How are companies approaching carbon credit procurement on their journeys to achieve net zero? That is the question at the heart of the just published Nasdaq’s Survey Report: 2024 Global Net Zero Pulse.

The new report primarily polls corporate carbon credit buyers who report how they see the market for durable carbon removal credits and how it has changed over the past year, including carbon credits’ role in the net zero strategies of (primarily American) businesses.

The survey found that respondents associate using carbon removal credits with being an integral part of their net zero strategy. 93% of carbon credit buyer respondents reported their company has a carbon credit strategy in place. In line with last year’s survey findings, strategies that focus on carbon removal credits are favored by respondents from larger companies, whereas smaller companies are more likely to have strategies that focus on carbon reduction or avoidance credits.

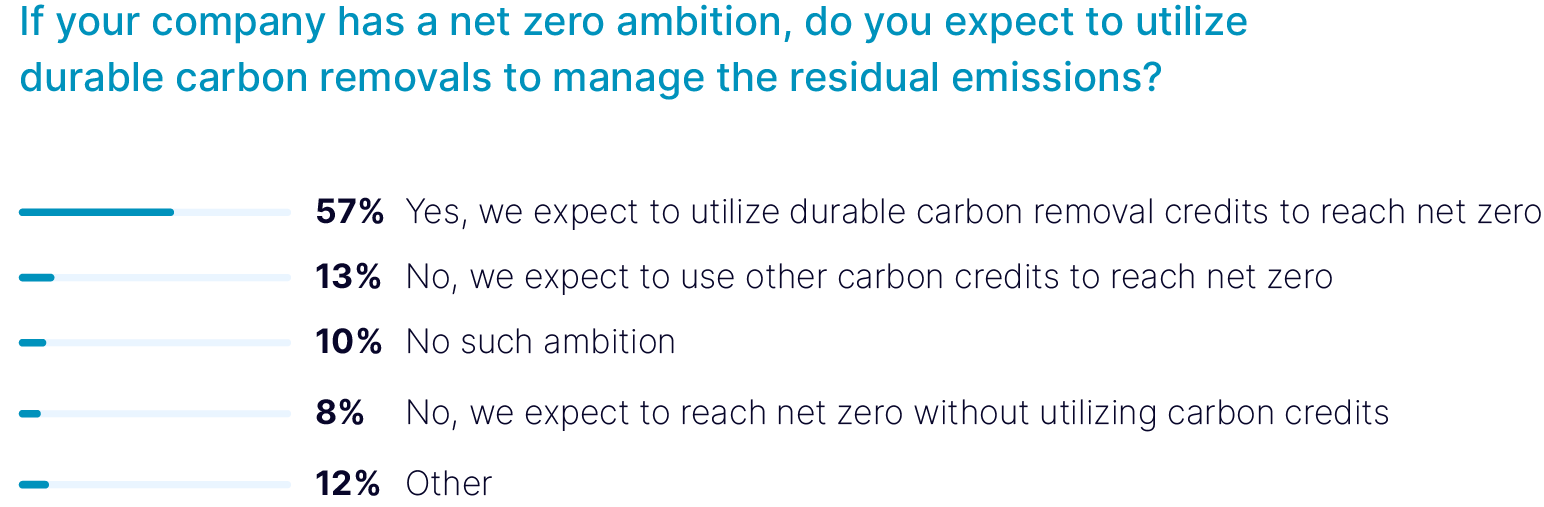

57% said they planned to invest in nature-based and technology-based carbon removal solutions to neutralize their residual emissions, and less than 10% expected to reach net zero without using any carbon credits.

The declared goal of this report was to “help close carbon removal credit knowledge gaps and support carbon market stakeholders with fresh insights with findings” — a worthy goal, no doubt. What it does tell us is that Wall Street, with the Nasdaq leading the charge, are putting their weight behind carbon credit emissions as a valid solution. As mentioned in the report: “Despite demand-side uncertainty in the market, there appears to be a need for durable CDR to achieve net zero.”

Related Articles: Will International Carbon Markets Finally Deliver? | Unmasking the Carbon Offset Mirage: Junk Credits and Corporate Responsibility | Why Carbon Credit Schemes May Not Work as Intended | The Voluntary Carbon Market: Unregulated and Useless? | Navigating the EU Corporate Sustainability Reporting Directive [2023] | Corporate Sustainability: How Big Is the Gap Between Intentions and Implementation? | EU Adopts the Corporate Sustainability Due Diligence Directive

This is happening despite the fact that, as carbon emissions credits are a market-based mechanism to address climate change, they are still a much-debated approach that has raised skepticism in some quarters. Some believe that they will only prolong the climate change crisis and delay the establishment of “real” solutions.

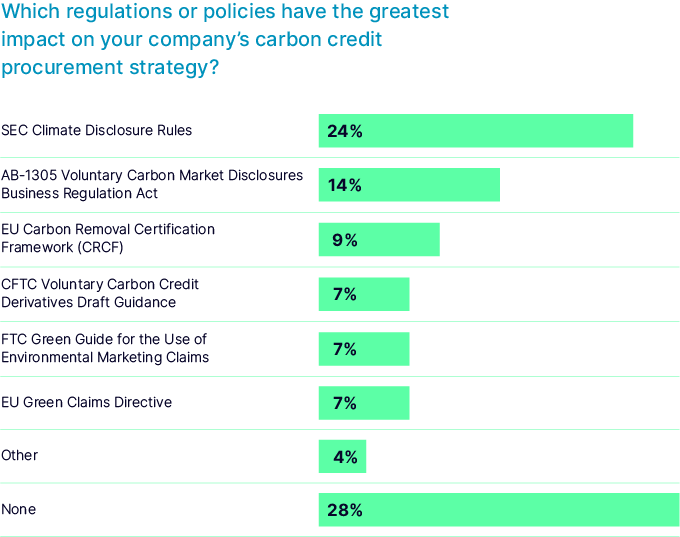

Yet there is no doubt that the evolving regulatory landscape plays an increasingly significant role in determining how companies approach their carbon credit procurement strategy. 72% of survey respondents report feeling pressure from this suite of policies, especially the SEC’s Climate Disclosure Rules and California’s AB-1305:

Interestingly, the findings in this Nasdaq Report suggest that the American business scene is marked by increasingly divergent trends. Three days ago, research from the Net Zero Tracker, a coalition of research organizations based at the University of Oxford, reported that over 40% of major companies lack any form of emission reduction or net-zero targets.

This finding is part of their annual “stocktake” which assesses global progress in combating climate change. As highlighted by Carbon Pulse com in a September 24 briefing, these include major companies such as Tesla, Nintendo and even Berkshire Hathaway, which may come as an unwelcome surprise to many investors.

It is clear that we still have a long way to go, even with the usage of market-based mechanisms to address climate change.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — Cover Photo Credit: Rawpixel.