In the last decade, consumers have empowered themselves to become increasingly political and ethical in the purchasing decisions they make on a day to day basis. Take the UK for example, where ethical consumption reached an all-time high at the end of 2019.

Conversely, in terms of making decisions around direct ‘ethical investing’, there have been barriers to entry that have held retail investors back from being able to influence change in the same way. Choosing to directly invest in a stock or quoted company based on positive social or environmental outcomes has only been available through intermediaries and limited to sophisticated investors.

Imagine if consumers who made ethical purchasing decisions, such as choosing to drive electric vehicles or purchase animal-friendly products, could also directly reward companies that are aligned with their ethical beliefs by directly investing in them, with a simple mobile app. Imagine if anyone (18 to 80) could build and manage their own stock portfolio which equates to their own personal moral framework through simple mobile technology and without an intermediary.

This is the inspiration behind a new mobile app, soon to be launched by Ethical Capital, which will converge retail investing into an ethical framework and at the same time motivate companies even further towards becoming a force for good.

The founders of Ethical Capital believe the days of quoted companies being allowed to cause social or environmental harm and existing only for the benefit of shareholders will be numbered if consumers can combine as a democratic force to choose the way they invest. The company seeks to spark the same change that is being seen around how consumers choose sustainable brands and is hoping to move finance much faster towards reaching global goals.

“Our new technology will mean an every day retail investor can take responsibility for investing any amount they can afford in line with their ethical beliefs in the same way they might shop ethically in a supermarket,” says Ethical Capital founder Dr. Eike Post.

“Anyone will be able to invest in companies with their heart on their sleeve. Not only can they support an ethical company by buying their products. They will also be able to invest directly in that company if it has made access to its capital public.”

“The ultimate aim is to empower consumers to make money while doing good,” says Dr. Post.

Related Articles: ‘Green’ Investing: The Future of Business? |Investing with impact: a look at Bodossaki Foundation |Vestive: Introducing Ethical and Financial Investing

Through the Ethical Capital app, consumers will have access to global stocks and initial public offerings where barriers to entry for direct investing have normally presided.

Dr. Post concedes there are risks associated with investing but hopes that consumers will support ethical companies in the same way they support charities or causes. If they make money along the way that is a bonus but they will have comfort that their profits came from the heart.

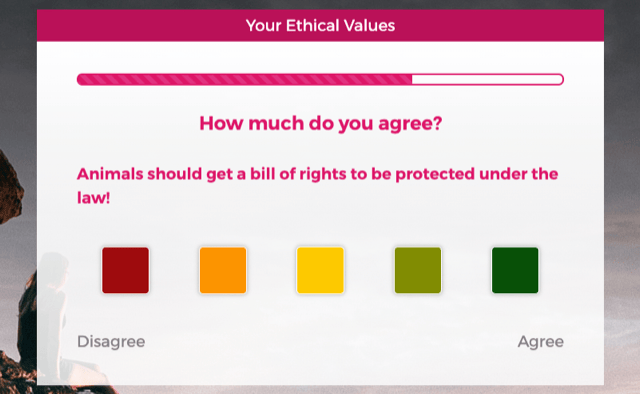

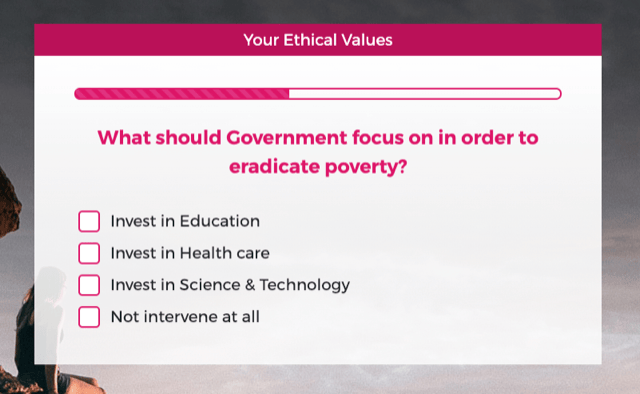

Ethical Capital amplifIes that while making a profit in itself brings a positive social outcome, return only should not be the only aim for an investor. The Barcelona-based company will seek to present portfolio options aligned with risk appetite as well as ethical appetite based on a simple ethical quiz. It is currently seeking licensing partners in various jurisdictions.

You can find out what type of investor you are with this quiz, and join the queue to pioneer a new way of steering finance as a force for good.