Farmers in Bangladesh face the twin challenges of coping with COVID-19 related atrocities while constantly being battered by monsoon floods. Fortunately, there was some respite for 316 flood-struck Bangladeshi Boro Rice Farmers who received a claim of Bangladeshi taka (BDT) of 150,000 as part of an innovative Index-Based Agriculture Insurance Scheme.

These farmers were a part of a pilot phase of this scheme which revolves around an innovative Index-Based Flood Insurance (IBFI) program, developed by the International Water Management Institute (IWMI) in partnership with the CGIAR Research Program on Climate Change, Agriculture and Food Security (CCAFS), the CGIAR Research Program on Water, Land and Ecosystems (WLE), Oxfam Bangladesh, Green Delta Insurance Company Limited (GDIC) and local associate Sancred Welfare Foundation (SWF).

Related Articles: Climate Service Entry Points in Vietnam | Crop Loss Assessment Monitor | Climate Services in Latin America

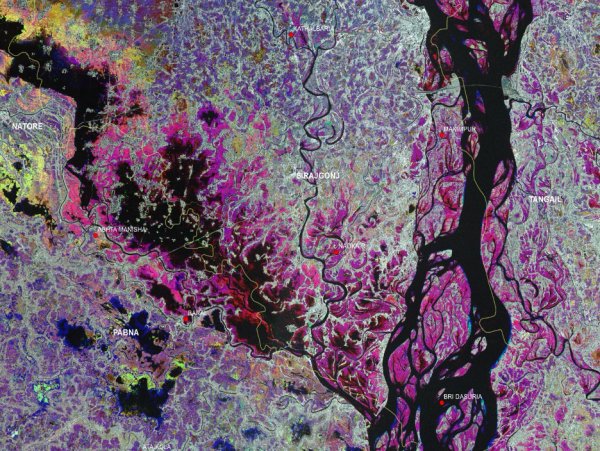

The initiative is in line with the vision of Honorable Prime Minister Sheikh Hasina of the Government of the People’s Republic of Bangladesh to stand by the farmers who are at risk of massive financial loss in the flood-prone Haor area. In order to create an effective hedging scheme to provide social security to the farmers via timely disbursement of insurance claims, the project takes an innovative approach by engaging and integrating satellite remote sensing, real-time data provider weather stations, digitalization of transaction methods, among others (refer to project report). The program offers a novel risk management solution by elevating the resilience of farmers to weather shocks and encouraging investments while providing an adaptive safety net.

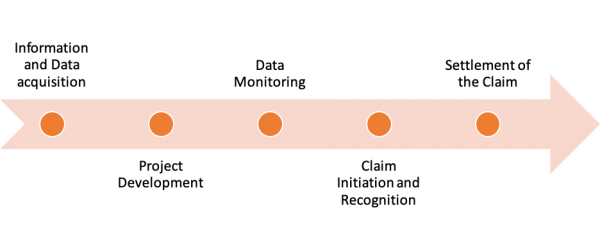

SUCCESS PATHWAY

The program strives to provide a need-based and tailormade solution for the farmers of the Haor Area by following a five-step approach involving:

- Information and Data acquisition

- Project Development

- Data Monitoring

- Claim Initiation and Recognition

- Claim Settlement

As heavy monsoon rains torment Bangladeshi farmers every year, IWMI along with its partners were able to calculate precise payouts in a timely manner using IBFI, therefore ensuring economic relief was provided to farmers in the form of swift insurance payouts.

“IBFI’s use of latest technology such as satellite remote sensing, real-time weather data and flood models, and digitalization of transaction methods significantly reduces the need for on-ground checks, controls operational costs and amplifies the claim disbursement process,”

—Dr. Giriraj Amarnath, Research Group Leader for Water Risks to Development and Resilience (WRDR) at IWMI

Amidst current socio-economic, geo-political and climatic problems, the Index-Based Agriculture Insurance can be a beacon of light for farmers by providing a sustained source of income despite heavy rainfall, extreme weather events and increased infestation rates. The IBFI becomes even more crucial given the pandemic induced lockdown and travel restrictions, as it removes the need for labor and time-intensive field visits for processing insurance claims.

The program also demonstrates the potential of IBFI in reducing the financial risk that smallholder farmers face from natural disasters such as floods and droughts. Scaling up such initiatives can be instrumental in securing these highly vulnerable groups, by offering a robust and sustainable crop insurance mechanism. Furthermore, it could play a critical role in achieving the Sustainable Development Goals of reducing poverty, achieving gender equality and underpinning food security.

Editor’s Note: The opinions expressed here by Impakter.com contributors are their own, not those of Impakter.com. In the Featured Photo: Aerial photo showing flood affected houses in Faridpur Bangladesh on July 19, 2020. Photo Credit: Xinhua