Researchers Find That Corporate Boards Increasingly Reward Executives for Corporate Social Responsibility.

Though the Business Roundtable declared in 2019 that corporations should serve the needs of all stakeholders, there’s fierce debate over whether this shift to “stakeholder capitalism” is really happening.

Stakeholder capitalism holds that managers ought to promote firm profitability in ways that meet the interests of multiple stakeholders, including but not limited to shareholders. It’s seen as a replacement for the shareholder focus popularized by Milton Friedman.

Some commentators say that the new emphasis on stakeholders is empty rhetoric and companies still focus solely on shareholder value. Others say that the world has finally broken away from Friedman’s belief that “the only social responsibility of business is to increase its profits.”

It can be hard to know what businesses are actually doing, as observers tend to choose examples that support their point of view. Here, we provide a systematic analysis that has been years in the making. This study is the first research to demonstrate the corporations are moving toward a stakeholder orientation. It shows that over time, a firm’s commitment to social and environmental issues has become an important part of management evaluation.

The Role of CEO Incentives

Our research examined how corporate boards reward and punish CEOs. Board of directors and CEOs represent the highest level of corporate decisions about priorities. Boards influence CEO behavior through rewards (e.g. pay packages) and penalties (e.g. dismissal).

If stakeholder capitalism is replacing shareholder capitalism, we should see boards rewarding CEOs for socially responsible actions and punishing them for a short-term focus on shareholder value.

For our research, we analyzed data from 217 U.S. publicly traded manufacturing firms, those listed among the 100 largest firms by Fortune magazine from 1980 to 2015. We looked specifically at times when a firm was performing poorly financially (as measured by return on assets), when boards were more likely to closely examine CEO behavior, to see how boards judged CEOs for behavior that prioritized:

- short-term shareholder value. How did boards view downsizing the workforce (vs. expansion) and selling off unrelated businesses (“refocusing”)?

- corporate social responsibility (CSR). Did boards reward or penalize CEOs for strong CSR performance (as measured by evaluator KLD)?

Signs of Shifting Board Behavior

Our research shows that since the early 2000s, U.S. corporations have moved from a model of capitalism that emphasizes shareholder value to a more stakeholder-oriented one.

