A poll released by Omnisis, a member of the British Polling Council, Thursday found the majority of Britons in favor of the UK financing climate funding for poor countries because of their carbon emissions.

The poll’s results come a day before the end of the United Nations annual COP27 climate conference currently being held in Sharm El-Sheikh, Egypt; and climate funding for developing countries dominated this year’s talks.

What were the results?

The results showed 49% of citizens believe the UK owes money for the carbon emissions havoc the UK, and other big polluters, have had on poorer countries, whilst 31% stated they did not and the remaining 20% responding they did not know.

People between the ages of 18-34 showed strong support for climate funding with 65% in favor compared to only 37% of adults aged 65-74. Clearly, the older segments of the population struggle to believe in climate change.

Omnisis also took into consideration citizens’ thoughts on how providing climate funding to other countries would affect the economy. The results found the majority of persons, 48%, believed funding to stop the climate emergency would be good for the economy while 38% said it would negatively affect the economy.

Related Articles: Denmark Makes UN and EU History by Paying for Climate Change Damage | Cutting Emissions: Can The Rich Pay the Poor To Do it On Their Behalf?

When factoring in political party and age range, people from each group believed climate emergency efforts would fuel the economy.

Despite the confidence in climate funding, the polls’ results showed 53% of people thought the COP27 conference would not speed up climate action.

Fewer people also supported halting new oil and gas projects in the UK, only 34% of respondents opposing oil and gas — a contradiction to the purpose of climate funding.

At the moment, the public is teetering on a fine line between supporting wood burning in UK power stations: 39% saying yes it should be banned while 38% saying it shouldn’t.

The results of the poll come amid the creation of new oil and gas projects in the UK as the newest Prime Minister Rishi Sunak, representing the conservative party, ramps up oil and gas production due to a shortage of fuel caused by the Ukraine-Russia War.

The poll showed only 24% of the public believed Sunak was committed to tackling the climate crisis.

But the British are not alone in supporting climate finance for poor countries

Another poll last year across all G7 countries also supported rich countries providing substantial funding to developing nations, with 66% of respondents agreeing and 11% disagreeing.

Public support is thus overwhelming for financial commitments to developing countries to help them in their energy transition. Support was high in all G7 countries, but it was highest in Italy (85%).

More recently, on November 15, the Carnegie Endowment for International Peace, a think tank with some 150 researchers from over 20 countries, issued a report calling for a “Modernized Global Financial Architecture to Address the Needs of the Most Vulnerable Countries”.

The report makes several major recommendations:

- G20 countries should “urgently take steps to provide the necessary liquidity to help vulnerable countries weather the economic storm and build resilience for the future”;

- the “polycrisis requires long-term resourcing that is an order of magnitude greater that what is currently on the table” but there is “hope on this front” as there is support from all the major developed countries for a plan to address “cross-border investment challenges such as pandemics and climate change” via the Multilateral Development Banks (MDBs) including the World Bank, that are expected to be able to mobilize up to an additional $1 trillion without risking their AAA credit ratings;

- increasing “calls for Global South countries to have a meaningful seat at the decision-making table”, and that would include a permanent African Union seat at the G20 and the creation of a new African chair on the IMF’s board next year.

What is interesting here is that these recommendations appear to have substantial political support from the West and correspond to the public opinion revealed by the polls. Yet not everything is rosy.

US and UK fail to provide adequate climate funding

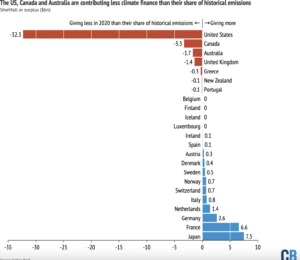

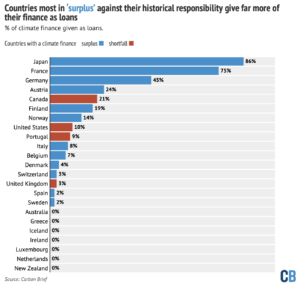

An assessment conducted by Carbon Brief, a U.K.based investigative journalism website, released last week found the US, UK, Canada and Australia have fallen billions of dollars short on their promises of climate funding.

Compared to other big countries included in the assessment, the UK did better than the rest, however, still fell short.

According to the data, the UK gave 76% of its fair share of climate funding, falling short of $1.4 billion.

Canada gave 37% of its promised share, falling short of $3.3 billion, while Australia provided 38% of its share, falling short by $1.7 billion.

The US had by far the most depressing results, the giant powerhouse only contributing 19% of its share and giving only $7.6 billion to climate funding when they should be financing $39.9 billion. The US is also the world’s biggest historical emitter responsible for 52% of total historic carbon emissions.

Unlike the US, UK, Australia and Canada, countries such as Germany, France and Japan had each given billions of dollars more than their fair share in 2020.

Promises to fund the climate initiatives of poor countries were made at UN climate negotiations back in 1992 where a list of Annex II countries were developed. Annex II countries consist of a list of “developed” or “industrialized” nations legally obligated to provide poor countries with climate financing for the damage their carbon emission have caused.

In total, Carbon Brief found Annex II countries were responsible for 46% of cumulative historical carbon emissions from fossil fuels, industrial process, cement, forestry, etc.

The first draft of the COP27 text suggests financing efforts need to scale up to $5.6 trillion by 2030.

Many nations, particularly Australia, have accused the World Bank of also failing in climate financing efforts for the past several years.

In his address, Australia’s climate change minister Chris Bowen put pressure on the World Bank to step up their game and joined calls to reshape the international climate financial system.

“Some of our international financial institutions are stepping up to this, our most important global task,” said Bowen. “Others are not. Just as we commit to this agenda as individual nations, our multilateral development banks – including the World Bank – must be wholeheartedly committed to this, from their purpose to their actions.”

As the COP27 comes to a close Friday, the EU has launched a proposal for establishing a loss and damage fund. Now the world awaits to see whether other powerhouse nations such as the UK and US, as well big financial institutions like the World Bank, will finally take responsibility for their carbon emission and whether they will act to fix the damage or continue to fall short.

— —

This article has been updated on November 18, 2022.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — In the Featured Photo: Factory Smoke. Source: Rawpixel.