EDITOR’S NOTE: THIS ARTICLE IS BY PAOLO MAURO, SENIOR FELLOW AT THE PETERSON INSTITUTE FOR INTENATIONAL ECONOMICS (PIIE). THIS PIECE IS PART OF A SERIES EXPLORING THE SUSTAINABLE DEVELOPMENT GOALS. SEE THE INTRODUCTION TO THE SERIES HERE.

Over the next two decades the structure of world population and income will undergo profound changes. Economic growth in the emerging-market economies, including China and India — the most populous countries in the world — is projected to be well above growth in the advanced economies. A demographic explosion is underway in Africa, where strong economic growth is also projected. Such changes will transform the global distribution of incomes and with it, the patterns of consumption in terms of goods and services demanded and in terms of the location of consumers.

Public discourse on inequality has recently focused on the fabulous riches accrued to those at the very top and has sought to relate them, on the one hand, to benefits for technological and business innovation and, on the other hand, to challenges with respect to equity or even potential distortions to democratic representation. The spotlight has been on rising inequality within some large economies, including the United States, where median real incomes have not risen during the past few decades, while the “top one percenters” have become even richer. Although those developments are real and merit public policy attention, one should not lose sight of the fact that the picture is more mixed when considering a wider spectrum of countries. Indeed, several economies experienced stable or declining inequality during the past 10 or 20 years.

Moreover, many global issues and challenges are influenced by the whole distribution of income globally. When considering developments in the well-being of the bulk of the world’s citizens and the related implications for consumption choices, it is necessary to cast the net as wide as possible and to consider not merely the gap between the top one percent and the rest of the population but rather the whole distribution of income. Further, it is essential to consider the distribution of incomes for all individuals worldwide, regardless of nationality.

In fact, beyond improvement in welfare, increases in consumption and changes in its composition pose policy challenges that are inherently global, including those related to pressures on scarce natural resources and climate change. Similarly, from the perspective of internationally-active companies and investors, changing consumption patterns need to be analyzed at the global level. Applications that are potentially relevant for both private sector participants and public policymakers include demand for various categories of goods and services (e.g., basic consumer goods vs. luxuries; food vs. transportation; meat, fish, water), “bads” (e.g., smoking, sugary drinks), and infrastructure (e.g., roads, airports, energy plants).

Existing income gaps between the world’s richest few and poorest millions are indeed shocking: Two thirds of the world’s population currently earn incomes below the United States’ official poverty line based on data that take into account differences in purchasing power across countries. (The gap is even wider, as emphasized by Oxfam and others, considering wealth: The 60 richest people have as many assets as half of the world’s population — a sizable share of the world’s population has essentially no assets).

In photo: The Bull of Wall Street; wealth inequality is an ongoing problem wrought by stagnant median incomes and more factors. The 60 richest people of the world have as many assets as half of the world’s population. Photo Credit: Sam Valadi, Flickr

However, there is also a more hopeful side to the story. With rising incomes in developing and emerging-market economies, hundreds of millions of people are being lifted from abject poverty to “working poor” levels where they can afford a more adequate, varied diet and basic consumer goods, and additional hundreds of millions will move from modest consumption levels to a degree of affluence currently associated with advanced economies. The ability to participate in and benefit from economic growth has immediate and tangible impacts on the lives of the bulk of the world’s population.

In a forthcoming book, Tomáš Hellebrandt and I project the global income distribution twenty years from now. To that end, we combine existing projections of population and output growth with the highest-quality information available regarding within-country income distributions (drawn from household surveys in a large number of countries, accounting for the near-entirety of world income and population). We use these data to project the number of individuals in various income brackets (e.g., between US$10,000 and US$11,000 in today’s prices) in 2035 on the assumption that within-country income inequality remains at the level observed in the surveys of the late 2000s (or, in alternative scenarios, assuming that within-country inequality develops in line with historical cross-country regularities). This makes it possible to compare the worldwide distribution of income two decades from now with the current situation and to calculate changes in global inequality that will result from different growth rates in population and GDP in different countries. Although previous studies have sought to estimate global income inequality and past trends in global income distribution, our analysis is the first to shift the focus to projections over the next two decades, and their implications for consumption patterns and ensuing policy challenges.

Our estimates reveal that global inequality is projected to improve in the next twenty years. Global income inequality started declining significantly at the turn of the century, and this trend is expected to continue for the next two decades, under what may be considered the economics profession’s “consensus” projections for the growth rates of output and population. Specifically, in our baseline projections, the Gini coefficient (the most common indicator of inequality, ranging between 0 for perfect equality and 100 for extreme inequality) for worldwide income distribution is expected to decline from 70.0 in 2014 to 67.4 in 2035. By comparison, it was 73.4 in 2003 and at similar values in the late 1980s. Whereas individual income at the 10th percentile in the global distribution was 32 times that at the 90th percentile in 2014, this ratio is projected to fall to 26 in 2035. (In a population of 100 people ranked by income, the 10th percentile would represent the income of the person with the 10th highest income. The ratio of the 10th to the 90th percentile is a common way of summarizing income inequality that reduces the influence of extreme poverty and extreme affluence.)

