The COVID-19 crisis has led to severe economic disruptions, knocking energy markets off balance, especially the electricity sector. Up to now, the energy sector has seen the steady growth of renewables- both globally and within the US- while the power of coal is steadily waning. Faced with COVID-induced economic turbulence, how will renewable energy fare now as growth is forced downwards for the first time in 20 years?

The coal industry has been dealt a hard hit by the COVID-19 pandemic. It has been identified as one of the sectors most vulnerable to the pandemic-induced economic turmoil. As the world went into lockdown and encouraged social distancing, less electricity was needed to manage utilities. The US Energy Information Administration (EIA) predicts that electricity consumption in the country this year will be almost 6% less than last year. Coal has been the most impacted, given its higher cost compared to gas, wind and solar power. Consequently, the pressure for companies to shift away from fossil fuels has ramped up.

Pre-COVID-19, the fossil fuel industry had been under siege from growing climate activism and divestment advocacy. For example, divestment campaigns are gaining momentum in US universities. The University of California recently announced its full divestment from fossil fuels, as did American University. While slow-going compared to the UK, where half of its public universities have embarked on divestment strategies, other universities in the US may eventually follow suit amidst mounting pressure from student bodies. For example, Georgetown University is progressing slowly but steadily, pledging to divest from public securities and private investments relating to fossil fuel companies.

Globally, divestment strategies are gaining momentum. Barclays, the sixth largest fossil fuel investor globally, is facing greater demands from its investors to halt its fossil fuel lendings. Late last year, the European Investment Bank (EIB) announced its intention to stop funding fossil fuel projects by the end of 2021. Moving away from the West, the EY Global Corporate Divestment Study found that business sentiment to divest is at record high rates among the Southeast Asian companies surveyed. Investors are beginning to turn away from fossil fuels in response to the gloomy prospects of the industry- for the most part. Things are different in the US; to its fossil fuel industry, COVID-19 presents an opportunity for revival, with Trump providing financial aid for struggling oil companies, despite protests by Democrats and environmentalists.

Steady Decline of Coal in US Electricity Sector

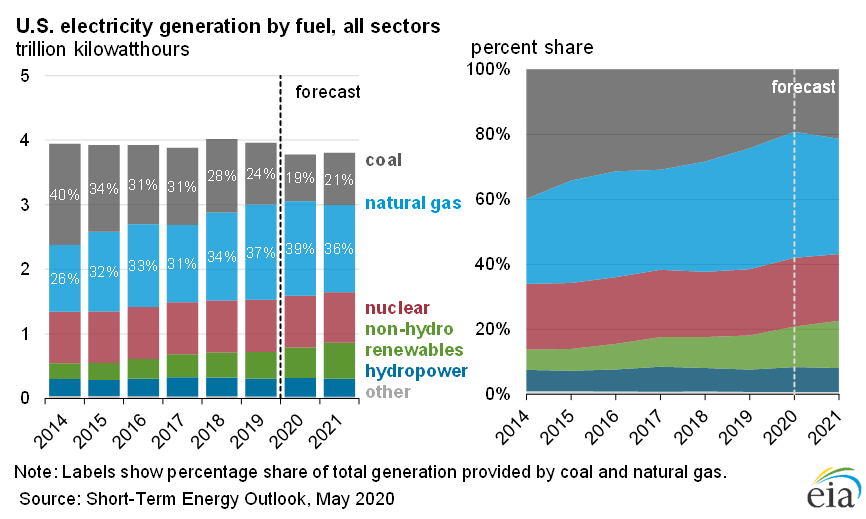

The coal industry in the US has been steadily declining. Ten years ago, coal was the powerhouse of US electricity generation, accounting for half of the country’s electricity. Over the years, its share has dwindled, down to 24% in 2019. In the same year, coal energy consumption was outpaced by that of renewables, a first in the US in over 130 years. A June 2020 report by the EIA forecasted that renewable electricity generation would grow by 4% this year, while coal generation would be reduced by a quarter. This disparity comes from the leading role of renewable energy in expanding generation capacity, particularly wind and solar, as well as its low operating cost. In the face of the pandemic, industry analysts predict that the transition from coal to renewables is accelerating, and coal’s share may well diminish to a mere 10% in five years.

In the image: Fig. 1: Declining share of coal in US electricity generation over the years. Image credit: Earth.Org.

