The term ‘sustainable investing’ seems like an oxymoron upon first observation. How can someone expend money with the hope of receiving a return on their investment while constraining their strategies to ethical principles? Indeed, this task is quite challenging — many professionals choose to take the easy road and avoid sustainable investing all together.

Therefore, many funds over the last few years have portrayed themselves to be ethically conscious with their investments, with the term ‘ESG‘ — an investing criteria based on the environmental, social, and corporate governance factors of a company — becoming attached to a myriad of funds.

However, the term ‘ESG’ is little more than just a buzzword, according to the Wall Street Journal. Indeed, funds have found it difficult to maintain their returns while keeping their investments geared towards sustainable developments. Many of the funds that have re-branded to a name indicative of the morality of their investments, have done little to actually change their holdings in order to reflect that.

As a result, the number of funds currently utilizing ESG criteria in their strategies remains small, with 182 ETFs currently implementing it worldwide. However, sustainability conscious products are continuing to slowly grow in popularity and improve, as people increasingly aim to keep their investments in-line with their personal values. As the ESG criteria becomes more defined and the process of investing in such products is streamlined, the outlook for this type of investing remains positive.

Vestive is a quickly growing startup that makes sustainable investing possible for the individual, retail investor. Having recently launched in March 2019, Vestive aims to tailor and manage portfolios geared towards sustainable developments for individual clients. The service aims to make the investing process quick, easy, and most importantly, educational for its customers. The portfolios managed by the startup seek to match or even outperform the returns of similar, but non-sustainable portfolios.

The CEO of Vestive, Mik Breiterman-Loader, founded the startup after working as a portfolio manager for nine years at Morgan Stanley, where he worked with large institutional clients, pension funds, sovereign wealth funds, and college endowments, enabling them to invest in sustainability. Impakter Magazine sat down with Breiterman-Loader to discuss his venture.

This interview has been edited for clarity and length.

How does your service work?

