Next time an investor claims they’re an impact investor, it’s okay to investigate with some questions, such as “how do you define impact and how do you make it a priority?” Impact investing has come into vogue and is a class seemingly intent on standing apart from venture capitalists, however, these are not mutually exclusive entities when it comes to impact.

Rather, in many instances, the impact is both the motivation and hopeful outcome, whereas venture capital represents the risk-tolerant financial means to that impactful end. Venture capitalists have also been investing in impact since inception, albeit with varying degrees of intention.

There are three key qualities in impact investing: how intentional is the impact focus, how measured is the investor’s impact mindset, and how is the investor impactful throughout the journey. Insights into these dimensions shed light on the subset of VCs that are perhaps more aptly considered Impact Capitalists. If you consider yourself significantly impact-driven, you might like to know more about this type of investor.

Startups utilize technology breakthroughs, business model innovation, visionary leadership, and execution as their means towards delivering impact. Impact Capitalists are like-minded, but use capital, strategic networks, and experienced thought partnership as their toolkit or means for supporting shared visions. Impact Capitalists are VCs who are deliberate like founders, focused on the impact that is profoundly significant and durable, and catalyzes second-order innovation in pursuit of transformation while yielding venture-grade returns.

Regardless of capital base permanence, horizon ambitions, fund structures, or otherwise, there are Impact Capitalists of all kinds to drive transformative impact in many facets. Here are three important qualities of the Impact Capitalist mindset worth contemplation by anyone in the impact economy.

#1 Intentionality

Impact motivations and expectations vary widely in the investment universe. On the philanthropic end of the spectrum, eBay founder Pierre Omidyar and his wife Pam started Omidyar Network, a philanthropic investment firm supporting for-profit and nonprofit organizations.

Laurene Powell Jobs started Emerson Collective as a social change organization utilizing a range of tools and strategies, including venture investment and even M&A for breaking barriers. Meanwhile, there are numerous examples of high-net-worth individuals and institutions investing with vital impact motivations, but through a venture capital lens that appreciates massive scalability and self-sufficiency in the creation of entirely new platforms for the betterment of the environment and society.

Institutions, corporations, and VCs, such as the Bill & Melinda Gates Foundation, Breakthrough Energy Ventures, Koch Disruptive Technologies, and Lux Capital to name a few, increasingly converge and co-invest in a like-minded space. I call them friends and fellow impact capitalists. The Impact Capitalist is an investor that is very intentional towards making investments in venture-grade opportunities yielding high potential returns in lock-step with impact that meets or exceeds a similarly ambitious threshold.

