As our environment is undergoing ever faster collapse, with the rainforest burning in the Amazon, the ice melting in the Arctic and now California ravaged by fires, the goal of achieving sustainable finance appears ever more elusive. It is obvious that nature risks directly translate into financial risks. And with climate change accelerating, it is equally obvious that growing natural risks is the cause of equally growing financial instability.

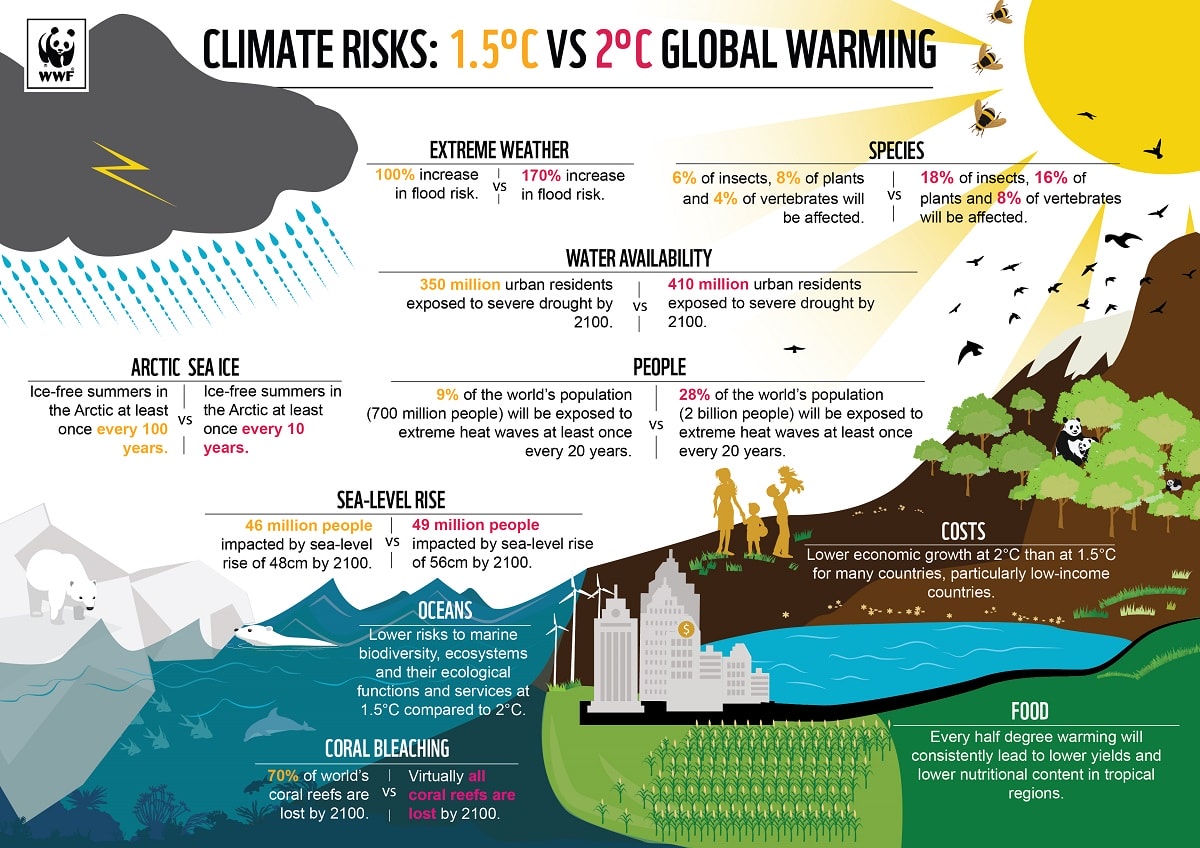

While the relation between nature, climate and sustainable finance is obvious, the exact impact is not so clear. Natural disasters, from floods to air pollution events to wildlife species extinction, can impact businesses and whole economic sectors in variable ways, some more than others. And a small further rise in global warming, as small as a half degree centigrade, can make a stunningly huge difference:

To illustrate with the famous case of a highly valuable wildlife species threatened by extinction, i.e. bees whose pollination activities are fundamental for agricultural production. A prosperous European pharmaceutical company suddenly faced catastrophic financial losses after it had acquired in 2018 an agrochemical company accused of causing adverse impacts on bee populations that led to a series of health-related trials. Suddenly, it lost almost 40% of its market capitalization in less than one year, causing shareholders billions in losses. To put a name on these firms: the pharmaceutical company is Bayer, the agrochemical is Monsanto and the cause of the bee-killing is, of course, a pesticide, the infamous “Roundup”. In short, Bayer is worth less today than the $63 billion it paid for Monsanto about a year ago.

As a first step to ascertain what the effects of nature risks are on the finance industry, a number of academics at the University of Hamburg have formed a Research Group on Sustainable Finance and analysed for the first time the existing academic literature which highlighted the relationship between nature risks and financial risks. The study has been financed by WWF Switzerland and will be uploaded to their website this month.

They identified 154 peer-reviewed articles published between 1966 and 2019. These articles covered four areas: banking, insurance, real estate, and stock markets; and nine nature risks: disease, drought, erosion, flooding, invasive species, oil spills, pollution/environmental contamination – of air, groundwater, soil/land and surface water -, solid waste, and bushfires.

Destruction of ecosystems results in financial risks

Overall, the articles confirmed that the destruction of ecosystems results in financial risks. They also found that nature risks are not adequately reflected in current risk models of financial institutions and therefore not priced correctly.

Incorrect pricing is a major concern. It means that financial institutions urgently need to identify how the activities they finance impact the natural world. Developing a framework for investors to analyse nature risks and integrating these systematically in their valuation models is crucial. It would be the first indispensable step to achieve sustainable finance.

What is interesting is how the literature reviewed by the Research Group on Sustainable Finance identified variable impacts depending on the sector and the kind of nature risk. The sector that tends to suffer the most from nature risks is real estate. The greatest threats to valuation in the real estate sector include flooding followed by air pollution (and environmental contamination in general) and bushfires.

That of course, is a massive financial problem – but it is a problem for individual property owners too. The house you just bought, or that you inherited from your parents, could be worth next to nothing in just a few short years.

According to anyone who knows how to invest in stocks, the stock market performance of listed companies was found to be affected mainly by pollution, oil spills, and the outbreaks of diseases. Concerning the banking sector, credit losses from drought were found to affect the capital reserves of microfinance institutions, weakening the supply of credit as a result. With the rise in flooding, air pollution, erosion, and drought, customers tend to uptake insurance as a safety measure. However, and this may come as an unwelcome surprise to many, there is no systematic exploration of the overall effect on net loss or net gain of insurance companies. In other words, what happens to insurance is a black box.

The studies generally indicate that overall nature risks do indeed translate to financial risks and result in a series of highly undesirable results: decline in property prices and stock prices (market valuation) as well as bank defaults, among other effects.

The conclusion is clear: Sustainable finance is the only model that will ensure steady returns for investors and a stable economic environment.

WWF’s active role in promoting sustainable finance

WWF Switzerland reports that “a growing minority is driving forward the discussion on sustainability in the Swiss financial center and on a global scale”, spurred on by the Paris Climate Agreement that calls for making “financial flows climate friendly”. But, it is acknowledged, there is a sense that a “healthy environment is not yet a priority for many financial market players.” This is so, because as long as the “return is right for the investors”, aspects like environmental protection or social justice “fade into the background.”