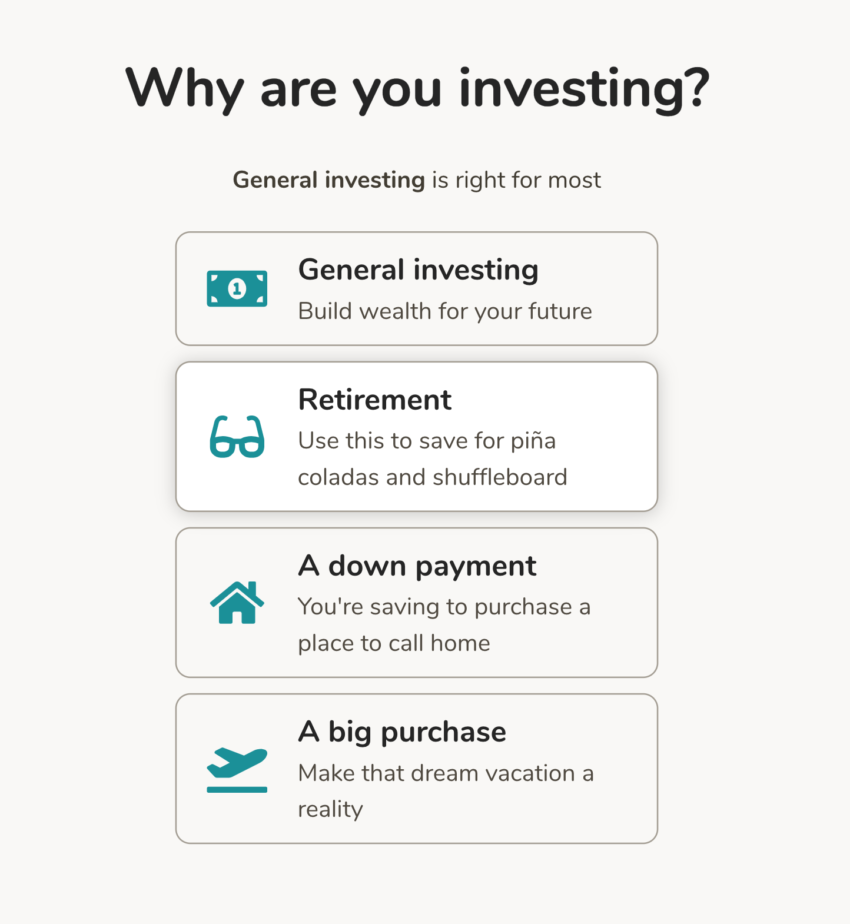

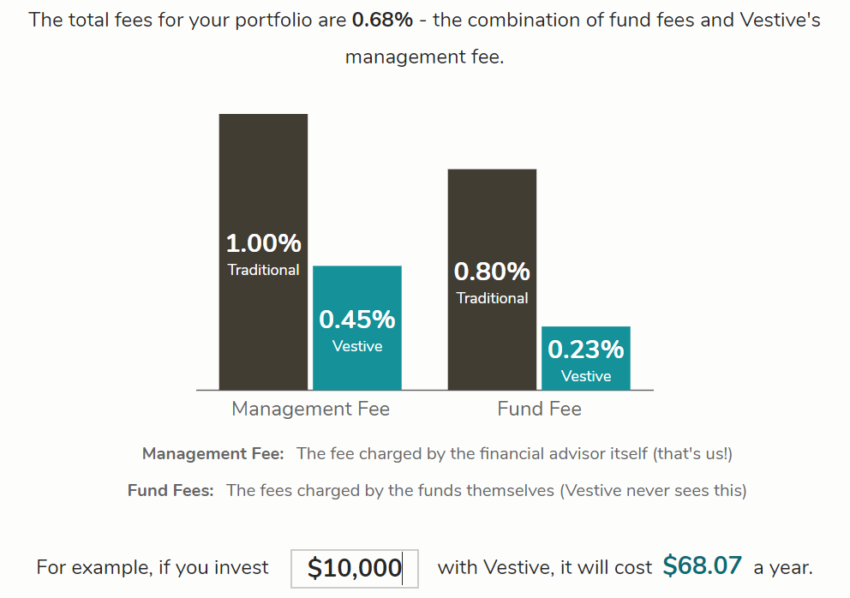

Mik Breiterman-Loader: When you open our website, getvestive.com, it will take you through a brief survey of your specific situation. It will ask: what are you trying to save for? What is your risk tolerance? And a few other questions. Based on your answers, we then recommend to you a portfolio and we show you a bunch of different financial metrics about that portfolio, including the costs involved (much lower than typical), what sectors you will be invested in, and what geographies we are suggesting that you invest in.

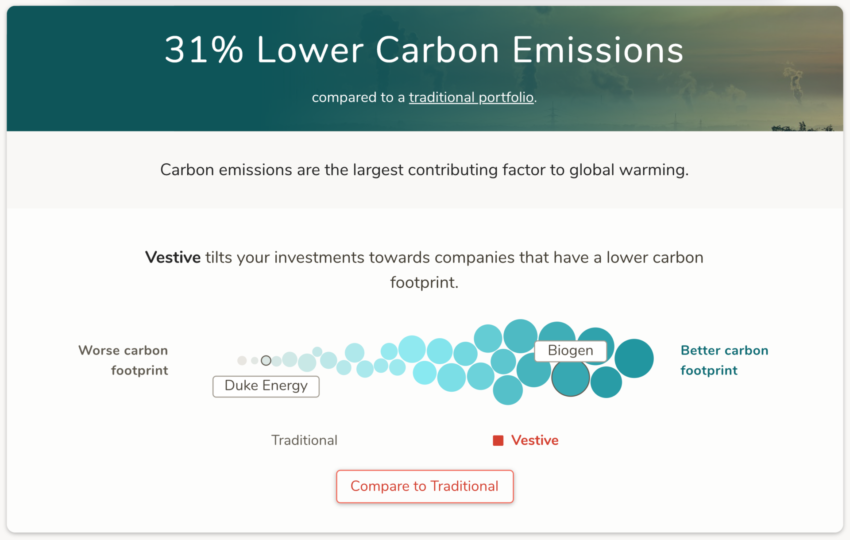

M.B.: Additionally, we show you a whole bunch of sustainability metrics: what your carbon footprint is, how much more you are investing in alternative energy, how much less you are investing in things like guns and tobacco, as well as other metrics.

