Innovative ways to improve soil carbon accounting can support investment-oriented actions promoting soil carbon storage and help smallholders participate in carbon markets.

Today is the 6th annual international World Soil Day, which aims to direct attention to the importance of healthy soils and advocate for sustainable soil management. Soil is where most food begins, but every year more soil is lost under expanding cities or degraded until it is unsuitable to grow food. The shrinking area and health of soil are one of the biggest threats to future global food security.

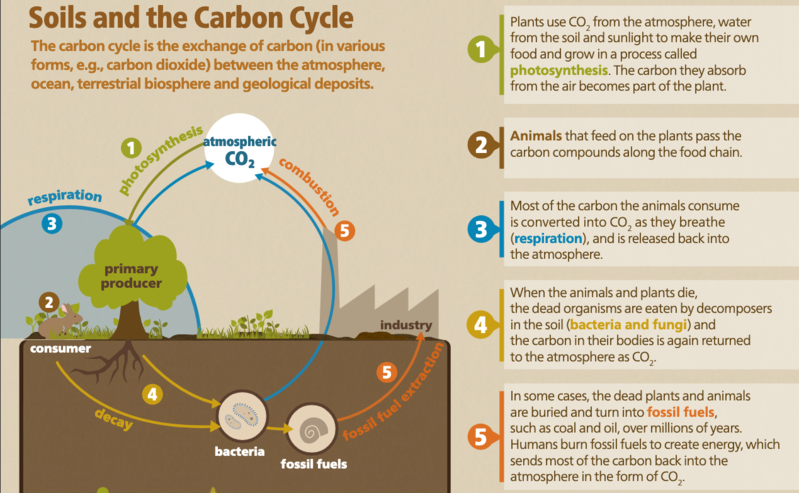

In addition to being the foundation of the terrestrial food chain, soils combat and help adapt to climate change by playing a significant role in the carbon cycle—by storing carbon or carbon sequestration. Sustainably managed soils increase soil health and, thus, store more carbon and remove more greenhouse gas (GHG) emissions from the atmosphere than conventional agriculture and forestry practices. Healthy soils have the largest storage capacity for carbon on land. Sustainable soil management could produce up to 58% more food.

An Elusive Solution

Enhancing soil health can improve agricultural productivity and soil organic carbon (SOC) sequestration. Technical options and practices available today for agriculture that reduce emissions are inadequate to mitigate the one gigaton of CO2 equivalents per year necessary in the agriculture sector alone to meet the 2˚C target. There is a need for transformational technologies and widespread scaling up of mitigation practices.

Sequestering carbon in our forests, oceans and soil can contribute a substantial portion to the mitigation needed in the agriculture sector. Soil carbon alone can have equal or larger impacts on mitigation than all current practices. However, the amount of carbon soil can store is dependent on the overall health of the soil and over a third of our soil is unhealthy.

Improving soil health improves agricultural productivity as well as its potential to sequester soil carbon. However, despite broad international attention, a substantial gap remains between the potential of soil carbon sequestration and on the ground practice implementation. The investment community is actively looking for opportunities to increase its climate impact, and many organizations are now asking how best to support practice implementation.

Related Articles: Apple Commits to be Carbon Neutral by 2030 | Climate Smart Agriculture in Vietnam

Opportunities for public and private finance exist and are emerging. However, a major limitation to investing is the lack of methods to account for changes in soil carbon stocks that fit the needs of investors, scientists and implementers (e.g., farmers). There is no single transparent, accurate, consistent, and comparable method that works for everyone or everywhere. Promising approaches combine practical, user-friendly tools with site-specific modeling used in tandem with geospatial data sources and blockchain technology.

Taking the Lead to Transform Soil Health Investment

In September 2020, the World Bank (WB), The Nature Conservancy (TNC), the 4 per 1000 executive secretariat, the CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS), and Meridian Institute, held a Soil Carbon and Finance Webinar and Hackathon where a group of experts discussed how soil carbon accounting methods could be improved to support investment-oriented actions promoting soil health and carbon storage. Participants examined actionable opportunities using emerging methods and frontier technologies that enable connecting technical practices with finance and policy for accurate and cost-efficient SOC accounting.

Investors want an approach to soil carbon accounting that is standardized, accurate, low-cost, and attractive to future investors—already not an easy task—but it also must be able to evolve to climate market methodologies as data, modeling and sophistication of measurement, verification, and reporting (MRV) systems improve.

For the finance experts, it is vital that an MRV system should provide what investors want, all while soothing their fears. Investors, like researchers, desire a methodology that promotes best practices and yields robust results. However, innovation, uniqueness, positive outcome stories and high value for money are more important to investors than to researchers who may value quality and accuracy more. What investors dread is also different from the fears of measurement scientists and researchers. Investors worry about a lack of project delivery or risks to their reputation as a climate investor by accusations of greenwashing or criticism from stakeholders. Researchers, on the other hand, fear funding cuts and risks to their reputation, but from criticism of the robustness or integrity of their work.

Accounting methods that compromise to address both needs and fears of all stakeholders are necessary to advance investment-oriented actions that promote soil health and carbon storage.

Bypassing Barriers to Implementation

Carbon-credit markets can be a strong incentive and expand an economy, but they are a tricky business. They require third-party verification of results using standardized protocols needed to ensure credible outcomes. However, there are other ways to incentivize farmer practice changes that require less accurate or sophisticated MRV systems. Practice-based loans or incentives and performance-based payments can be used as steppingstones to a carbon-credit market.

Improving accounting accuracy requires reducing uncertainties in the system over time, which necessitates overcoming barriers of cost of collecting data, accessibility to models and existing data, and the feasibility of including smallholders. Actions to overcome barriers could include:

- Using data from peer-reviewed scientific literature to fill data gaps.

- Utilizing existing activities like extension, farm management record-keeping, or reporting requirements of buyers to collect data for MRV purposes.

- Using remote sensing data to reduce the costs of data collection.

- Improving the technical ability of projects to use models and make them more accessible to project experts.

- Encouraging collaboration between projects and external groups.

- Using C-credit discounts to make transactions viable for smallholders.

- Using proxy indicators for SOC stock changes.

World Soil Day

There is an urgent need for a standardized, low-cost, fit-for-purpose approach to SOC accounting that encourages investment and adapts to the climate market while being scientifically robust and accurate. Adopting a hybrid approach may be the most efficient route that considers the need of all stakeholders.

Increasing soil carbon stocks on land and even in our oceans would greatly benefit healthy food production and mitigate climate change. It is a crucial step along the path to a sustainable future. Achieving ambitious results will require ambitious action, and there is no better time to start than the present.

On this World Soil Day, it is time to take action to secure our planet’s future. Recognizing the critical role soil plays in all life is essential to transforming our food systems. Soil is a non-renewable resource fundamental to future food security and combating climate change.

The 2020 theme of World Soil day is “Keep soil alive, protect soil biodiversity.” The campaign aims to raise awareness of the significance of healthy soils and the consequences of ignoring our current climate problems that impact soil health. It addresses the challenges of sustainable soil management, the need to fight biodiversity loss, and encourage policymakers, businesses, organizations, and communities everywhere to commit to improving soil health. The well-being of all life on Earth and a healthy environment are undeniably intertwined.

Editor’s Note: The opinions expressed here by Impakter.com contributors are their own, not those of Impakter.com. In the Featured Photo: Our soils feed us. It’s time we returned the favor. Photo Credit: G. Smith (CIAT)