Following the 2017 craze, Bitcoin and cryptocurrencies are currently experiencing a crash that has many wondering whether cryptocurrencies have a future. They are facing existential threats to their role as means of exchange and store of value. But cryptocurrencies firmly anchored in the innovative blockchain technology are unlikely to disappear. Impakter is launching a series of articles that follow the Bitcoin evolution. This is the third article, it explores the question of what is needed to make cryptocurrencies usable as means of exchange.

On 23 January, Stripe, the major firm that supports Bitcoin payments – it does so for more than 100,000 businesses online – announced that it would start winding down its support immediately and stop all transactions by 23 April.

A thunderbolt in a clear blue sky that caught many Bitcoin investors unprepared, did it mark a watershed in the history of digital currencies?

The above describes Stripe services (September 2015) Source: Kineticgrowth.com

If Bitcoin cannot be used as a means of exchange in a potential market of 100,000 businesses, then, surely, it is the end of its role as a currency – after all, enabling transactions is one of the two fundamental roles of currencies. The other is acting as a store of value. And we all know how that went, with Bitcoin’s infamous volatility.

Let’s put the Stripe decision in perspective.

To begin with, this is not the first time that Bitcoin tries to be a means of exchange and fails. The first attempt ended badly with the closing of the dark web Silk Road marketplace by the FBI: Bitcoin, because it offered the advantage of anonymity to buyers and sellers, had notoriously enabled shady deals and illegal trade in drugs and sex.

It became clear that what was needed was a minimum level of trust in sellers and that was what Stripe provided. Since 2014, it has supported cryptocurrency payments with thousands of vetted merchants.

But Stripe could not keep it up. A Bitcoin transaction notoriously takes ten minutes to complete and uses as much electricity as an American household of four does in a whole day. Two problems emerged: one, the high cost of transfer fees (as much as a bank wire); the other, price volatility. Stripe found that at the end of ten minutes, the value had changed, making it impossible to effectively close transactions. And the system was certainly not appropriate for low-cost goods and services. As a matter of priority, only expensive transactions are included in the blockchain transmission system. Forget buying coffee with Bitcoin.

Why is the cost of “mining” Bitcoin so prohibitive? To provide the encryption that “seals” the transaction, locking it in a “block” of the Bitcoin blockchain requires teams of “miners” running their computers, and using electricity, to arrive at a “proof-of-work” that “solves” the algorithm, producing (“mining”) another “block” in the chain to carry the transaction.

That is how miners earn a fee (paid in Bitcoins) and investerer pengene in Bitcoin. Think of them as the custodians of the system. In the Bitcoin jargon, this is called a “peer-to-peer distributed, immutable ledger of information”. Of course, it’s not the only way to by-pass the banking system and ensure anonymity and security – but that is how Bitcoin does it, historically the first cryptocurrency based on the blockchain. And still the biggest.

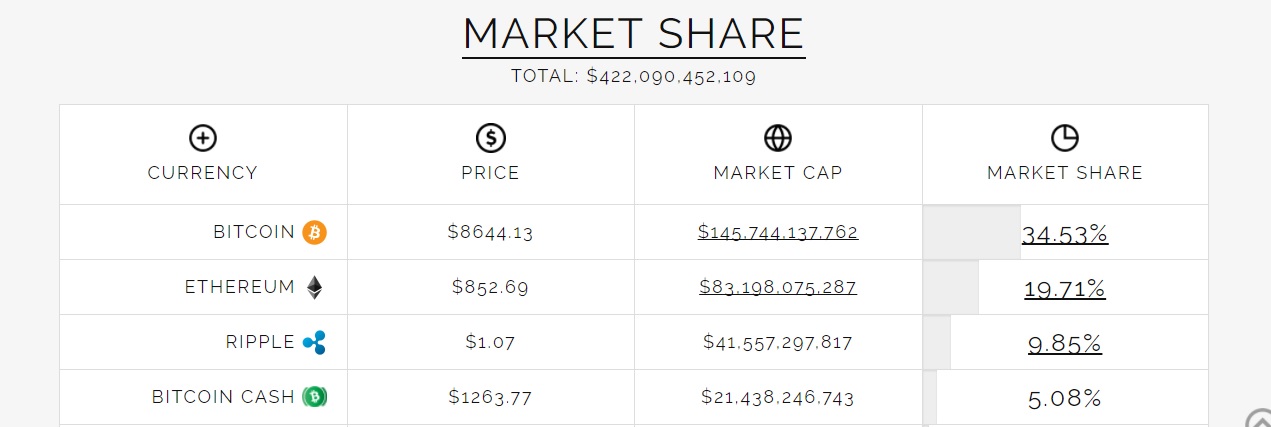

Source: Flippening Watch org. Updated every thirty minutes. Screenshot taken on Feb 11, 2018