Related article: “IS CRYPTOCURRENCY THE NEW WAY WE BUY AND SELL?“

The projected improvement stems primarily from faster economic growth in the developing and emerging-market economies than in the advanced economies. Interestingly, relatively strong growth in China over the next two decades is less central to this result than it was over the past decade, because the Chinese median earner is now already close to the worldwide median. Rapid growth in India is now a more significant factor underlying the result. On balance, Sub-Saharan Africa’s contribution to reducing global inequality is projected to be negative, as the impact of the demographic explosion prevails over the effects of higher-than-average GDP per capita growth than in other parts of the world.

The baseline results are obtained under the working assumption of no change in within-country inequality during the next two decades. But for the finding of declining global inequality to be reversed, inequality within countries would have to worsen at unprecedented rates, well beyond what was experienced in the past one or two decades. In an alternative scenario in which within-country inequality in the emerging economies improves in line with past cross-country trends (the so-called “Kuznets curve,” whereby developing countries initially experience rising inequality in the early stage of industrialization, followed by declining inequality as the bulk of the population enters modern production techniques), global inequality declines even faster than in the baseline scenario.

The baseline results also stand on the “consensus” projections of economic growth and, in particular, relatively rapid growth in the emerging economies. Under an alternative “reversion to mean” scenario in which countries’ economic growth rates are projected to revert gradually toward the worldwide sample mean, inequality continues to decline, albeit more slowly, to a Gini coefficient of 69.3 in 2035. Under an “optimistic scenario” in which the four emerging economies with the largest projected populations in 2035 (India, China, Indonesia, and Nigeria) maintain rapid growth for the next two decades through sound economic policies and reforms, the global Gini coefficient would fall to 67.0 in 2035.

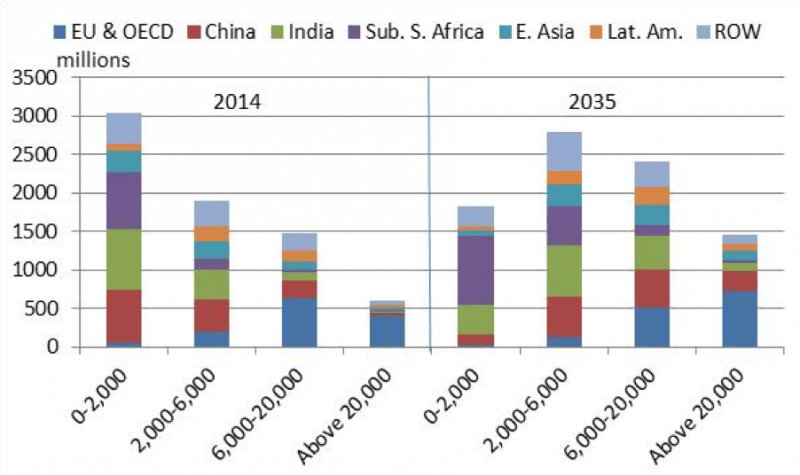

On the whole, under the baseline scenario we project major increases in the potential pool of consumers worldwide, with the largest net gains in the developing and emerging-market economies. For example, the number of people with annual household per capita income below $2,000 (in international U.S. dollars at 2011 prices) is projected to decline in absolute terms by more than 1.2 billion people. The $2,000 to $6,000 income bracket will swell by around 900 million people, with the largest gains in Sub-Saharan Africa and India. The number of people with incomes between $6,000 and $20,000 will increase by 936 million, with the largest gains in India and China. Those with incomes over $20,000 will increase by around 870 million, with the largest gains in the advanced economies and China.

In photo: Number of people worldwide by income bracket. The chart reports the number of individuals worldwide as well as their regional distribution, for each of four groups defined by the ranges shown in terms of absolute annual household per capita incomes expressed in 2011 international U.S. dollars (which correct for cross-country differences in purchasing power). The chart shows the situation in 2014 and the projection to 2035 under the authors’ baseline scenario.

The changing global distribution of individual incomes has important implications for consumption patterns. As the composition of consumption baskets depends on incomes, projections of the number of individuals in each income bracket will facilitate a better-informed analysis of the levels of consumption of various goods and services in the future, their distribution across the globe, and associated policy challenges.

Using household surveys on consumption choices, we document that as individuals’ incomes rise, they reduce their share of spending on food and increase their spending on transportation goods and services more than proportionately. For example, as incomes reach about US$5,000 per person per year, it becomes more common for them to purchase a car, and at US$20,000 occasional air travel for leisure becomes a real possibility. These empirical patterns with respect to per capita GDP hold at different points in time and in many different countries. It seems that traveling is one of those fundamental human desires: it is fun, or at least convenient, and people across different cultures enjoy it. Based on the estimated empirical regularities, we project rapid growth of consumption of transportation of goods and services in some of the most populous emerging economies, with a quadrupling in India and China during the next two decades.