M.B.: If you like what we are showing, with a couple of clicks you can enter your personal information and link your checking or savings account in one minute. You can also sign up for a recurring deposits, enabling you to regularly invest. We also have traditional accounts and retirement accounts–both Roth and traditional IRAs. It is really seamless and it takes five minutes to go from entering the site to having an investment account. Withdrawals happen pretty quickly, a few days is all it takes to withdraw your money at your request. So the portfolios are quite flexible in terms of investing and withdrawing.

How do you determine the allocation of the portfolios? How unique are the portfolios from customer to customer?

M.B.: For a lot of people their financial lives fall into pretty similar buckets based on their income and job. And while they might be different their goals are pretty similar, usually either: saving for retirement or looking to buy a house or other similar goals. We calculate each portfolio individually so that they are customized to the customer’s specific situation. However, they often end up being similar to each other, because most people’s financial lives fall into common categories.

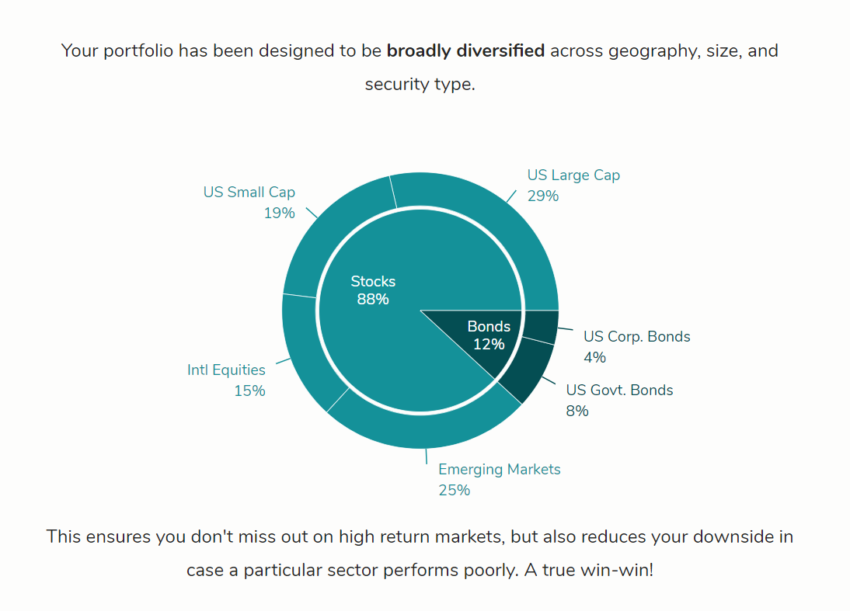

Do your clients know exactly what they are investing in?

M.B.: When you log into your Vestive dashboard, one of the first things you see, is a detailed holding list of what we are holding. What we are buying is a variety of ETFs and we’ll show exactly which ones we are buying and the amounts in each of them. Our strategy is to be diversified across a number of things, sectors, geographies, and asset classes. There will be large U.S. companies, emerging market companies, U.S. bonds, corporate bonds, etc. One of our goals is to be transparent in what we are buying, in our fees (which benefits us because we are cheaper than typical.) We are trying to give you as much information as possible, while being digestible to someone who may or may not be experienced in investing.

How do you find new investments and when do you add them to your portfolio?

M.B.: We definitely have to be on our toes in terms of making sure that we are aware of and evaluating new opportunities to invest in. Right now we are investing in ETFs and not in single companies at the moment, although it is something that we may explore down the road. Buying the funds makes creating a diversified portfolio much cheaper. We always keep on our radar some funds that are not sensible to invest in at the moment.