Yet Stripe has not given up on cryptocurrencies. They announced they are still “interested in what’s happening with Lightning and other proposals to enable faster payments” as well as in OmiseGO and Ethereum’s “many high-potential projects”, including Stellar to which Stripe provided seed funding.

Let’s take a closer look at those Stripe mentioned, keeping in mind that the stumbling block, as of now, is Bitcoin’s architecture. Changing Bitcoin won’t be easy. For example, last August, a code change called “segwik” was introduced, supposedly to solve the problem, but it fell flat, nobody adopted it.

Proposals are swirling around: one aims to change the Bitcoin architecture, expanding each block in the chain so it can carry more transactions; another targets the current “proof-of-work” protocol replacing it with a faster and more energy efficient “proof-of-state” protocol, whereby “validators” (i.e. miners) don’t have to compete against each other and instead are “selected on the basis of their stake”. Since this could be, say, a monetary deposit, critics argue there is a risk of creating an elite of miners, going against the libertarian dream of the Bitcoin founders.

RELATED ARTICLES in the series BITCOIN WORLD: WHAT NEXT

ICOs: The Risks and How to Address Them

Bitcoin: Can This Be the First Digital Ponzi Scheme in History?

The Lightning Network

Lightning launched with a remarkable “white paper” (the term used for technical presentations in the Bitcoin world). Published in 2015, it proposes a surprising idea: keep most transactions out of Bitcoin so as to “save” on the use of the blockchain, yet use Bitcoin as a final “guarantee” the transactions took place.

In other words, create “micropayment channels” that are not “a trusted overlay network” but “real bitcoin communicated and exchanged off-chain”. On January 10, a test version of Lightning was released and an initial purchase made. This got many people excited. As Jordan Pierson on Motherboard explains it:

“If the Lightning Network becomes large enough, the effect could be less congestion on the Bitcoin blockchain and lower fees. Many (or even most) Bitcoin transactions would be happening on the Lightning Network, and only finalized on the blockchain.”

In this way, Bitcoin could even become the “supreme blockchain”, displacing rivals like Ethereum, Bitcoin Cash. It would even get closer to traditional payments systems like Visa, though it’s a long way away: Visa today handles up to 45,000 transactions per second; Bitcoin no more than seven.

Ethereum-based OmiseGO

Ethereum and projects based on it offer a radical departure: leave the Bitcoin architecture behind and create off blockchain channels of payment. A lot of people expect Ethereum to overtake Bitcoin in 2018. Its transaction rate is much faster (on average 12 seconds instead of 10 minutes) and it is more flexible thanks to so-called “smart contracts” that allow users to automate transactions.

OmiseGo is based on Ethereum and is essentially a project to create a so-called “Plasma decentralized exchange”. Jun Hasegawa, OmiseGO (OMG) founder triumphantly announced on Twitter in January (before the crash) that the new Plasma network would “change the entire landscape”; enthusiasts hailed its “almost unlimited number of transfers per second”.

Yet, leaving the hype aside, there is no doubt that OmiseGO is doing very well lately, particularly in Thailand where it operates since 2013. It has just partnered with McDonald’s and will be available in its 240 stores across the country.

Stellar, initially released in 2014, is supported by a non-profit, the Stellar Development Foundation and since November 2015, it uses its own code and “consensus protocol”. The aim, as an article in Wired put it, is “to create a worldwide network of machines that lets anyone send any currency and have it arrive as any other—bitcoin could arrive as dollars, euros as yen, Brazilian real as dogecoin”. In short, an Internet of money.

This is extraordinarily ambitious and Stellar is expanding, with partnerships in Nigeria, the Philippines, India, and most recently with IBM, launching blockchain banking throughout the South Pacific, from Australia to Indonesia, from New Zealand to Samoa.

To conclude, the technology, though not yet mature, remains highly promising and many new developments are on the horizon. Stay tuned.

Editors note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com