Imagine spending half your salary to purchase water — water for drinking, cooking and bathing. Juleha, a 37-year-old woman from a coastal town in Indonesia, did more than imagine it. She lived it. Juleha paid up to half her earnings from her job as a factory worker each week to a local vendor in return for safe water for her family. Juleha, her toddler and her husband, who worked as a fisherman, lived in a small home with no water connection and no toilet.

Juleha’s story is not an uncommon one. Worldwide, 844 million people lack access to safe water. That’s one in nine. Even more people, one in three, lack access to a toilet.

Access to water and sanitation is a global crisis. It’s also a women’s crisis. The burden of collecting water disproportionately falls to women and girls. Often overlooked is the inextricable linkage between Clean Water and Sanitation (SDG6) and Gender Equality (SDG5). To solve gender equality, we must solve the water crisis. And to solve the water crisis, we must unlock new sources of capital through innovative financing. Doing so will unleash the power and potential of girls and women globally.

Providing households with drinking water often requires an enormous investment of time. Globally, women and girls collectively spend 200 million hours every day collecting water. In Asia and Africa, women and girls walk an average of six kilometers (3.7 miles) each day gathering water. Time and energy spent collecting water means time and energy not invested in earning an income, starting a business or going to school. Consider these facts: Women in Sub-Saharan Africa spend 40 billion hours a year in collecting water, equivalent to a year’s worth of labor for the entire workforce in France. And for every year a girl stays in school, her earning potential increases by as much as 25 percent. Without earnings and education, women will never achieve gender equality. Without safe water and sanitation, they will not maximize their earnings and education. Water and a toilet are central to gender equality.

Millions of women like Juleha find ways other than waiting or walking to meet their family’s water needs; they employ vendors to whom they hand over a high percentage of their hard-earned salary to buy safe water. It’s a paradoxical principal that applies across much of the developing world — people in poverty pay a much higher proportion of their income to buy water than their wealthier neighbors, up to 15 times as much, simply because they are not connected to the piped water infrastructure. This reduces their household disposable income and perpetuates the cycle of poverty.

Now let’s talk toilets. SDG 6 calls for universal access to sanitation and water. More than 2 billion people lack access to safely managed sanitation, and as with water access, women and girls suffer the most. Collectively they spend 266 million hours every day looking for a place to go. That’s both an enormous investment of time and a threat to their health and safety. Lack of access to a clean, private toilet puts women and girls at risk of infection, disease and even assault if they venture out after dark. It is unacceptable that women and girls risk violence, rape or death to meet a basic human need.

In short, the water and sanitation crisis is a women’s crisis. It locks women and girls in a cycle of poverty and robs them of their immense potential.

It doesn’t have to be this way. Just as the problems are linked, so too are the solutions. Empowering women and girls with access to safe taps and toilets at home gives them time to stay in school or earn an income. They can save the money that previously went to water vendors. And the fears of disease from dirty water or assault dissipate.

But here’s the catch. Access to a tap or toilet at home costs money, paid upfront, and women who lack access to safe water and sanitation often cannot afford the investment required. Our organization, Water.org, focuses on removing this financial barrier. We enable access to affordable installment loans to pay for the upfront costs of access. These personal loans cover, for example, a connection to the municipal water system or a toilet at home. It’s a hand up, not a hand out, and as such it is immensely empowering. This affordable loan unlocks the potential and power of these women, allowing them to solve their family’s water and sanitation needs and to gain their time back. That’s time for school and for work.

Remember Juleha, the woman in Indonesia who used half her salary each week to buy water from a private vendor? Water.org worked with a microfinance institution and a local utility company to help Juleha and others in her town obtain small, easy-to-repay loans to cover the up-front costs of connecting to the utility’s pipelines. The average loan amounts to about $340. Juleha paid back the loan in six affordable monthly installments; this money has since helped provide a loan for another family in need of a water connection. Connecting to the utility pipelines cut Juleha’s monthly water costs in half, savings now available for food, medical care and her son’s education. That benefits not only Juleha’s family, but her community, too.