Some funds are really expensive to invest in at the moment, but then they might lower their fees and it might make sense to allocate there in the future. Another issue could be liquidity, if it is a new fund that has just launched and there is not enough people invested in it then it isn’t something that we could buy in and out of. It is a combination of evaluating new products as well as continually evaluating things that are on our buy list and things that are potential buys.

Related articles:

“How Will We Finance the New Deal for Nature?” byDr. Gianpiero Menza

“How Will We Finance the New Deal for Nature?” byDr. Gianpiero Menza

“Impak Finance: Reinventing the Banking Experience” byGonzague Mulot

“Impak Finance: Reinventing the Banking Experience” byGonzague Mulot

How do you prepare your portfolios for a potential downturn?

M.B.: The answer really comes down to our investment philosophy, while it is fun to speculate about what the returns in the next year or five years are going to be, research shows that the best strategy is actually just being well diversified, having low costs, and keeping your investment horizon relatively long term. Part of the product is educating people on some of these notions. Sometimes the right thing to do is to stay the course. So if there were an economic downturn we think that our portfolios would actually hold up pretty well, because they are very diversified.

How do you gauge the performance of your unique portfolios?

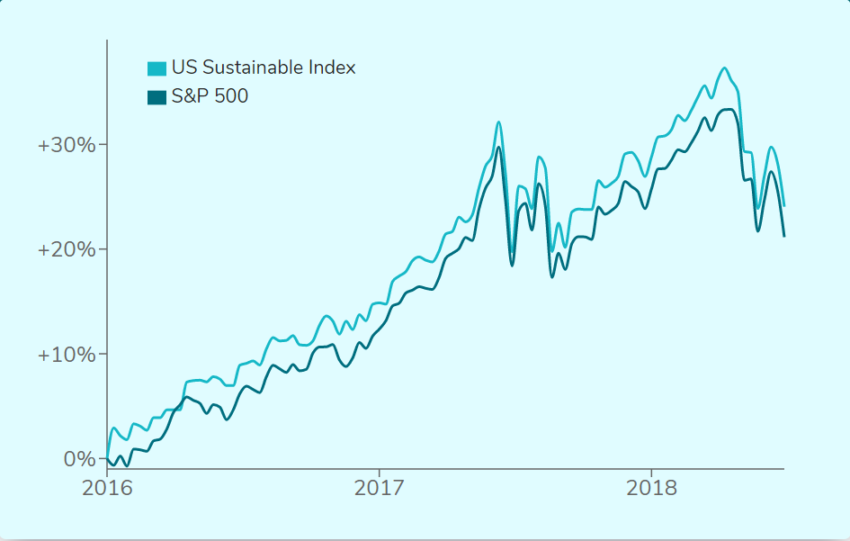

M.B.: Our benchmark for ourselves is how our portfolios are performing, versus what the equivalent portfolio performance would have been if you didn’t incorporate the sustainability criteria. It allows us to benchmark every portfolio, even if they are all different. Our goal is to keep pace with what a non-sustainable portfolio would have been. One of our overall goals is to have sustainable investing without sacrificing financial returns. We only launched in the beginning of March, but in the backtests that we have done, we would have done just as well as the non-sustainable portfolios — if not better in some cases.

What kind of competition do you have right now?

M.B.: I created Vestive because there wasn’t something that was doing exactly this in the market. In a way we do not have a main competitor, no one is trying to do sustainable portfolios that are financially savvy. You either have companies that provide sustainable portfolios without a focus on returns and diversification 0r you have companies that make investing as easy as it is with Vestive, but their focus is not on sustainability. Our competitors are doing only one of the components of what we are doing: the investing is in sustainability but does not make sense financially, or it makes sense financially but does not make sense in a sustainable sense.

In the Cover Picture: Money and a Plant Cover Photo Credit: ShutterStock

________________________________________________________________________________

EDITOR’S NOTE: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com.