Investors can use the Positive Peace Index to gauge the performance of environmental, social and governance factors in countries.

Global interest in ethical investment is growing. More companies and funds are committing to finding solutions for the world’s challenges through sustainable investment.

Analysis from the Institute for Economics and Peace (IEP) shows that Positive Peace measurements for countries can guide investors looking for ethical investment options. Considering the level of environmental, social and governance (ESG) performance of any country is just as relevant as any company or corporation, especially for investors interested in the creditworthiness of a nation or the economic trajectory of frontier and emerging markets.

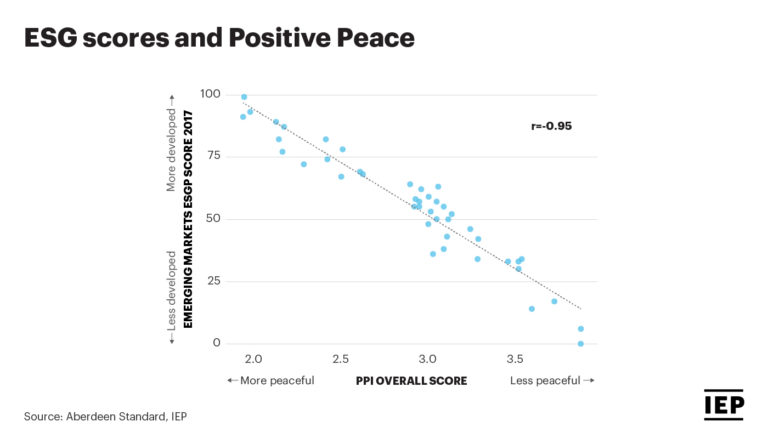

Findings from IEP’s analysis show that the indicators used to measure the Positive Peace Index maintain a high correlation with commonly accepted ESG indicators used by investment funds. The correlation coefficient between the Positive Peace Index (PPI) and sovereign ESG scores computed by BNY Mellon’s Insight Investment for 186 countries in 2018 is 0.91.

For emerging markets, ESG sovereign scores computed by Aberdeen Standard Investments match the PPI with a correlation coefficient close to one in absolute value. Lazard Asset Management’s emerging markets debt team has computed sovereign ESG scores whose absolute value correlation coefficient against the PPI Score is 0.87.

Positive Peace can be used in financial markets to help investors identify reliable and sustainable growth opportunities. A reliable gauge of economic resilience, Positive Peace can also be used to select portfolios of countries that consistently outperform global gross domestic product (GDP) growth. Improvements in Positive Peace are statistically associated with better performance in a range of macroeconomic indicators, including stronger GDP growth, stronger flows of foreign direct investment, appreciating currencies, lower and more stable interest rates, and inflation rates.

Per capita GDP is highly correlated with the Positive Peace Index Score. Data for 2019 shows that for every one index point improvement in Positive Peace, GDP per capita increases tenfold. Domestic currency in countries where Positive Peace improved appreciated by over one percentage point per year more than countries where it deteriorated. Among countries where Positive Peace improved, household consumption rose in the past decade at a rate almost twice as high as for countries where the PPI deteriorated, and growth in business activity improved up to 2.6 times higher.

Related Articles: Fasset: Using Blockchain to Promote Sustainable Investments | Peace in the Age of Chaos — Interview with Steve Killelea

Nations that improve in Positive Peace consistently outperform comparable countries in real GDP growth. By choosing countries that advance in Positive Peace in a given year and mapping their real GDP growth in the subsequent year, investment analysts can build an annually rebalanced portfolio of countries that outgrows the global average by one percentage point per year.

Other macroeconomic gauges such as consumption, business valued added and capital expenditure, also perform better in countries with improving Positive Peace. Using financial market instruments that mirror domestic economic performance, one could generate above global average returns for investors interested in promoting Positive Peace.

The Positive Peace Index uses 24 indicators to analyse 163 countries that are improving or deteriorating in Positive Peace. Since 2009, 134 of the 163 countries measured on the index have improved.

— —

About the author: The article has been written by the Vision of Humanity Editorial staff — brought to you by the Institute for Economics & Peace (IEP). The IEP investigates the impact of COVID-19 and future trends in economics, politics, social dynamics, conflict and development.

Editor’s Note: The opinions expressed here by Impakter.com columnists or contributors are their own, not those of Impakter.com. — In the Featured Photo: Windmill in Valtetsi, Greece. Featured Photo Credit: Vasilios Muselimis, Unsplash.