You’d expect the country with the biggest gross domestic product to be the wealthiest, right? W-w-woe, not so fast. Before weighing a country’s worth in gold, behold the elephants in the room.

In this article, we’ll navigate the pink elephant, Debt. After all, earnings are meaningless unless we figure out how much is canceled out by borrowings.

What does weighing GDP in terms of debt have to do with sustainable real estate?

Real estate is often bought with loans, exposing the real investment market in particular to debt and banking risk. Undermined by outdated tools, it’s not easy to find a sustainable neighborhood to invest in. We need to look at equity―starting with GDP―in its ecosystem to see the whole picture.

What matters to real estate investors is not so much GDP, as the money left over from GDP, and how that money goes into maintaining neighborhoods. If debt payments wipe out gains, inhabitants might also be ushered out, as we are seeing with urban flight in the United States, still reeling from the latest episode of its ‘debt-ceiling’ debacle.

The application of real estate parameters to the broader economy is a wide-open area of macroeconomics, offering the opportunity to see the world in terms of what it does for the household, rather than for the shareholder.

Like the invention of the Big Mac Index, which compares the price of a Big Mac hamburger in different countries to calculate the Purchasing Power Parity (PPP), which is used for comparing countries’ PPP GDPs, the modification to GDP that I’m proposing is useful for comparing the viability of neighborhoods: the inverted debt-to-GDP ratio.

Bringing home the veggie burger

The beauty of applying street-smart real estate economics to grandiose macroeconomics is that it brings home the veggie burger. The assumption is, what’s good for the household is most likely to be good for the country and wider world.

Yet, the ‘debt-to-GDP’ ratio is always presented with GDP in the denominator (Debt/GDP) to spotlight GDP’s effect on (usually astronomical) debt. Hermetically sealed in its upside-downness, the debt-to-GDP ratio’s pageantry of increasingly excessive debt shows countries like the US once again among the biggest as if bigger is better, or even sustainable.

Let’s invert that. Rather than looking at debt in terms of GDP, we can look at GDP in terms of debt. The inverted lens shows the economy in terms of real estate.

To decide where to buy property, we want to see gross domestic product, with debt as a mere adjustment to GDP―why I put debt in the denominator. The GDP/debt ratio I’m proposing spotlights ‘real GDP’ for real estate purposes.

Focusing on GDP-to-debt is next-level

‘Debt-denominated GDP’ (or GDP/debt) takes the pie out of the sky and indicates how much GDP actually irrigates the health of a neighborhood on the ground. The debt-denominated GDP ratio shows how much of a country’s GDP is available for investment without incurring more debt.

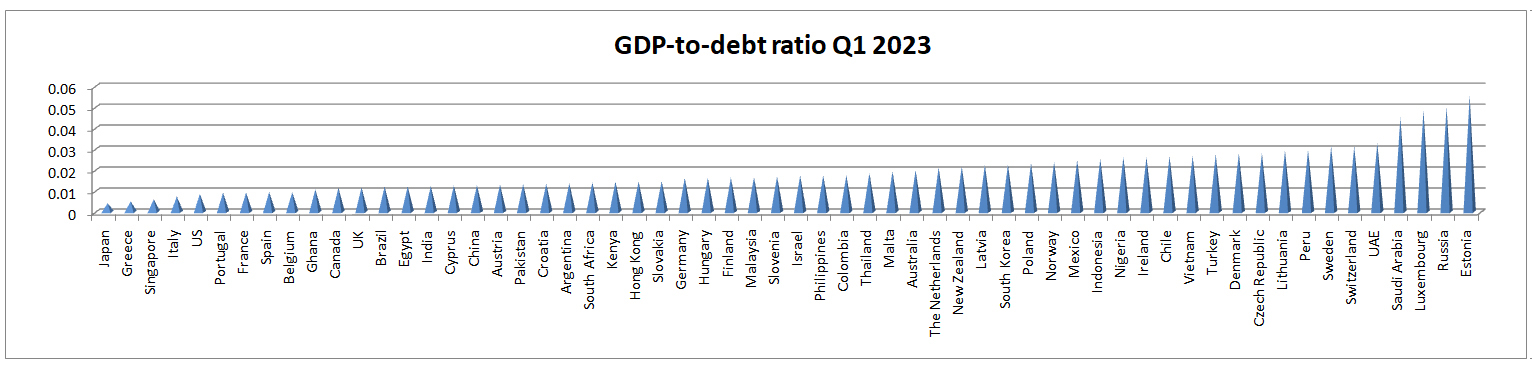

Denominating GDP in terms of debt gives a sobering view of the world’s wealth. Applying GDP/debt, here’s what the take-home looks like after debt has been taken into account:

Hidden in plain sight

This landscape reveals the top five on the right: Estonia, Russia, Luxembourg, Saudi Arabia, and the United Arab Emirates. Meanwhile, debt-laden behemoths backslide into the valley on the left, with Japan in the last position, reflecting the recent devaluation of the yen and bankrupting USA close behind.

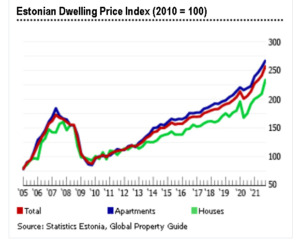

The inverted ratio I propose also more accurately predicts the success of real estate markets in Estonia, not to mention the failure in vacancy- and crime-ridden cities like tech-center San Francisco.

The debt-denominated GDP ratio adds another ‘real’ to ‘real GDP’. A debt-denominated equity ratio can be used more easily than the counter-intuitive inverse while pounding the pavement to forecast which neighborhoods will yield the highest investment returns.

Simply subtracting debt from GDP gives an inaccurate view. It not only ignores interest rates and durations on loans but also gives a number rather than a percentage, which is necessary for comparing different countries or neighborhoods.

The case study of Dubai

The United Arab Emirates doesn’t get its ears wet with debt.

In Dubai, the predominance of cash deals has provided insulation from the turmoil felt in other financial centers of late. Even amidst the drastic interest rate hikes of the past twelve months, its higher mortgage rates have not tempered buyers.

Dubai’s 300 percent increase in real estate transactions prompted a 44.2% increase in prices in 2022 from the previous year, the highest in the world.

These developments signal the region’s safe-haven status.

Putting debt in perspective with the proper lens

Applying for a mortgage is usually the way to go when you’re young and getting a leg up on the real estate market, but even so, you can mitigate systemic risk by buying in areas that have a high proportion of cash investors.

For productive areas where borrowing is the norm, using the proper measures can ensure a neighborhood’s fundamentals are strong.

Real estate is…keeping it real

As if unwilling to get on the scale in the morning, economists always show this indicator in terms of GDP mitigating debt. Never the inverse ratio, showing debt mitigating the rewards of GDP.

The time has come to reprogram. A simple shift in perspective is à propos in this era of competing interests versus sustainability.

Unveiling debt-denominated GDP, we correct for the supposition that neighborhoods function in terms of debt service. We can simply invert the habitual ratio and focus on what’s left of GDP to live on after accounting for our debts.

Shifting the focus off of excess and onto neighborhoods gives a realistic view of viability. When it comes to real estate economics, macroeconomics, and sustainability, the success of unlevered economies reminds us that slow and steady wins the human race.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — In the Featured Photo: Meadow-grass-view of the world’s tallest building, the Burj Khalifa, Dubai, United Arab Emirates Source: Photo by JL Morin