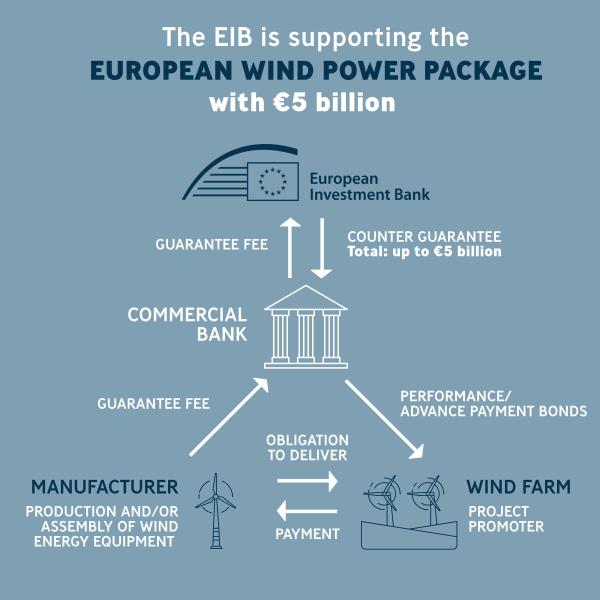

The European Investment Bank’s (EIB) Board of Directors has approved this week a €5 billion project designed to support manufacturers of wind energy equipment.

The funding, part of the European Investment Bank’s contribution to the European Wind Power Package, aims to speed up a “just and swift transition to net zero” while fostering domestic industrial innovation, the EIB explains.

The Board has also approved €20.4 billion in new funding for investments in water, energy, transportation, business, education, and regional development, both in Europe and globally.

This includes further funding for repairing Ukraine’s roads and bridges and enhancing train connections to Moldova and Ukraine.

Related Articles: Can Wind Turbines Be Greener? Startup Modvion Is Working on It | World’s Biggest Wind Turbine Producer Sees Profits Decline by 98% | COP28: Danish Investment Firm Launches $3 Billion Clean Energy Fund | World Bank to Spend 45% of Its Financing on Climate-Related Projects

In the press release announcing the move, the Board revealed that it also gave its approval to the EIB and the Spanish government to sign an Implementing Agreement, which would involve the EU Bank acting as an implementing partner to distribute funds from the Recovery and Resilience facility throughout Spain.

“Today’s Board decisions highlight the EU bank’s commitment to deploying the full range of its resources in support of the clean energy revolution. Words matter, but they are not enough,” President of the European Investment Bank Werner Hoyer said, adding:

“We urgently need action and actual results. Climate depends on it, and so do Europe’s competitiveness, innovation, and energy security. There is no trade-off between these goals. On the contrary, we cannot achieve any one of them without pursuing them all.”

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — Featured Photo Credit: Gpointstudio.