After a fallout in 2022, ESG investing is on the rise again. A new report published by Robeco highlighted the potentially positive consequences of sustainable investing.

Sustainable investing is about “broad value creation”: The main principle is to invest in companies that take sustainability into consideration when operating their businesses.

This does not include only financial sustainability, but also societal and environmental. This way of sustainable investing is called “ESG integration.”

Environmental, Social, and Governance (ESG) is a framework that helps us understand how sustainably an organisation is operating. The ESG approach expands the concept of sustainability — usually related primarily to environmental issues — to embrace a holistic view.

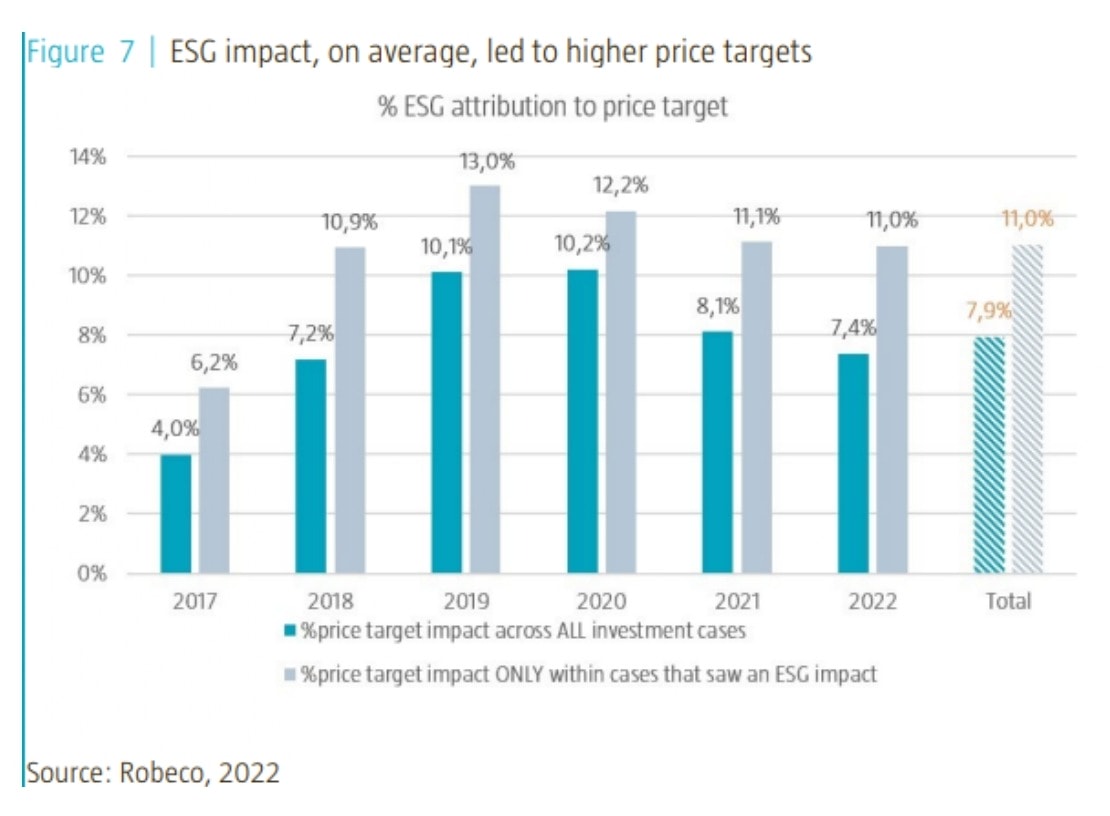

The methodology of the report published by Robeco integrated ESG factors in their valuation models to properly assess the impact of sustainable investing between 2017 and 2022. The analysis was based on the 451 investment cases written by the Sustainable Global Stars equity team.

Of these investment cases, around 60% showed a positive ESG effect to the price target, 12% showed a negative one, and 28% showed no effect.

Related articles: ESG Investing: No Longer Just For The Generous and Wealthy? | ‘Green’ Investing: The Future of Business? | Why Sustainable Investing Is A Win-Win

The report’s results highlight that ESG integration increased the overall companies’ investment performances: About 22% of the strategy’s excess returns can be attributed to ESG.

Even if 2022 was a difficult year for ESG investing — due to the war in Ukraine, the energy crisis, and the inflation — “sustainable investing is very much alive.”

Investing in companies that actually take sustainability into consideration can be beneficial for both the planet and the economy. However, moving forward, “a forward-looking approach, ESG financial materiality, enhanced engagements in combination with thoughtful exclusions are critical.”

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com