Released on November 1, Autonomy’s new report, “A Climate Fund for Climate Action – revealing the massive inequality in UK carbon emissions,” reveals the vast emissions disparities between income groups in the UK.

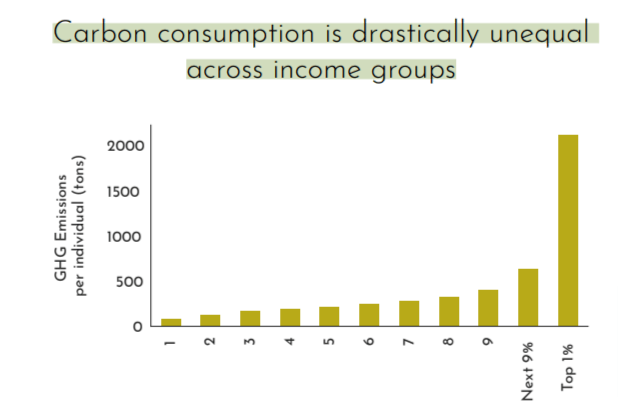

The report looked at 10 income groups between 1998 and 2018 (before Covid), and found the UK’s top 1% to generate the same emissions in a single year as the lowest 10% over two decades.

This means that it would take 26 years for a low-earner to emit the same amount of carbon dioxide that a top 1% earner generates in one year.

As the report shows, UK citizens who made at least £688,228 in 2018 were responsible for far more greenhouse gas emissions than the 30% of people who made at least £21,500 in that same year.

In other words, the activities of the UK’s wealthiest 1% (about 670,000 citizens) have generated more carbon dioxide than those of the entire third-income decile (approximately 6.7 million people).

“The enormous release of carbon emissions by the very richest in society over the past few decades is astonishing. Our analysis suggests that the most effective way for the government to tackle climate change would be to properly tax the rich, through a well-targeted carbon tax scheme,” Will Stronge, director of research at Autonomy, said.

The (missed) benefits of taxing extreme carbon emitters

Autonomy’s new study also estimated the hypothetical results of taxing excessive carbon emissions of the wealthiest 1%.

“If the UK had implemented a tax on the excessive carbon consumption of the wealthiest 1%, how much could have been raised over the previous two decades?”, the researchers ask.

According to the report, the UK could have earned roughly £126 billion by now had it implemented a carbon tax (of about £115 per ton of carbon) on the top 1% in 1998.

The report also goes on to suggest what the UK could have done with this money:

- Invest in almost five times the current offshore wind capacity

- Triple current solar (PV) capacity

- Double onshore wind capacity

- Add 2.1 GW of tidal energy capacity and add a similar amount of pumped storage hydropower.

- Retrofit almost 8 million homes, upgrading their efficiency to EPC “C”, cutting energy bills while reducing overall emissions.

As a professor of international relations at the University of Sussex Peter Newell told the Guardian:

“‘This new report on the benefits of taxing extreme carbon emitters makes for shocking reading. On the eve of a critical climate summit [Cop27] in Egypt, and staring down an unprecedented cost of living crisis, it is clear we are not all in this together. Revenue raised from a carbon tax on the wealthiest top 1% of the population would have raised enough money to retrofit nearly 8m homes, keeping us warm this winter and bringing down fuel bills, while providing critical support for renewable energy and making us less dependent on Putin’s gas.”

Earlier this year, a group of over 100 millionaires and billionaires, self-described as “Patriotic Millionaires,” released an open letter calling for a tax scheme on wealth that alone could bring 2.3 billion people out of poverty.

“Tax us, the rich, and tax us now,” the letter read.

Related articles: The Huge Carbon Footprint of Billionaires | At “Virtual Davos” A Group of Billionaires Calls For a Wealth Tax | Can COVID-19 Pave A Path Forward For More Sustainable Travel?

Despite this, the carbon footprint of the UK’s top 1%, for now, remains untaxed, even if we now know that every year that the wealthy 1%’s huge carbon footprint continues unchecked is another year of much-needed funds squandered.

Fortunately, the moment to act has not yet passed. The UK can still take the lead in imposing carbon taxes on its wealthiest 1% and demonstrate to the World how the carbon tax earnings can be used to support the vital economic transformation, desperately needed by current and future generations.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — In the Featured Photo: A woman lounging in a car in front of a private jet. Featured Photo Credit: Chalo Garcia/ Pexels.