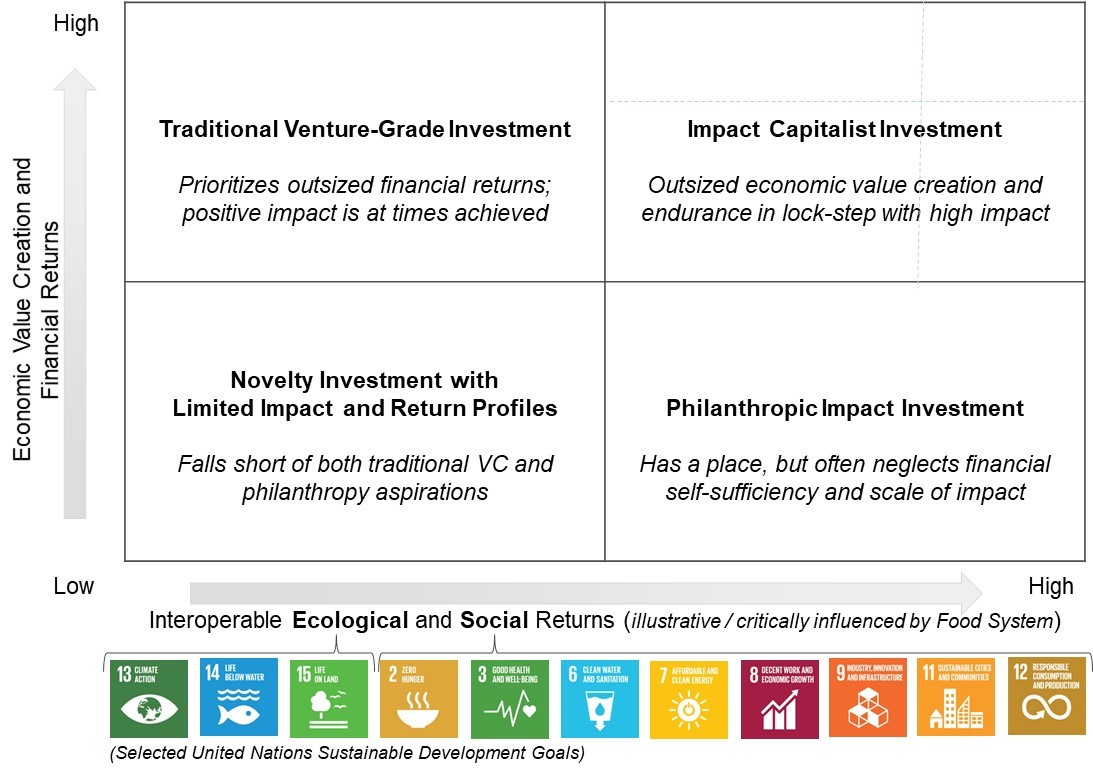

Highly-attractive economic value creation for key stakeholders, significant impact returns, and outsized financial returns are interdependent and are the primary conceptual criteria for Impact Capitalists. Presented below is a figure illustrating how the growing number of leading Impact Capitalists prioritize value and impact on the same spectrum—a critical cornerstone philosophy.

#2 Calculus

In the preceding figure, you may have taken note of specific impact objectives (selected UN Sustainable Development Goals). Impact Capitalists construct deliberate goals and work to identify meaningful levers for change, as well as align specific and measurable targets to desired outcomes. Impact Capitalists are highly measured, diligently employing thoughtfulness and resources to validate investments in solution areas that have the potential to measurably move-the-needle.

Upon estimating the success state of a given company or impact pathway, do the achievements reasonably exceed a meaningful impact threshold in terms of size, scope, and time? The calculus is performed through three important methods: mapping (definitive goals and opportunities), sequencing (order of operations), and quantification (ROI, stakeholder win-win dynamics, and life cycle analysis).

RELATED ARTICLES: Building Resilient Climate Smart Agricultural Systems For Smallholder Farmers|From Apartheid to the Climate Crisis: The Limits of Shareholder Engagement |Pymwymic: Pioneering the Change in Venture Capital |ImpactX: Addressing the Systemic Inequities in Business |How To Make Investing In Green Finance Easier? |

In practice, studying the rules (impact pathways, levers, and boundaries) as a starting point, reimagining the rules that can be violated, while respecting the existence of others and thinking for ourselves is how worthy opportunities can be spotted, as well as the shortfalls of on-trend tech, enabling a well-informed deviation from the popular vote.