Despite this steady decline in coal use, some players are clinging onto a shred of faith that the industry will rebound. Political support for coal is still going strong in some parts of the US, with some pushing for new policies to prevent coal-fired power plants from closing down, however economically unviable they may be. West Virginia recently introduced a bill providing a tax break for coal plants, in exchange for keeping operations running until 2025. In Wyoming, an important state for US coal production, a new legislation obligates electric public utilities to attempt to sell coal plants before they can be closed down, effectively making it harder to retire them. Another legislation serves to pump more research into alternative uses of coal beyond electricity generation. Unfortunately for coal supporters, these efforts may not prevail against the headwinds of market forces; even before COVID-19, Trump – as avid a supporter of coal as he is- could not stop the decline of coal. Since taking office in 2017, coal plants have been shutting down rapidly, with more planned this year. There have been more than four thousand job cuts in the industry, and more than ten coal companies have filed for bankruptcy, including Murray Energy, the US’s largest private coal producer. Peabody Energy, the world’s largest private coal company, reported a loss this year, as it has every year since 2015. It is apparent that Trump’s pledge of support for coal has been unfruitful.

Rise of Renewables, Stagnation of Coal

Conversely, the future of renewables appears promising. Technology has been a boon for the dramatic decrease in costs of electricity generation and storage. According to Lazard, a financial advisory that analyses energy costs on an annual basis, the unsubsidised levelised cost of energy (LCOE) of coal ranges from US$66 to $152 per megawatt hour, while wind prices range from $28 to $54 and solar prices $36 to $44. LCOE describes the average cost of electricity generation by a plant over its lifetime, allowing for comparisons between energy competitiveness. Another formidable competitor in the electricity sector is natural gas, cheap and bountiful from the fracking boom. Lazard’s figures show its unsubsidized LCOE to range from $44 to $68. While natural gas has been topping the US electricity mix since 2016, these numbers show that renewables are catching up in terms of cost competitiveness, which is especially welcome considering the methane emissions associated with natural gas.

While natural gas releases up to 60% less carbon dioxide than coal when burnt efficiently, methane- its primary component– is a much more potent greenhouse gas. While relatively short-lived, methane is still capable of packing a punch over the 20 years it lingers in the atmosphere, having a global warming impact 90 times greater than that of carbon dioxide. Given these numbers, the EIA’s 2020 Annual Energy Outlook comes as a relief, as it projects that renewables will eventually surpass natural gas in US electricity generation, doubling from a share of 19% in 2019 to 38% in 2050. Natural gas provided 37% of electricity in 2019, a figure that is expected to remain largely unchanged, coming to 36% in 2050.

In the photo: Whilst renewables have been growing steadily in recent years in the energy sector, COVID-19 has had a negative impact on this growth. Photo credit: Unsplash.

In the photo: Whilst renewables have been growing steadily in recent years in the energy sector, COVID-19 has had a negative impact on this growth. Photo credit: Unsplash.

However, as with coal, renewables are not immune to the repercussions of COVID-19. As the economy stagnates, renewable installation projects will be temporarily shelved or halted due to supply chain disruptions, lockdown measures and expenditure reduction by companies. The growth of renewables- globally and in the US- is thus expected to take a nosedive. The pandemic is especially ill-timed for the renewable industry, as 2020 was meant to be a record year for capacity expansions. According to the International Energy Authority (IEA), renewable capacity expansions this year is set to be 13% less than that of last year, breaking its 20-year growth.

Fortunately, this decline is not permanent, cushioned by the long-term trend towards carbon-free energy, which even the pandemic cannot undo. As public and economic pressure force more coal plants to shut down, the resulting vacuum in energy capacity will likely be filled by renewables. Furthermore, more states are ramping up their efforts to go carbon-free. Currently, seven states, such as New York and Washington, have set their clean energy targets to attain 100% clean electricity by 2050. Such policies mandate the installation of renewable plants, hence it is only a matter of time before the shelved projects are set back in motion.

Post-pandemic, the renewables sector is expected to be well-poised to bounce back on track and continue growing, albeit less rapidly. Governments can play an important role in this comeback by incorporating investments in renewables in stimulus packages designed to help economies recover from the pandemic, with the UN chief urging governments to use taxpayer money to support businesses that cut greenhouse gas emissions and support the creation of green jobs as part of their economic recovery plans.

In the cover photo: Coal mining. Photo credit: Unsplash.

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com.