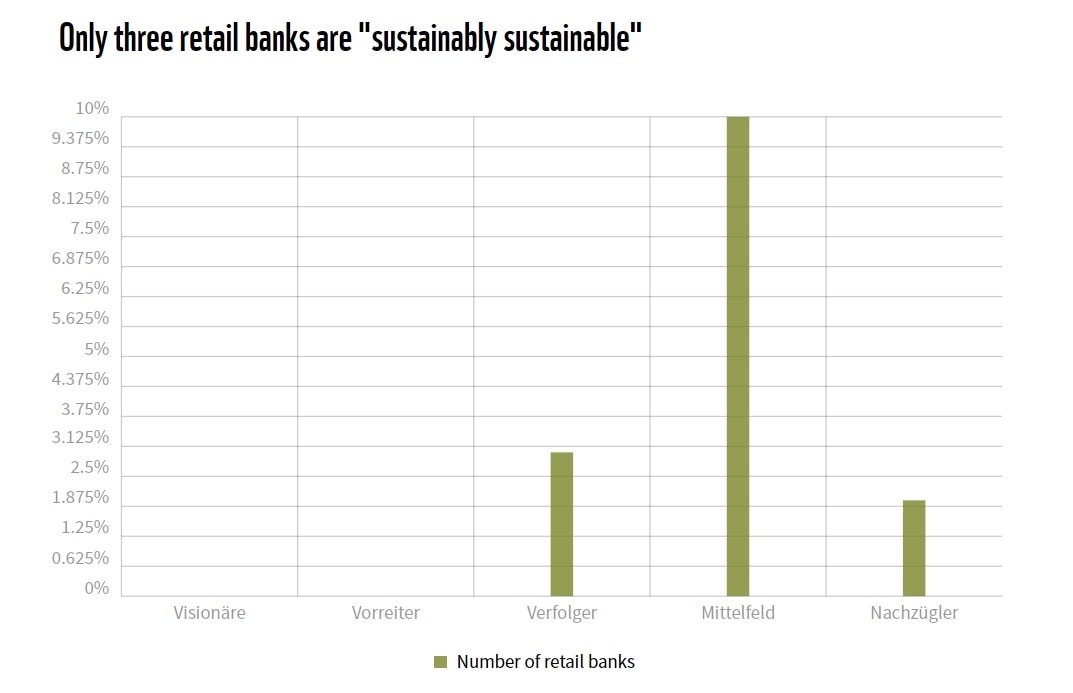

This hasn’t stopped WWF Switzerland from taking concrete steps to promote sustainable finance with a series of studies, including the one mentioned here. It also provides guidance to bank customers with a guidebook to help them choose the “right” bank, i.e. more sensitive to sustainability issues. And it has devised a powerful tool, a rating system to rank banks and pension funds. Here is an example of their analysis to rank the largest 15 retail banks in Switzerland in terms of how far they have gone in pursuing a sustainable finance model:

Likewise, at regular intervals, WWF also evaluates the sustainability of the 20 largest Swiss pension funds and engage in dialogue with stakeholders, with the objective of promoting sustainable investment, for example in solar energy. Compared to the first rating of pension funds carried out in 2015/16, they found that in 2018/19 most of the pension funds examined dealt with sustainability issues in their investments. Overall, progress was made and almost half of the funded pension funds have improved. This said, the majority of the 20 largest Swiss pension funds are still relatively far from actively contributing to a sustainable society.

WWF’s overall objective is to “protect the ecosystems and living things of our planet” and for that purpose, financial instruments are needed that directly allocate capital to the relevant projects. As WWF sees it, the “big challenge is reconciling returns with the protection of natural resources”.

At the the 2019 Building Bridges Summit, held in Geneva on 10 October and attended by some 800 NGO officials, bankers, wealth managers, and regulators, WWF Switzerland CEO Thomas Vellacott has urged the finance sector “to take the sustainability discussion from niche to mainstream if it wants to play its part in meeting the UN’s Sustainable Development Goals.”

In short, WWF with its partners supports and promotes the transition to a financial system that benefits the people and the planet. Investors will need to learn that they cannot forget the bees. Or rising sea levels. No doubt, increasing losses caused by natural disasters will eventually convince them. Hopefully before damage to our planet is irreversible.

Cover image:WWF