The climate crisis is costing the US $500 billion annually, an analysis by Bloomberg Intelligence (BI) shows. This represents 2% of the American GDP.

According to Andrew John Stevenson, BI senior ESG climate analyst, these expenses include “property damages, power outages, government spending and construction-surge inflation at the state level.”

If we consider the cost of climate change over these past thirty years, the results are shocking. Almost $7 trillion has been lost in financial damages related to global warming.

Although the number is considerably high, the actual cost of the climate crisis could be even higher. The estimate above does not include financial losses indirectly connected to climate change, such as rising property insurance premiums and lost wages resulting from extreme weather.

Bloomberg Intelligence tags costs of burning fossil fuels at $500 billion a year, totaling almost $7 trillion in damages in last 30 years, creating financial “headwinds for the overwhelming majority of individuals, companies and the government.”https://t.co/uYKxgNz1YD

— Sheldon Whitehouse (@SenWhitehouse) October 4, 2023

The more time passes, the worse the situation gets. However, Stevenson stated that the climate crisis can be seen from a different point of view. Some sectors are profiting because of global warming.

In fact, climate events are “a growing, visible part of the US economy, creating tailwinds for a few companies.” Since 2016, 32% of GDP growth has been connected to climate change.

To help investors calculate severe (positive or negative) weather’s economic impact, Stevenson has introduced the BI Climate Damages Tracker.

This resource, updated monthly with government and insurance data, estimates climate-related spending in the public and private sectors. These might include “everything from the emergence of new businesses and changes in household spending to consumer credit and insurance risks.”

Related articles: Climate Change and Economic Growth: Will the New Asia Pacific Economic Engine Go Green? | Can Climate Change the IMF? | New Report Reveals True Financial Cost of Climate Change

The companies that help more after a climate change-related event are likely to gain more investors. For example, Aon Plc, Quanta Services Inc., and Home Depot Inc. help businesses and homeowners tackle the consequences of storms. According to Stevenson, investors have been diverting more funds to them compared to companies in different sectors.

The effects of climate events usually lead to significant inflation at the local and national levels. This happens because, in order to address the urgent needs of affected areas, goods and services are immediately diverted to the afflicted communities.

The BI Repair Sector and the BI Prepare Sector

The BI Repair Sector includes 37 companies focusing on “storage, rentals, waste removal, building products, materials and construction and heating, ventilation and air conditioning (HVAC) services.”

According to Stevenson, on “a total-return, beta-neutral basis” over the previous ten years, the median stock in the group, which comprises Home Depot and Waste Management Inc., exceeded an equal-weighted S&P 500 — the single gauge of large-cap U.S. equities — by 96%.

Let’s take the case of Advanced Drainage Systems Inc. The company works with storm-water management and drainage systems. Since 2020, its share has almost quadrupled, and its revenue has nearly doubled.

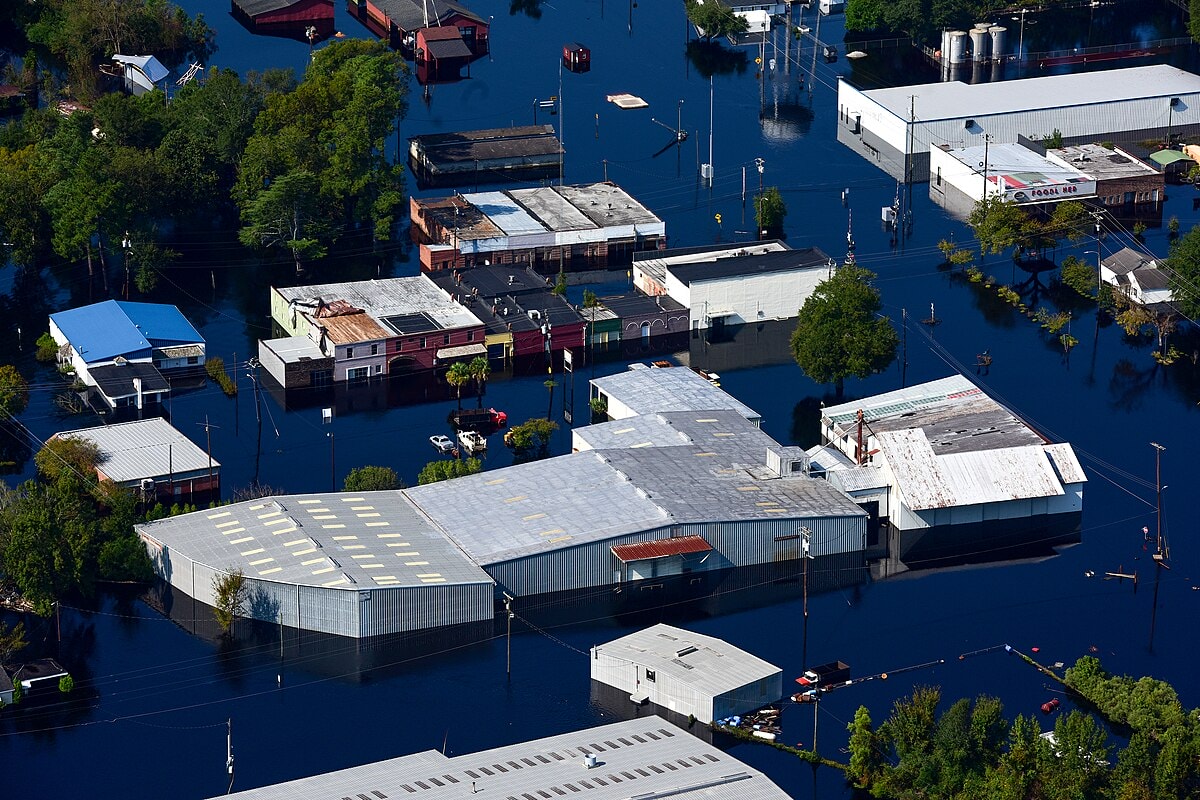

Climate change might explain this increase: In the last couple of years, many coastal areas have been affected by floods, increasing the need for storm-water management and drainage systems.

#Climatechange turning NY basement apartments into "death traps", with residents dying in floods. Legalizing units & retrofitting safety features could help protect vulnerable tenants. https://t.co/xuocTJvZcd

— earthactionglobal (@earthglobalact) October 2, 2023

The BI Prepare Sector includes 40 companies that work in supply-chain disruption risk mitigation, heat stress, wildfire pollution and infrastructure planning. According to Stevenson, this group “exceeded the equal-weighted S&P 500 by 107% in the same 10-year period.”

Climate change also benefits instalment lenders such as World Acceptance Corp. and FirstCash Holdings Inc., which lend people money to pay back over time. This happens because climate events might lead to increased, out-of-budget spending. As Stevenson said, people turn to lenders to avoid larger future bills — “after all, the money has to come from somewhere.”

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — In the Featured Photo: Nasdaq, 2003. Featured Photo Credit: Wikimedia Commons.