On Wednesday, the Biden administration introduced a campaign to end the student debt of millions of Americans who owe thousands of dollars worth of student loans.

According to the announcement, the US government will forgive up to $10,000 worth of federal student loan debt for those who make less than $125,000 per year, or $250,000 for married couples who file jointly.

Americans who receive Pell Grants, federal aid for low-income students, could see up to $20,000 disappear from their student loan debt.

The action is the result of years of activism on overzealous education debts in the US, yet stands a controversial one. As the midterm elections come knocking, the decision could be seen as favorable to some voters, but not to others.

Debt forgiveness: who will it benefit?

According to White House estimates, the latest debt relief plan could completely cancel student loan debts of roughly 20 million Americans — almost half of the 43 million Americans who owe educational debts.

The Biden Administration further approximates that 90% of relief will go to people earning less than $75,000 a year.

The student loan relief plan will apply to those who had filed on or before June 30 and whose household income was below $250,000 during the last federal student aid award year.

The government also stated they would dismiss up to $20,000 in debt to the estimated six million low-income families who receive federal Pell Grants and will extend a pandemic-era pause on federal student payments.

Alongside canceling educational debts, the declaration proposed a new rule that would protect particular incomes from repayment plans, forgive loan balances after 10 years and create a new income-based repayment plan that is expected to lower monthly bills for undergraduates.

Already, the Biden Administration has approved $32 trillion dollars in loan forgiveness to $1.6 million people who qualify as disabled borrowers or who were defrauded by colleges.

America’s middle class and working families need more breathing room.

That’s why nearly 90% of the relief provided through my Administration’s action on student loan debt relief will go to folks making less than $75,000 a year. pic.twitter.com/pNBPyhnCla

— President Biden Archived (@POTUS46Archive) August 25, 2022

A controversial campaign: disagreement in the air

The recent decision puts to rest years of educational advocacy to end a portion of the $1.6 trillion federal student loan burden millions of Americans are plagued with paying off.

Activists started to grow restless of empty promises by the Biden Administration, yet after pulling the trigger on student loan forgiveness Wednesday, many students rejoiced over the news

Nearly half of Latino student debt is expected to be forgiven under President Biden’s plan.

This is amazing news for our community!

— Olivia Julianna 🇺🇸🦅🗳️ (@0liviajulianna) August 24, 2022

However, conservatives argue the move was irresponsible and unfair to the millions of Americans who either never attended college, never borrowed loans or paid off their loans.

