate change.

At the same time, a report by the United Nations Development Programme (UNDP), titled “The Human Cost of Inaction: Poverty, Social Protection and Debt Servicing, 2020–2023” found that poverty rates have risen in poorer countries, leaving an additional 165 million people living on less than $3.65 a day by 2023.

Public Debt and Development

Although public debt can aid development by helping countries protect and invest in their people, and assist in building a better future, the report notes that excessive borrowing and expensive financing can become a burden for countries, especially for developing countries.

This is because many developing economies allocate a larger share of their public revenue and expenditure to debt servicing, noted the UNDP. In fact, some low-income countries are reported to spend more on debt repayment than on education and healthcare.

Indeed the report concluded that interest payments on debt now surpass spending on education, health, and investments in many countries, affecting at least 3.3 billion people.

Besides limiting investment in development, paying off high debts leaves limited funds for emergencies and climate change response in developing countries, the report explains.

Furthermore, the response group found that developing countries face challenges in funding important investments due to higher interest rates on borrowing compared to developed countries, hindering progress towards sustainable development.

3.3 billion people live in countries that spend more on debt interest payments than on education or health.

This is more than a systemic risk – it’s a systemic failure.

Action will not be easy. But it is essential, and urgent.

— António Guterres (@antonioguterres) July 12, 2023

As Achim Steiner, the United Nations Development Programme Administrator, said:

“Countries that could invest in safety nets over the last three years have prevented a significant number of people from falling into poverty. In highly indebted countries, there is a correlation between high levels of debt, insufficient social spending, and an alarming increase in poverty rates. Today, 46 countries pay more than 10 percent of their general government revenue on net interest payments. Debt servicing is making it increasingly harder for countries to support their populations through investments in health, education and social protection.” (bolding added)

Additionally, when governments of poorer nations are looking to borrow money, they often turn to foreign, private creditors, many of which trade with foreign currencies.

In the past decade, private creditors have held an increasing percentage of external public debt in developing countries. In 2021, they accounted for 62% of their total external public debt.

According to the UN report, this makes developing nations more vulnerable to external shock factors such as fluctuations in currency exchanges. In addition, it is making borrowing costs higher and debt restructuring more difficult.

A New Roadmap to Sustainable Financing

The “World of Debt” report calls for a restructuring of the global financial architecture and, with that, lays out a roadmap for the financing of sustainable development.

Related Articles: Is High Public Debt the Result of Excessive Social Welfare Spending?| How Forgiving Debt Could Help Save the Earth | Unveiling Debt-Denominated GDP | “Debt for Climate!” Campaign Demands Cancellation of Global South Debt

Especially in light of the recent UN Sustainable Development Report highlighting the slow progress towards achieving the SDGs by 2030, this new roadmap is now offering an essential way out of the problem.

The roadmap focuses on three areas of financing: reducing the high cost of debt and debt distress risks, scaling up affordable long-term financing, and expanding contingency financing to countries in need.

With that, the UN aims to tackle the inequality currently present in the international financial architecture.

165 million additional people fell into poverty between 2020 to 2023.

In our new policy brief, we call for a Debt-Poverty Pause to mitigate poverty until the multilateral system addresses #debt restructuring at speed and scale. https://t.co/4DkmymHBhq #HLPF pic.twitter.com/mJiQjn5WEZ

— UN Development (@UNDP) July 14, 2023

Furthermore, the UNDP calls for adaptive social protection and a “Debt-Poverty Pause” to allocate debt repayments towards essential social expenditures and counter macroeconomic shock effects.

Guterres urged the G20 ministers to take into account the new report on the public debt crisis as well as ideas brought forward in the Bridgetown Initiative and Paris Summit for a New Global Financing Pact at their current summit. “Action will not be easy. But it is essential, and urgent,” he said.

It remains to be seen if or how the UN roadmap will be implemented at the G20 finance ministers’ summit.

Note: Impakter will update this article as news from the Finance Ministers’ meeting become available.

Update: 19 July 2023 10AM CET:

In a press release on the outcome and chair’s summary of the G20 finance minister meeting, the G20 ministers expressed their concerns over the current below-average global economic growth and called for well-calibrated policies to stimulate growth, reduce inequalities, and maintain stability.

Furthermore, they reaffirmed their commitment to effectively address debt vulnerabilities in low and middle-income countries, emphasizing the timely implementation of the Common Framework for Debt Treatments, welcoming recent debt treatment agreements, and encouraging enhanced communication among stakeholders.

Lastly, the G20 reaffirmed their commitment to take action in line with the G20 Sustainable Finance Roadmap.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — In the Featured Photo: Women carrying sand buckets on heads, Rhino Refugee Camp, Arua, Uganda, 2019. Featured Photo Credit: Ninno JackJr.