Today’s ESG Updates

- U.S. and China Cut Tariffs for 90 Days: Temporary tariff reduction aims to ease trade tensions while talks continue.

- EMSTEEL Unveils Green Finance Framework: New framework backs emissions-cutting projects in steel and cement production.

- Norway Divests from Israeli Oil Firm over Ethics: Norwegian wealth fund pulls investment from Paz Oil due to its role in fueling West Bank settlements.

- United Airlines Invests in Clean Aviation: United invests in startups for carbon capture and sustainable jet fuel.

Klimado – Navigating climate complexity just got easier. Klimado offers a user-friendly platform for tracking local and global environmental shifts, making it an essential tool for climate-aware individuals and organizations.

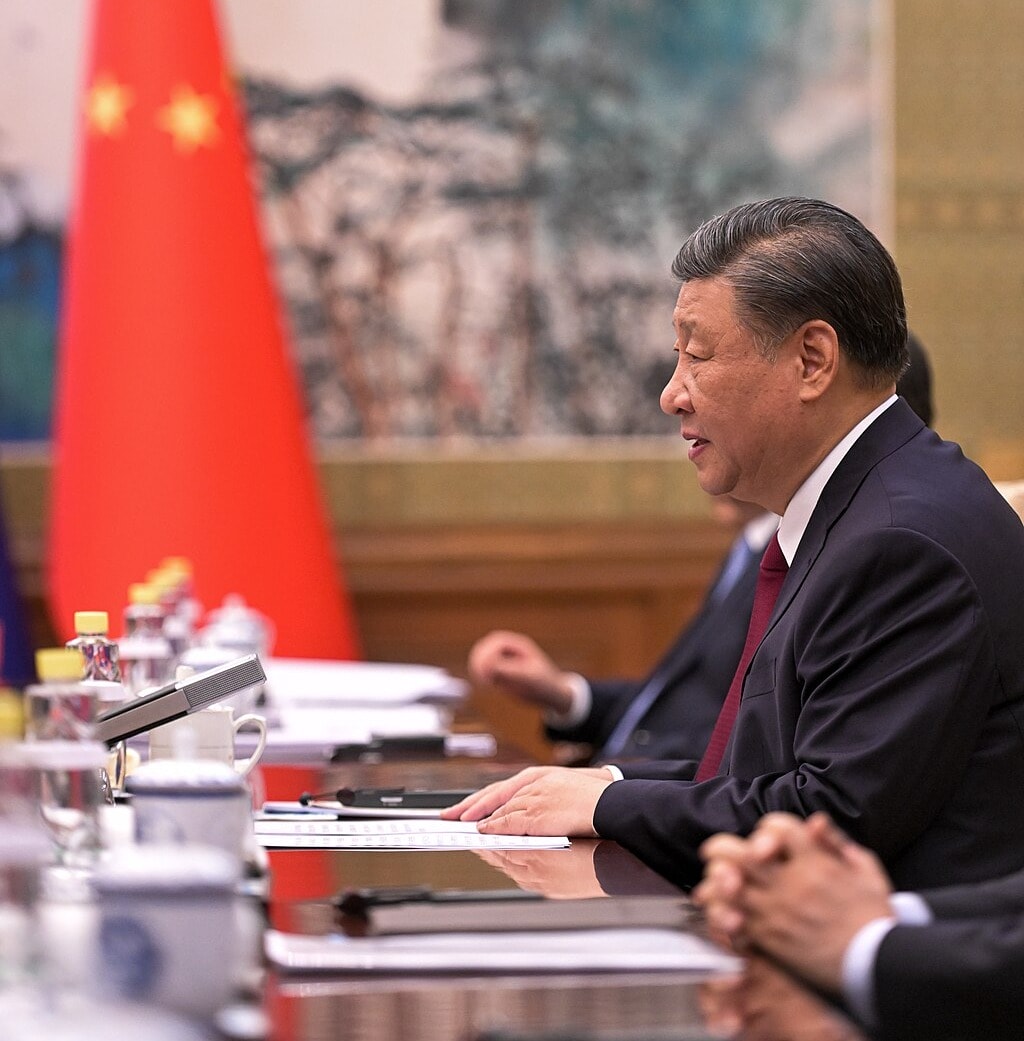

Tariffs between the U.S. and China to be dramatically reduced as negotiations continue