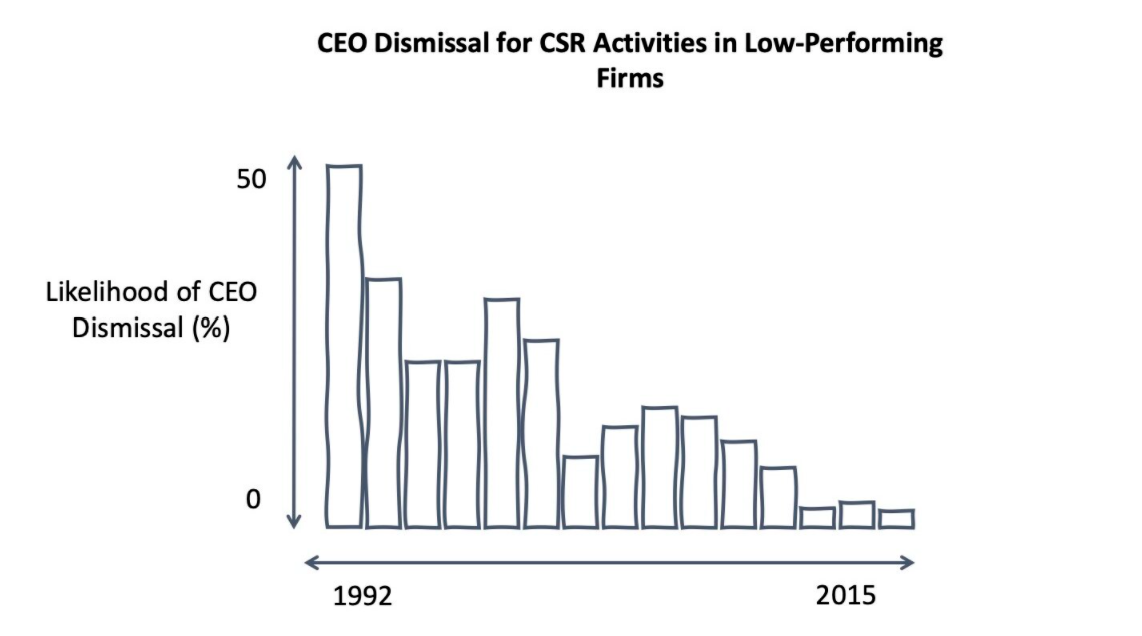

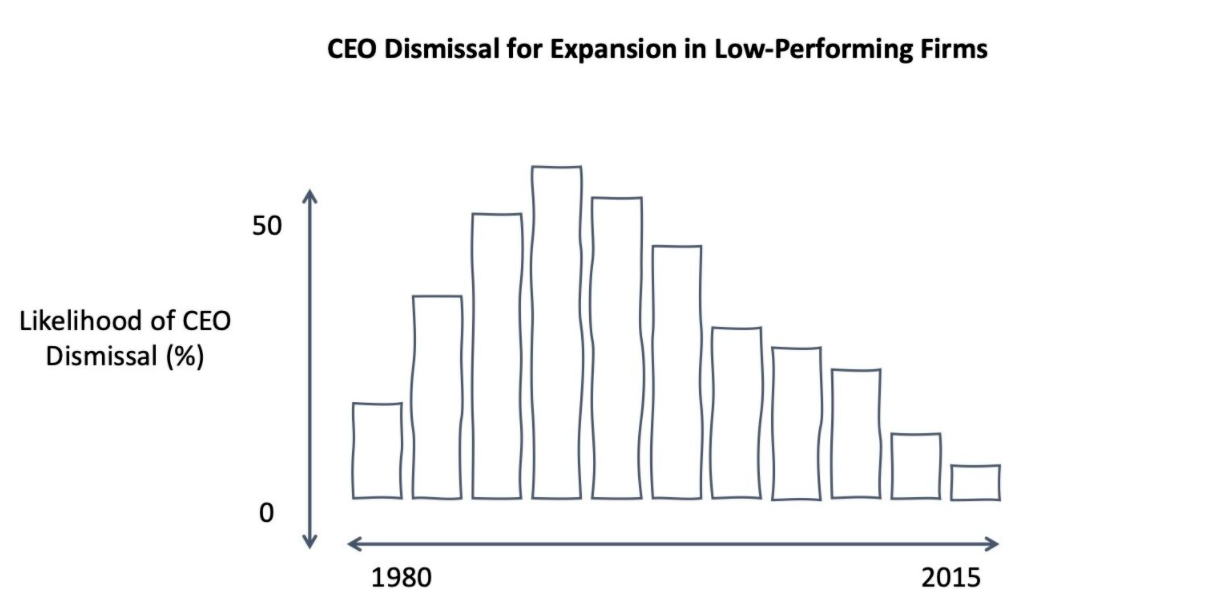

In the 1980s and 1990s, boards reacted to poor firm financial performance by:

- rewarding CEOs for behavior targeting short-term shareholder value (downsizing and refocusing).

- penalizing CEOs for CSR activity.

In the 2000s and beyond, boards reacted to poor financial performance by:

- penalizing CEOs for downsizing and refocusing.

- rewarding CEOs for CSR activity.

The graphs below show these changing dynamics.

A New Norm?

In our research, we looked specifically at times when companies were experiencing poor performance and what kind of CEO behavior boards chose to reinforce then. That’s because we believe that when firms are struggling, boards are more likely to consider whether CEOs are following generally accepted management practices.

As a result, we think that boards’ choice to reinforce stakeholder-friendly actions reflect their views of generally accepted management practice. In rewarding CEOs for prioritizing stakeholders, boards are indicating that stakeholder capitalism is the new norm.

In more recent times, CEOs are increasingly being seen as creating value through their commitment to CSR initiatives. The lesson extends to other levels of managers, who are increasingly expected to adopt CSR initiatives and pursue firm profitability in a way that considers a wide range of stakeholders and builds long-term value.

EDITOR’S NOTE: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com. — Cover photo credit: Unsplash.