If a company only pays attention to maximizing profits and neglects its social responsibility, it may eventually bring negative events to society. These issues can be related to food safety, environmental pollution, tax evasion, and so on. As a result, the reputation of an enterprise will be seriously threatened, and the sustainable development of society will be endangered. Enterprises have gradually realized the importance of social responsibility and are willing to pay costs related to corporate social responsibility (CSR).

Companies that have chosen to fulfill their corporate social responsibility have experienced both positive and negative outcomes. To better the performance of CSR, stronger information disclosure systems are essential.

Related Topics: Greenwashing in Finance – Financing Women – Canadian B Corps – The Fundamentals of Start-ups and New Brands

Stakeholders Have Extra Requirements, Outside of “Profit Maximization,” for Companies

Early enterprises chose to fulfill their social responsibility under the pressure of labor conflicts and government departments. However, since the chief aim of enterprises has always been maximizing profit and shareholders’ interests, early scholars believed that fulfilling social responsibility is meant to increase economic benefits. Otherwise, they agreed that enterprises are not obligated to fulfill social responsibilities.

Companies are both social and economic organizations. Because of this, it is harmful to define an enterprise as a “profit-making economic organization” and “subsidiary of shareholders” because companies will then regard “profit maximization” as their only goal and will ignore their responsibilities as social organizations.

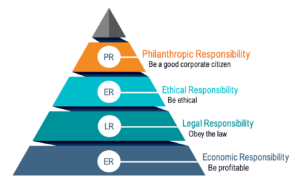

According to R. Edward Freeman’s Stakeholder Theory, enterprises have a series of contractual relationships with multiple stakeholders. Stakeholders exist in both internal and external enterprises and include investors, managers, employees, customers, suppliers, government departments, communities, and so on. They make direct and indirect investments in enterprises and assume the risks arising therefrom. Therefore, to ensure the sustainable development of society, enterprises should be responsible for all related stakeholders and not just shareholders.

Enterprises are Pushed to Take CSR into Account

Companies that neglect CSR and exists only to maximize profits will likely be harmful to society. Fortunately, the increasing efficiency of information dissemination exposes such companies. Once a negative social event occurs, the company/brand at fault will have their image and value – which have been established over many years – be severely damaged all at once.

The sustainable development of enterprises cannot be separated from society. Therefore, enterprises need to take CSR into account. Today, the corporate agenda is increasingly influenced by the concept of sustainability. The World Business Council for Sustainable Development (WBCSD) stressed:

[Corporate Social Responsibility is] the [continuing commitment by] business to behave ethically and contribute to economic development while improving the quality of life of the workforce and their families as well as of the local community and society at large…

Therefore, more enterprises are starting to consider the importance of sustainable corporate development and believe that being socially responsible is in line with their long-term development interests.

Unfortunately, increased costs are inevitable when fulfilling CSR. Benefits also may not come immediately. The trade-off between cost and benefit will be a critical factor for many companies deciding many resources they use to fulfill their social responsibility.

The impact of CSR on financial performance has become a popular research topic, but the results vary with different samples and backgrounds. The varying relationships between CSR and financial performance can be described by one of the following models: positive linear correlation, negative linear correlation, U-shaped, and inverted U-shaped.

Positive Effects of CSR

Fulfilling CSR can help enterprises improve their business performances in the following aspects:

- Development of specific markets.

- Product differentiation strategies.

- Sale of pollution-control technology.

- Reduction of conflicts with external stakeholders.

- Energy savings.

- Reduced service, capital, and human resource costs.

Negative Economic Effects of CSR

When enterprises pay to fulfill social responsibilities, the economic benefits may not be as great as the benefits of investing in their main businesses. Some companies are unable to simultaneously boost their financial performance and CSR spending.

Information disclosure will alleviate this problem by having socially irresponsible companies be negatively evaluated in the capital market, which will lead to higher regulatory costs, a blemished reputation, and dissatisfied stakeholders.

U-Shaped Effects

The relationship between CSR and financial performance can also be U-shaped or inverted U-shaped. U-shaped curves show that spending a relatively small amount on CSR will deduce financial performance, but, after a certain point of spending, CSR will increase performance. On the contrary, inverted U-shaped curves show that exceeding a certain spending point on CRS will have negative impacts on financial performance.

With an inverted U-shaped curve, company executives may wish to bring benefits to themselves by over-investing in social responsibility. This may, at first, have positive effects on financial performance and their public image. However, this over-spending on CSR – driven by personal interest – will endanger business performance and stakeholders’ interests down the road.

Editor’s Picks:

“Increasing diet diversity in low-income communities”

“Increasing diet diversity in low-income communities”

“Meeting SDG 12 requires addressing drilling waste”

“Meeting SDG 12 requires addressing drilling waste”

Information Disclosure Systems Need Enhancement To Promote CSR

At present, CSR reports fail to reflect all social issues related to company operations. To maintain a positive image in the capital market, enterprises selectively choose what information is disclosed in their CSR performance reports. They often avoid serious, negative information and problems. For example, a polluting enterprise will choose to disclose more information outside of their environmental responsibilities, or they may choose to disclose positive behaviors in environmental governance and cover up the problems they create.

The principles of CSR information disclosure are mostly voluntary. Hopefully, in the future, more parts of information disclosures will be mandatory. Especially with the increasing environmental problems, the implementation of environmental responsibility will rise if enterprises have to disclose more information. Some initiatives, such as the Task Force on Climate-related Financial Disclosures (TCFD) and the Sustainability Accounting Standards Board (SASB), have made recommendations on how to regulate corporate social responsibility reporting and make it mandatory.

Increasing transparency makes markets more efficient and economies more stable and resilient. – Michael R. Bloomberg

Conclusion

With increasing public demand for corporate information disclosures, enterprises that refuse to fulfill their social responsibilities will have trouble maintaining a good corporate image and be favored in the capital market – even if they are profitable.

The following statements are from Business Nasdaq‘s article, Buy-Side Pressure Puts ESG on the Main Stage. We can see that ESG investment has become more and more popular in the capital market, and enterprises actively fulfilling social responsibility will become more and more popular.

When we look at the U.S. markets, we’ve seen such a change…. Five years ago, we weren’t really talking about ESG with U.S. investors. Over the past couple of years, we’re talking about ESG in about 50% of the conversations that we’re having. – Foli Pontillo, Global Head of Nasdaq’s Perception Practice

We found that ESG was almost universally top of mind for these executives… It was clear to us that corporate leaders will soon be held accountable by shareholders for ESG performance – if they aren’t already. – Robert Eccles, Professor of Management Practice at Saïd Business School at the University of Oxford

To conclude, enterprises need to fulfill their social responsibilities to create a sustainable future. Sustainable development of enterprises can not be separated from society. As mentioned above, enterprises are both social and economic organizations. No enterprise can achieve prolonged self-development without the development of society as a whole.

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com – Cover Photo Credit: Fordham Law News.