Ever since New York shut down in March, I have been feeling as if I am living in a Sci-Fi movie. Daily news reports with COVID-related tragedies and havoc around the world. People in plastic suits with face shields and masks. Chatting with colleagues over a glass of wine after work, throwing a house party, even family reunions – all seem like a thing of the past. A different world.

The vast majority of pandemics we have had has been caused by humans. It is our impact on the environment – cutting roads through rainforests, wildlife consumption and trade, agricultural expansion into natural areas – that drives emerging diseases. We are inviting zoonotic viruses to jump from their natural homes into ours with catastrophic results for human life. The COVID death toll will soon reach one million and the global recession is the worst seen since the Great Depression with an estimated 400 million full-time job losses between April and June 2020 alone.

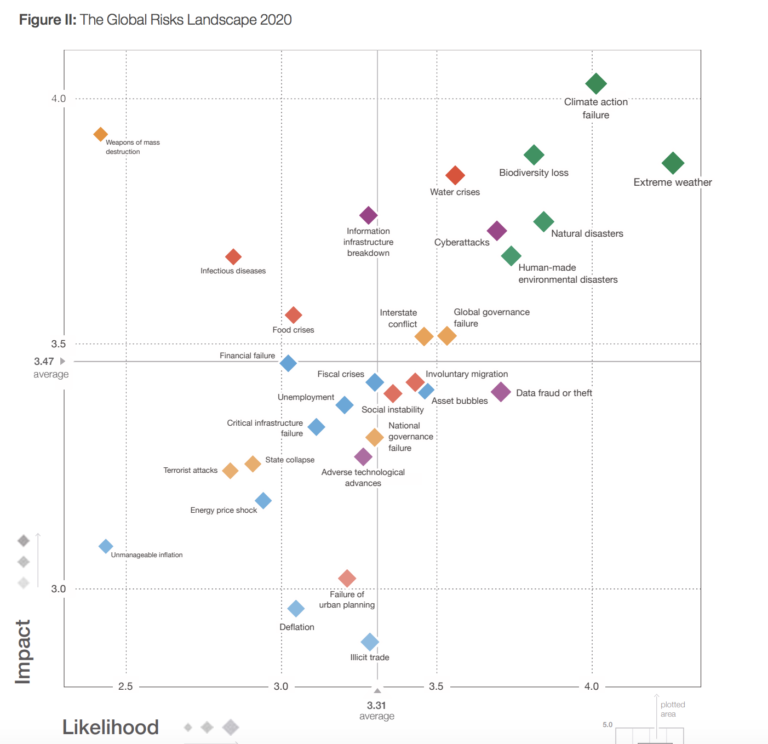

Nature loss is more than a bit risky. Biodiversity loss is one of the top three ranked risks in the world in terms of impact according to the Economic Forum’s 2020 Global Risks Report. In addition, at least six more top risks in terms of impact are closely linked to nature loss, including climate action failure, water crisis and infectious diseases.

[O]ver half the world’s total GDP is moderately or highly dependent on nature and its services.

In June, the Dutch Central Bank published Indebted to Nature. This powerful and candid report describes physical, transitional and reputational risks to financial institutions related to nature loss. As revealed by World Economic Forum’s The Nature Risk Rising, over half the world’s total GDP is moderately or highly dependent on nature and its services, with so many sectors such as agriculture, fisheries and tourism relying on nature and ecosystem services for their production and operation.

These businesses run physical risks if one or more of these ecosystem services are diminished or lost. Dutch financial institutions alone have provided worldwide EUR 510 billion in finance to companies that are highly dependent on one or more ecosystem services. Wildlife pollination services alone are staggering in scope with the financial sector exposing EUR 28 billion in products that depend on pollination.

In 2019, US$ 948 billion capital investment was made in travel and tourism industry worldwide, accounting for 4.3% of the global total investment. Who would have imagined that this investment is prone to nature-related risks at this magnitude because of the pandemic caused by nature loss? The whole travel and tourism industry that accounts for 10.4% of the global GDP, with 1 in 10 jobs around the world, is at risk. The World Travel and Tourism Council projects a 197.5 milion job loss and up to 62% loss in GDP in 2020 compared with 2019.

The reputational risks come from investing in or providing loans to companies with activities that have negative consequences for nature, such as agricultural commodities productions causing deforestation. Dutch financial sector also has EUR 96 billion of investments that carry nature-related reputational risk.

Related Articles: On Extinction, Food, Climate and Inequality | A New Social Contract for a Healthy, Just and Sustainable World

When a negative impact on nature results in new policy, citizens’ movements or changes in consumer preference, or COVID response measures, companies need to adjust products or production systems, which creates transition risks.

These examples are just the tip of the iceberg that tells us trillions of dollars of global investments face nature-related financial risks.

In order to manage these enormous nature-related risks and increase investment in nature-nurturing businesses, a universal framework is needed to measure biodiversity risks and impact which businesses and financial institutions will use. And results of the measurements need to be disclosed and reported.

Over 60 financial institutions, governments and think-tanks and consortia have come together to create an informal working group (IWG) to start intensive work towards establishing a Taskforce on Nature-Related Financial Disclosure (TNFD). TNFD will work to strengthen nature-related risk management system and will work closely with the already established Taskforce on Climate-Related Financial Disclosure (TCFD), learning from its experience and ensuring synergies. IWG is supported by the UNDP and UNEP, in close collaboration with the Global Canopy and WWF.

Changing flows of money from nature negative to nature positive is a fundamental piece of the puzzle for shifting the global systems towards nurturing nature.

Businesses and humans need nature for their survival. At the same time, we continue to destroy nature, too often for private gain and at the cost of people, especially the poor and vulnerable. There is always money behind the destruction. Somebody is providing finance directly and indirectly for destruction, knowingly or unknowingly. Changing flows of money from nature negative to nature positive is a fundamental piece of the puzzle for shifting the global systems towards nurturing nature.

We have come to a tipping point when it comes to planetary boundaries. We need to protect the remaining intact nature. With one million species predicted to become extinct in a business as usual world, we need to protect wildlife including pollinators as never before. Only 25% of the ice-free land surface is free from human impact, and we have exterminated much of our cohabitants of this planet. What more do we need? How much more are we willing to risk? And put at risk?

We desperately need nature – for air, water, food and for our health, inspiration, jobs and livelihoods. We need nature to achieve climate goals and up to 50% of the 169 SDG targets. We need nature for life.

And nature needs us for it to flourish and provide milliards of benefits and cost-effective solutions for tackling our development challenges.

Financial institutions have a critical key for protecting nature. Our future returns are entirely dependent on our treatment of the environment. And our behavior will define how nature pays us back.

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com. — In the Featured Photo: Billows of smoke rise over a deforested plot of the Amazon jungle in Porto Velho, Rondonia State, Brazil, Aug. 24, 2019. Featured Photo Credit: REUTERS/Ueslei Marcelino.