A wind of change is blowing through Canada -and no, it’s not another fancy initiative from Prime Minister Justin Trudeau- as citizens now have the opportunity to become active participants in a new digital collaborative ecosystem. For 100$, people can buy 100 shares of Impak Finance, the first responsible bank in Canada, 100% dedicated to investing in sustainable projects, with total transparency.

Since the launch of their equity crowdfunding campaign in October, Impak Finance raised the largest single-day amount for a Canadian equity-crowdfunding initiative. In 24 hours, they hit 85 percent of their minimal investment target, receiving a total of 425,000 dollars in support of a bank dedicated to investing in projects with positive impacts for the community and the real economy.

Impakter had the chance to meet Founder and CEO Paul Allard one week before the wave of support initiated through the crowdfunding campaign to talk about how a small initiative from a visionary serial entrepreneur can lead a path to change the world for the better.

https://www.youtube.com/watch?v=q2ZI9uU7nk8

Tell me a bit about how you came up with the idea to create Impak Finance.

P.A: I’ve been involved in starting companies for the last 20 years, and all my life I’ve been looking for cash to support my initiatives. The first encounter with banks always did represent a struggle for me, especially when I ran startups: the real life came to me and it just appears that what you learn in school and what happens in real life is sometimes two different stories.

But as an entrepreneur, I applied that rule of not complaining and instead tried to find a solution with the cards I had in my hand: how can I be useful to societies while using my experience with technologies?

Before deregulation, financial markets were two to three times bigger than the real economy, in terms of annual volume. Today it is close to 70 times more.

At the same time, I was reading a lot about Triados Bank (A European bank which first initiated the model of Impact economy, meaning 100 percent is devoted to sustainable projects in the real economy) , and discovered that the bank can play a much more important role in society.

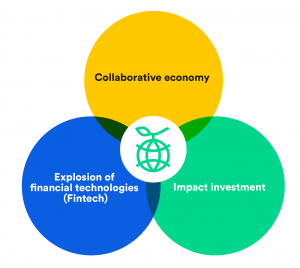

That was my inspiration to create a responsible bank in Canada. To invest in profitable companies which solve social and environmental problems through innovation while pushing the limits to reinvent the banking experience. All that thanks to high technological components which share values of collaboration, coolness, and transparency.

Related article: “THE GREAT TURNING: FROM MUTANT CAPITALISM TO THE CIRCULAR ECONOMY“

Why did you choose to reinvest in the real economy?

P.A: The initial role of a bank is to use citizen money as a leverage to support the real economy -the part of the economy that is concerned with actually producing goods and services, as opposed to the part of the economy that is concerned with buying and selling on the financial markets. However, since the sudden deregulation of the 1980’s, banks are turning into financial conglomerates massively investing in complex and sophisticated derivatives.

Before deregulation, financial markets were 2 to 3 times bigger than the real economy, in terms of annual volume. Today it is close to 70 times more. I came to the point that financial economy is now out of control, and represents one of the biggest causes of instability and social inequalities in our modern societies. The worst thing is that media doesn’t even talk about the fact that bankers had hijacked the democracy as they did in Greece, and I’m scandalized to see that those bankers are getting away with no charges…

PHOTO CREDIT: Impak Finance

Our mission is to reinvest citizens money in the real economy by connecting savers and investors that want to both transform the world and have a return on investment using the Triple Bottom Line criteria (Profit, Planet People). Triodos Bank has done that with success over 30 years and is the only bank who didn’t lose any pennies during the 2008 financial crisis.

A lot of companies today are taking sustainability as a mission: among all those projects, how do you measure which ones are more impactful ? Do you use a grid criterion, an algorithm, your intuition…?

P.A: We personally have on our advisory board of very smart people. Assaf Weisz from Purpose Capital, Margie Mendell from Concordia, an expert in Impak investment / social businesses, compiled with the hundreds of studies that have been done on that subject, the B Corp criteria etc. But in the end, the impact that one business can have, or want, is always different depending on the economic context: you cannot compare the sustainable engagement of a food company with the one of an apparel company for example. For every field of businesses, the impact analysis will be calculated using different benchmarks.

As a bank, you must take into account that risk of failure related to each project. What is your vision of financial risk compared to the one of a traditional bank ?

P.A: Two of our founders are ex-bankers for BCPE -one of the biggest banking institutions in France- and have been working for the past 10 years on what we call Risk Management Framework, that is still used by traditional banks to calculate risk.

IN THIS PHOTO: Paul Allard, CEO PHOTO CREDIT: Adrien Peynichou

The idea is simple: by doing an analysis before lending to a company, using historical financial data, bankers are able to calculate potential returns in function of the risk. All of their lending decisions are backed-up with this financial analysis and their main role is to do a trade-off between potential returns and risk level for each investment. This trade-off makes it difficult for small entrepreneurs to obtain a loan from the bank, as investors will prefer lending money to a few companies that have a lot of assets and collaterals that can be sold if the company failed to repay, reducing the risk level on the equation. But they miss the point of according loan to the small and medium-sized companies which are the one that creates nine jobs out of ten in Canada. Criteria like specifical context , intuition, and community support get rid of the financial equation.

Supporting local actions that will make our neighborhood economically, socially and environmentally safe, will also enable you to shine out and inspire other communities in acting similarly. The “Charity begins at home” state of mind is fundamental to ensure global collaboration in a second time.

What we are doing is reassembling the Risk Management Framework to the reality of Impact projects, using a risk analysis algorithm we have created, called the “Impact Scoring Algorithm” which also includes extra financial aspects, extracted from big data. The goal is is to attract Impact entrepreneurs in our ecosystem who don’t have access to traditional bank loans.

What about the companies that don’t score enough on the algorithm ?

P.A: Instead of just saying no to a company that has an interesting model but doesn’t quite hit our minimum level of risk expectations, we’ll redirect them to a VC part of our ecosystem interested in Impact projects, or a crowdfunding platform, loan-guarantee platform…And ensure they’ll find the resources they need. The goal is to create a long-term partnership between our community and the entrepreneurs, regardless of the score on our algorithm. There’s a lot of projects that are looking for cash and a lot of cash looking for projects, and we want to use our credibility as a bank to create the missing links.

PHOTO CREDIT: Impak Finance

Community, ecosystem, citizen-actor…all these terms are referring to an idea of physical proximity. Do you notice a link existing between the motivation one can have to fundraise a sustainable project and the fact that his benefits will be nearby ?

P.A: Absolutely. You think of yourself first to better think of others after, and that’s why there is nothing wrong with prioritizing our local community. Supporting local actions that will make our neighborhood economically, socially and environmentally safe, will also enable you to shine out and inspire other communities in acting similarly. The “Charity begins at home” state of mind is fundamental to ensure global collaboration in a second time.

Could you name 5 sustainable companies you would like to have as clients ?

Definitely Téo Taxi, Boralex, Global Eco Power , Loop Juice, Rise Kombucha… There are so many of them.

PHOTO CREDIT: Impak Finance

Recommended Reading: “POLICING THE BANKS IS AN INSIDE JOB”

EDITOR’S NOTE: THE OPINIONS EXPRESSED HERE BY IMPAKTER.COM COLUMNISTS ARE THEIR OWN, NOT THOSE OF IMPAKTER.COM. Feature Photo Credit: Impak Finance