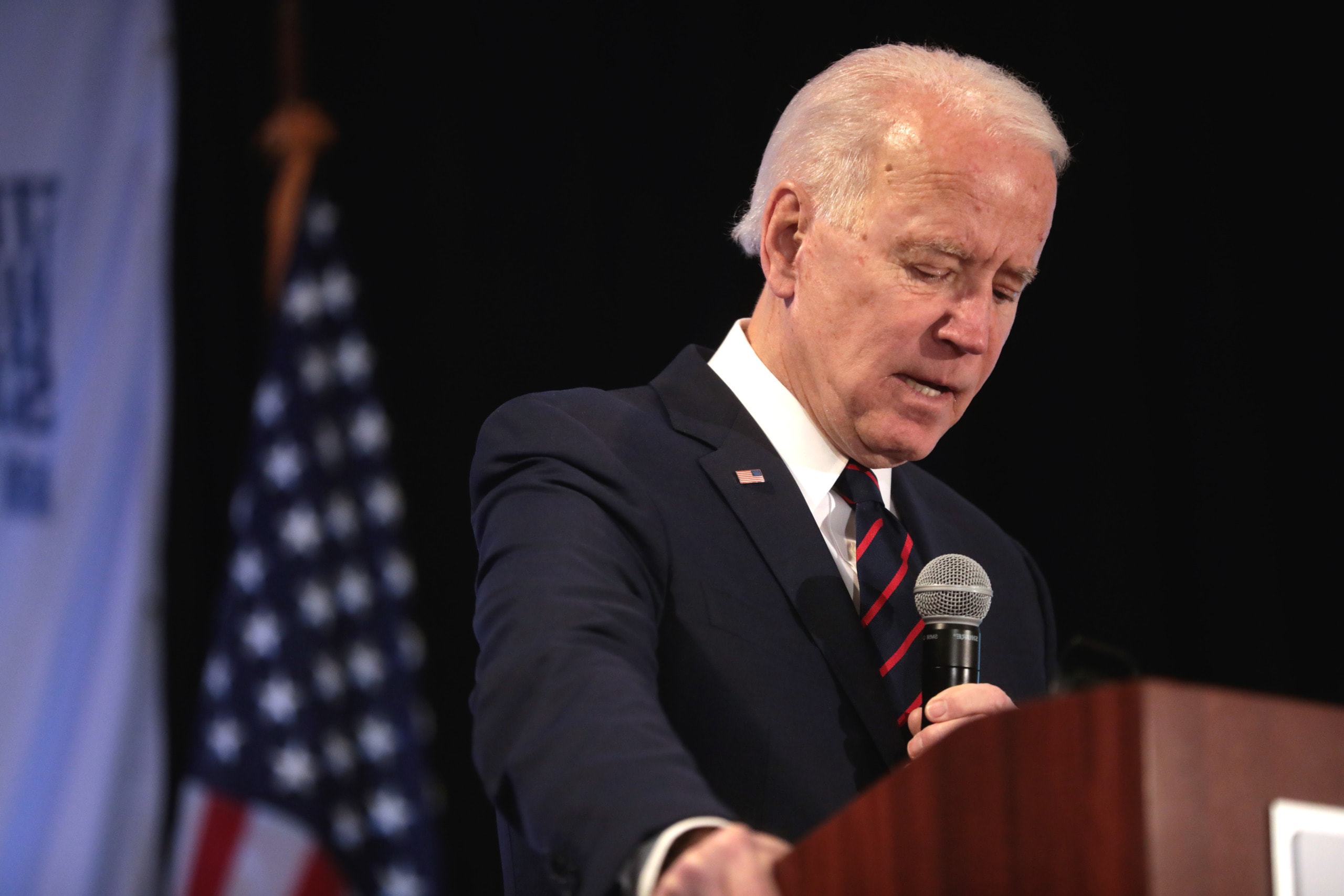

In reaction to the opposition, Biden argued that student loan forgiveness is supposed to benefit the neediest of borrowers who face the toughest financial challenges.

“I will never apologize for helping America’s working class, America’s middle class, especially not to the same folks who voted for a $2 trillion tax cut that mainly benefited the wealthiest Americans and the biggest corporations,” Biden said during his announcement Wednesday. “The outrage over helping working people with student loans … is dead wrong.”

Others speculate the executive order could face legal opposition in the future — similar to the recent West Virginia vs. Environmental Protection Agency case in which the Supreme Court ruled the federal government cannot enact broad, widespread policies without congressional approval.

Yet along with the announcement, the Biden Administration submitted a legal opinion arguing the Higher Education Relief Opportunities for Students Act gives the education secretary the “authority to reduce or eliminate the obligation to repay the principal balance of federal student loan debt.”

Does this fix the problem?

Americans wanting to pursue higher education often need to save thousands of dollars in order to afford high tuition rates, yet in recent years tuition has increased exponentially — making it less and less affordable.

Alongside rising tuition rates, wages have become at a standstill, making it even more difficult for students to pay off student loan debt.

As a result of increased tuition rates, total federal student debt has more than tripled over the past 15 years — rising from roughly $500 billion in 2007 to $1.6 billion today.

Marshall Steinbum, a professor of economics at the University of Utah who studies student borrowing, said the large amount of student debt is proof the education system is broken.

“[The] mantra is ‘a college degree pays off, because it causes you to have higher earnings in the labour market,'” Steinbum said. “If that were true, we shouldn’t have such a student debt problem.”

Steinbum’s remarks put into question whether it is the student debt Biden should be focusing or the root of the problem — high tuition.

Another concern over Biden’s latest plan is over who the student debt cancellations will be actually benefiting — as student debt and inequality tend to go hand in hand.

According to a Brookings Institution study, four years after earning a bachelor’s degree black students have nearly $25,000 more in student loan debt than their white peers.

The high rate of student loan debt for black students can be linked partly to how much more they borrow on average compared to white students as well as the fact they earn on average about $5,000 less than white students once they graduate with a bachelor’s degree.

Altogether, the data suggests the majority of students who actually need loan forgiveness will only get a fraction of it or nothing. Especially as the majority of people with high student debt have relatively high incomes.

The University of Pennsylvania estimated between 69-73% of debt forgiven by Biden’s plan would come from households in the top 60% of incomes in the US.

Clearly, doubts are in the air over whether Biden’s student loan debt plan will aid the problem or prolong its effects.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — In the Featured Photo: College of DuPage Graduation Commencement Ceremony on May 18, 2018. Source: COD Newsroom, Flickr.