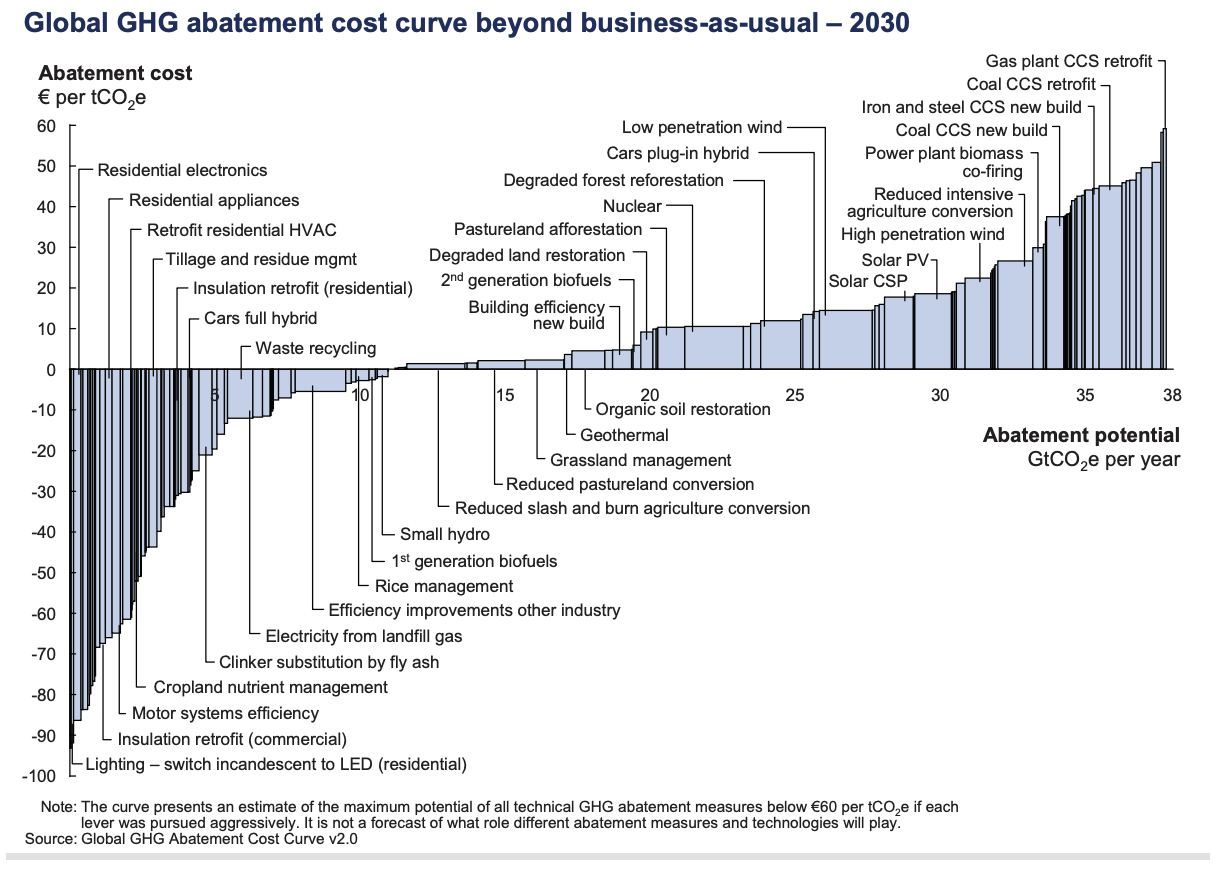

Take for example this graphical illustration of how much it will cost to abate greenhouse gas (GHG) emissions, a top-of-mind global concern. Each bar represents a unique solution pathway, which can meticulously be broken-down further than shown here. The width of a bar shows how many gigatonnes (billions of tons) per year of greenhouse gas emissions that investment would save and the height indicates the cost per ton saved. Bars below the zero-cost line are estimated as economical abatement opportunities.

On the other hand, bars above the zero-cost line come with net costs and are not yet economical without additional incentives. An impact capitalist focuses on the wide bars, dissecting paradoxes and identifying the barriers, which if solved for, bring the wide bars below the line. GHG emissions are just one paradigm among many that we assess through a similar lens. We can map the same for waste, hunger, health, water, farmer productivity and finance, industry 4.0 and go deep into each.

#3 Consciousness

Whereas the above qualities highlight capacity for laser focus and calculated investment rationale, Impact Capitalists also possess the soft skills and values important in a partner. They often operate hands-on with a philosophy that success is rooted in founder enablement, and is measured beyond returns and impact outcomes, but also in meaningful contributions and relationship outcomes. When we invest, we do so knowing that we’re joining a team and working for the founders and must be dependable in foreseen and unforeseen ways.

Moreover, it’s an everyday endeavor, not quarterly. The most conscious Impact Capitalists place founders first. They are thought-partners operating as extensions of the founders and their teams. It’s a paradoxical truth that many companies and executives emphasize shareholder value at the center of focus. Shareholder value, however, is best increased by focusing on the users or customers. In venture capital, prioritizing and enabling founders – the users of our venture offering – establishes an important partnership approach and supports the outcomes desired by investors and their limited partners. This is especially powerful if the founders themselves are also user-centric.

Founders first, because the journey with good and inspirational people is a true thrill and lifelong treasure.

In the cover picture: Left and Right Brain. Photo Credit: Germin8 Ventures.

Editor’s Note: The opinions expressed here by Impakter.com contributors are their own, not those of Impakter.com