In the early 2000s, Europe and the USA were exporting significant quantities of waste plastic, cardboard, and paper to China. In 2018, this changed with China’s decision to stop the import of low-quality waste materials, leading to significant diversion to other countries, stockpiling, and more landfilling. Update to May 2019 and the United Nations, under the Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and Their Disposal, has reclassified plastic as a hazardous waste, significantly increasing the cost of export. These policy changes, alongside well-publicised concerns about climate change and the scourge of ocean plastics, have refocused attention on consumer lifestyles and the “throwaway” society.

The need for a shift from this linear economic model, where we convert natural resources into products that we throw away, to a more circular, regenerative model, is widely acknowledged. In recent years it has been given voice through organisations such as the Ellen MacArthur Foundation and many third sector and government agencies. At the same time, a growing number of companies are also starting to recognise the value of the circular economy, where waste is designed out of the system, materials and products are maintained at their highest utility, and biological systems are naturally regenerated. These companies are facing higher raw materials costs, resource scarcity, and are recognising the need to optimise the use and recovery of materials, products, and assets after they have come to the end of their useful lives. The responses include designing products for disassembly, devising new commercial models such as leasing and sharing, and ensuring that waste and by-products are more effectively recycled. In all cases, the need for better data on these materials, products, and assets is acknowledged as a key enabler that can inform new circular economy business models.

This data required will cover inputs such as raw materials types and characteristics, design processes, product performance, and commercial models. It will also have to include the data generated by the $400 billion global waste management industry, as it is this industry that currently captures, moves, stores, processes, or disposes of the approximately 2.5 million tonnes of urban waste generated globally (rising to 3.4 billion tonnes by 2050). The key problem is that the waste industry has developed around a linear system, it remains quite traditional and is not data-driven.

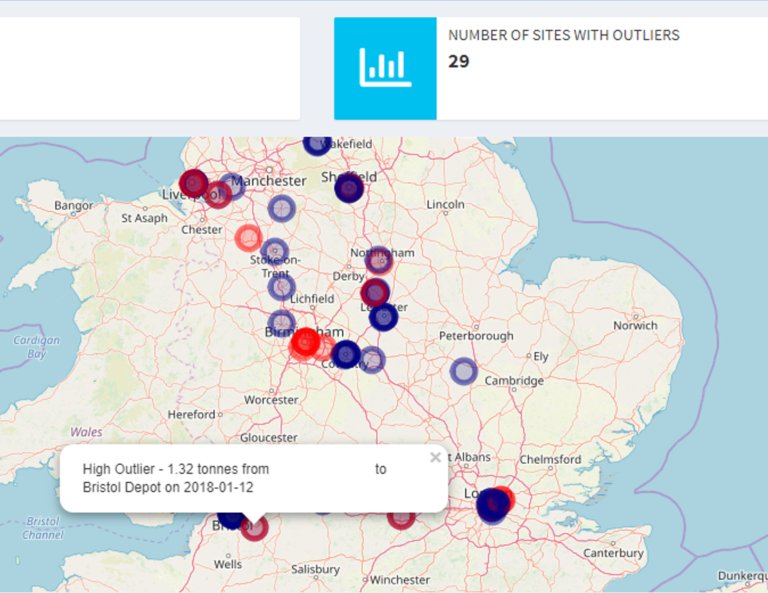

While the range and volume of material collected, moved, sold, processed, or disposed of by the waste industry generates a significant volume and velocity of data. It has not traditionally been captured well, nor has the industry used data to drive efficiencies, or even innovate and develop new business models. The waste value chain is also complex and opaque, with many private and public sector players as well as a significant “informal” sector in certain parts of the world. In the UK, for example, there are 23 million waste transactions per annum, handled by 100,000 registered waste companies and moved through 100,000 licensed waste sites. Extend the view globally and this represents a highly complex system of materials, measurements, and movements — locally, nationally, and internationally.

There is a need to use data science to build a higher level of confidence in the data on waste movements and generate insights that assist waste producers, waste processors, recyclers, investors, and policy makers.

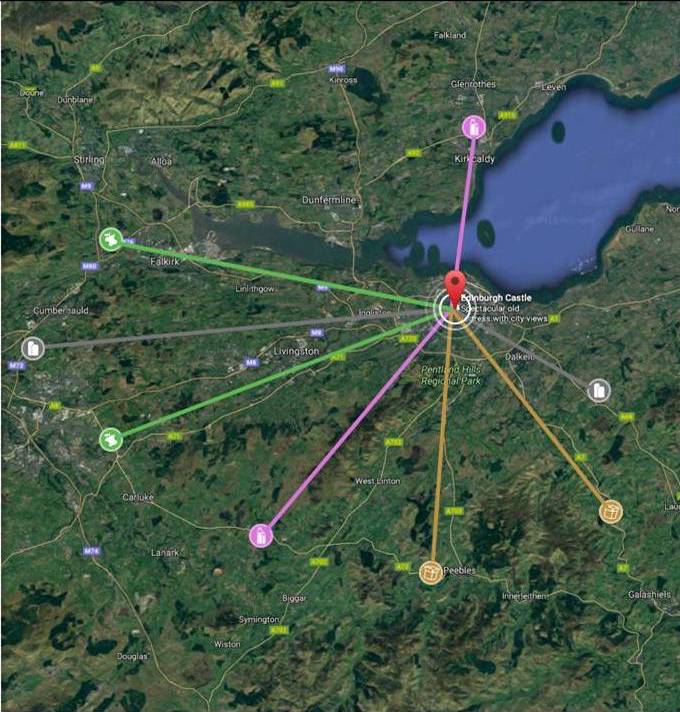

The diverse nature of licensed waste sites, ancillary sites, and the many sources of waste, including companies, public sector bodies, and local authorities, makes tracking of material difficult. Add to this the known deficiencies in the way that waste is defined and measured. There is a need to use data science to build a higher level of confidence in the data on waste movements and generate insights that assist waste producers, waste processors, recyclers, investors, and policymakers.

Data is also starting to inform new models of waste management, from materials marketplaces to “uberisation.” In the latter case, the customer has a relationship with a technology company or a “waste broker,” that does not own any waste transport or processing infrastructure. As with a taxi service, the waste material is picked up, moved, recycled, or disposed of by third-party operators.

“Can AI Advance the Circular Economy Within Hospitality?”

“Can AI Advance the Circular Economy Within Hospitality?”

“Could Microfinancing Be the Secret Weapon Enabling the Circular Economy?”

“Could Microfinancing Be the Secret Weapon Enabling the Circular Economy?”

In summary, while there are compliance schemes and systems for classifying waste, due to its complexity and volume, there is significant variation in the way this material is measured. At the same time, companies that generate such waste are realising that it is time to rethink their approach. This is partly driven by the need to convert raw materials more efficiently, increasing pressure to take responsibility for the waste, and the recognition that it has a market value that they are not realising. This, in turn, is impacting the waste management and recycling industry, which now has to develop new capacity and add more value to customer relationships in order to compete.

A wave of new technologies is changing and disrupting manufacturing, logistics, financial services, and many other sectors. Waste management and recycling is no exception, and over the next five years, we will see such Industry 4.0 innovations changing the sector and driving waste reduction, increasing the utility of this material and accelerating the circular economy.