These are exciting developments for the well-being of consumers and present opportunities for businesses. But they also present challenges for policymakers, both domestically and globally. For instance, such rapid growth in the consumption of transportation of goods and services will need to be accommodated by infrastructure investment, calling for additional financing through not only domestic government resources but also the private sector and international institutions. Rapid growth in such energy-intensive sectors will also pose challenges for the environment and climate change, calling on domestic policymakers to make climate-friendly strategic choices in infrastructure (e.g., metro-railway rather than roads) and for the international community (via export credit agencies and international institutions) to provide financial incentives to that end.

The projected improvement stems primarily from faster economic growth in the developing and emerging-market economies than in the advanced economies. Interestingly, relatively strong growth in China over the next two decades is less central to this result than it was over the past decade, because the Chinese median earner is now already close to the worldwide median. Rapid growth in India is now a more significant factor underlying the result.

Although global inequality is projected to decline, extraordinary inequities will persist. Poverty will be ameliorated but will remain widespread. The scope for policies to curb global inequality directly is limited, and there is no agreement on the extent to which such policies should be pursued. Surely we all have a mutual interest in ensuring that all economies grow at a healthy pace, and the detailed analysis of policies such as those aimed at maximizing the benefits of infrastructure investment, outlined in the body of the book, is indeed supportive of that objective. There is less consensus on the desirability of redistribution across national boundaries. Although foreign aid has long been viewed as morally justified by the vast majority of advanced economy residents, a debate rages on whether its impact has been beneficial. Simple calculations show that a global tax-and-transfer scheme to eliminate abject poverty would in principle require a relatively small tax on the better-off segments of the world’s population, but experience with aid schemes shows that the logistical challenges in identifying the poor and ensuring that the funds reach them are daunting. Perhaps biometric identification schemes will help to resolve those operational difficulties in the years ahead. Within countries, both the theory and the practice for improving inequality are well developed, though individual country choices have differed, reflecting political preferences. Redistribution of incomes through progressive taxation and targeted subsidies, protection against unexpected income loss through access to health care, equality of opportunity through the education system, are all standard ways in which countries have sought to ameliorate differences in both incomes and opportunities.

To reduce inequalities both globally and within countries, it is increasingly clear that — with the rising ability of individuals and firms to shift incomes and profits across countries — global coordination is required in tax administration and, perhaps more controversially, tax policy. Such coordination reduces the likelihood that lack of resources will prevent governments from funding public goods and services needed for economic growth and reasonable redistribution activities. With regards to tax administration, the recent G20/OECD initiative to stem tax avoidance on the part of global corporations through “base erosion and profit shifting” (BEPS) aims at ensuring that global corporations pay a reasonable share of their profits to the government of countries where such profits are generated. Efforts to soften bank secrecy laws to permit sharing of information with foreign tax authorities are also aimed at reducing tax evasion across national borders. In the perhaps more controversial area of coordination in tax policy, proposals for measures such as a global wealth tax have the advantage that they recognize the incentive of individual countries — especially small countries — to “race to the bottom” in regards to taxation to attract wealthy, globally mobile individuals. Although there is still no consensus on the specific policies to be undertaken in this area, the general principle that global cooperation is fundamental to success seems to be valid and worth pursuing.

For a full mindmap containing additional related articles and photos, visit #SDGStories and #wealthgap .

Similarly, global cooperation is needed in the area of government expenditure, to ensure that major, forthcoming increases in infrastructure investment provide the best value-for-money and that they are directed to climate-friendly technologies. For example, investment funded by international institutions should be allocated through transparent, open procurement processes, and financial incentives should be provided to steer investment toward technologies and types of infrastructure that have less adverse impact on the environment and the climate. International institutions that finance infrastructure both directly and as a catalyst for private finance are likely increase in scale (and possibly in number). Such growth is desirable, as long as such institutions promote high international standards with regard to open and transparent procurement as well as project and technology choices, taking into consideration global externalities.

The projected shift in consumption patterns toward greater spending on transportation, as well as the ensuing additional infrastructure investment are likely to bring about further increases in international goods trade. It is well known, in fact, that investment has a higher import content than is the case for private consumption or government spending, and that machinery and transport equipment is the largest component of goods trade.

Humanity has overcome challenges that had initially looked insurmountable. Concerns about the sustainability of economic and population growth put forward during the population explosion that began in the aftermath of World War II have, for the most part, proven unwarranted. Private profit incentives together with a reasonable degree of domestic government intervention and international cooperation have been sufficient to improve productivity in agriculture and in the economy more generally. Although a reasonably successful track record may be a reason for optimism, the challenges of the next twenty years will involve greater externalities at the global level. To confront those challenges, human ingenuity motivated by private profit motive will continue to be key, but will also require a healthy dose of government regulation to steer it in the right direction, as well as even greater international cooperation to address global externalities.

Recommended reading: “GETTING THE POOR TO PRODUCTIVITY“