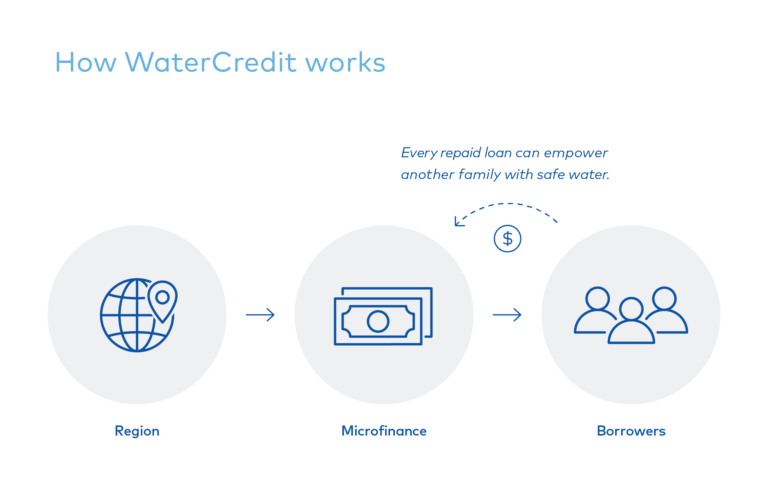

Juleha obtained her loan through WaterCredit, a solution Water.org launched more than a decade ago to help provide access to affordable financing and expert resources to make household water and toilet solutions a reality. Our solution uses philanthropic dollars to help select microfinance institutions (MFIs) in various regions of the world build their capacity to offer loans for water and sanitation to those in need. That capacity-building funding supports local market demand studies, pricing analyses or other technical assistance that puts the MFIs in the best situation to assess borrower creditworthiness and portfolio success. The MFIs access commercial capital to make the loans, and borrowers take out these loans to install the solution they deem best for their home.

WaterCredit is a proven success. It’s empowered more than 16 million people in a dozen countries to gain access to safe water and sanitation through nearly four million loans. Although WaterCredit is not specifically designed for women, they make up 88 percent of the borrowers. And almost every loan — 99 percent — is repaid in full, helping these women build credit histories. That’s critically important in removing barriers to financial inclusion and in creating a sustainable marketplace. Women are transforming the cycle of poverty into opportunity.

Experiencing the immense potential unleashed by WaterCredit is exhilarating. A few years ago, I visited a village outside of Bangalore, India that exemplified this impact; the village was a microcosm of entrepreneurship. Around every corner, I met enterprising women using their newly-reclaimed time to enhance their lives. In one house, women wove fabric on two huge looms. On the stoop of another home, women and girls rolled incense sticks to sell. Down the lane, women laid out brilliantly colored herbs to dry. No longer did these women wait or walk for water, or search for a safe toilet. They had their time back, which unlocked their power and potential. With a small hand up, they applied their immense creativity to earn a greater income and provide a bright future for their families.

Much work remains to achieve universal clean water and sanitation by 2030. The biggest barrier is capital. According to World Bank estimates, meeting SDG 6 targets will require $114 billion each year, more than three times the current annual investment. Philanthropy and government funds will never be enough. We must attract new sources of funding to the issue; we must take a blended finance approach. WaterCredit demonstrates this opportunity. This solution strategically utilizes donated funds to help mobilize commercial capital, thus catalyzing private investment and helping to close this significant financing gap. Our $27 million philanthropic investment in WaterCredit has enabled a global loan portfolio for those in need of $1.25 billion; equating to $47 worth of commercial loan capital for every donated dollar invested in WaterCredit.

At Water.org we believe the water and sanitation crisis will only be solved if we address the significant shortfall of capital. Innovative financial solutions like WaterCredit that are easily scaled and utilize blended finance will accelerate an end to the crisis. At Water.org we continue to seek insightful, forward-looking and sustainable ways to make the goal of universal water and sanitation a reality.

Let’s go back to Juleha in Indonesia. No sooner had she repaid her loan for a water connection than she began planning for her next WaterCredit loan (here’s more info). For what? To cover the costs of installing a household toilet, providing a safe and private bathroom for her family. Juleha is an example of how women are stepping forward to define their own future. They understand the specific needs of their own homes and communities and what will work; they simply need resources like small, affordable loans made available to them. Through access to safe household water and sanitation, they transform a cycle of poverty into a cycle of opportunity for themselves, their families and their communities. And in doing so, they help forge a path to gender equality. Achieving the interconnected SDG goals of safe water and sanitation for all and gender equality will in turn ensure a healthy, sustainable and productive future.

Water has the power to change lives. You do too. This World Water Day, give the power of water to people living without it.

Link: https://water.org/water-