As trade tensions and uncertainty continue to drastically impact markets, officials from the United States and China met in Geneva this weekend to discuss tariffs. With current tariffs set at 145% for all Chinese imported goods in the U.S. and 125% tariffs for all exported U.S. goods to China, both economies have felt the effects of these immense import-export fees. Although the discussion is not over, both countries have agreed to reduce these tariffs for 90 days, reducing the 145% U.S. tariff to 30% and the 125% Chinese tariff to 10%. Negotiations will continue as both countries hope to reach a mutually beneficial agreement. In an increasingly uncertain world, ESG solutions are crucial for keeping your company on track.

***

Further reading: U.S. and China Agree to Temporarily Slash Tariffs in Bid to Defuse Trade War

EMSTEEL announces new Green Finance Framework taking steps toward decarbonization goals

EMSTEEL, one of the UAE’s largest steel manufacturers, launched its Green Finance Framework on Thursday. Partnering with ING and First Abu Dhabi Bank (FAB), this Framework is a huge step in the company’s efforts to reduce emissions and create long-term sustainability. The projects expected to be financed through this framework include installing renewable energy systems, low-carbon production of cement and steel, and energy-efficient technologies that help drive decarbonization. EMSTEEL’s ESG strategy aims to reduce emissions from steel production by 40% and cement production by 30% in the next five years. Chief Financial Officer Mark Tonkens said, “The launch of our Green Finance Framework marks a pivotal step in reinforcing EMSTEEL’s commitment to sustainability. Aligning our financial strategy with global green finance standards enables us to secure funding for high-impact projects and positions us as a leader in the region’s transition to a low-carbon economy.”

***

Further reading: EMSTEEL Launches Green Finance Framework to Accelerate Sustainable Growth and Advance Net Zero Ambitions

Norwegian wealth fund divests from Israel’s Paz Oil Company as a result of war in Gaza

The world’s largest wealth fund in Norway sold all of its shares in the Israeli oil company, Paz. This is a direct result of the company’s activities of supplying fuel to Israeli settlements in the West Bank. The Council on Ethics is enforcing higher standards on businesses, especially those operating in occupied Palestine. In its divestment recommendation, the Council stated, “By operating infrastructure for the supply of fuel to the Israeli settlements on the West Bank, Paz is contributing to their perpetuation.” This recommendation is the second of its kind, as the Council also recommended a divestment from Bezeq, an Israeli telecommunications company, in December.

***

Further Reading: Norway wealth fund divests from Israel’s Paz Retail and Energy due West Bank activities

United Airlines invests in sustainability startups as part of net-zero initiative

United Airlines is proving its commitment to net-zero emissions by 2050 through its recent investment in the startup Twelve. Twelve aims to produce sustainable aviation fuel (SAF) using carbon dioxide and water. They call the process “industrial photosynthesis,” using electrolyzers to create synthesis gas. The airline has also partnered with Heirloom, a startup focused on carbon capture directly from the air, and JetZero, a startup developing a blended wing body aircraft. With a $200 million Sustainable Flight Fund backed by Google, Boeing, and about 20 other companies and airlines, United is committed to a 2035 target of 50% fewer emissions. Companies trying to reach net-zero targets, like United, can find help through utilizing ESG tools.

***

Further reading: United Bets on Photosynthesis and Limestone to Fuel Net-Zero Flight Path

Editor’s Note: The opinions expressed here by the authors are their own, not those of impakter.com — Cover Photo Credit: Arthur Wang