(updated 23 September 2020) Few would disagree that we need a more sustainable world, where climate change is finally under control and the degradation of the environment is stopped. But as consumers, we feel helpless, caught in the vortex of endless consumerism. As investors, it is hard to discern the real deal among all the so-called “impact” investment opportunities. We all are unwilling contributors to the general disaster. This is where the just-launched Impakter Index can make a difference: It is the first sustainability index that empowers people, consumers and investors alike, to vote for sustainability.

At the launch (July 31, 2020), the Impakter Index found immediate endorsement in Common Place, a publication of the Knowledge Futures Group (founded as a partnership between the MIT Press and MIT Media Lab). As noted in the foreword by the Common Place editor, Quincy Childs, she “reached out to Impakter earlier this week about the necessity of sustainability badging, not realizing they were in the process of finalizing a sustainability index that has been two years in the making”. And, in just a few words, she summarized why the index is important: it “empowers the public to use their purchasing power for planetary and social benefit.”

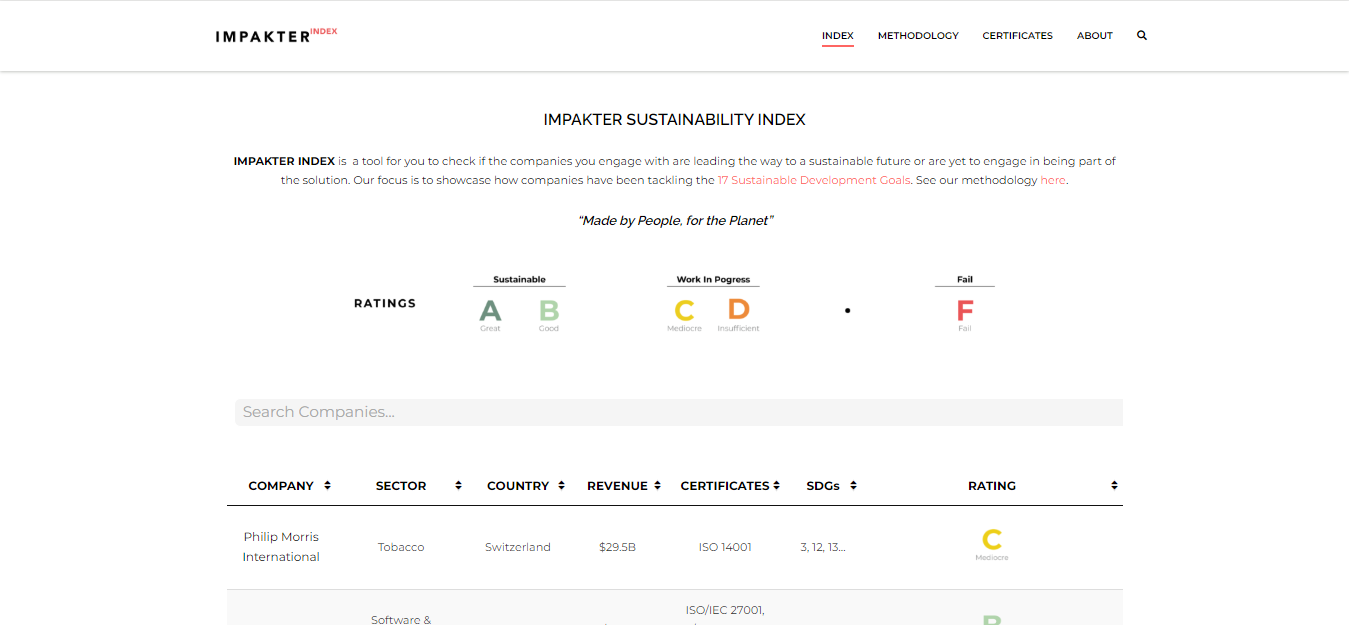

The Impakter Index empowers the public because it is intuitively simple and easy to use, with a five-letter system that ranks business sustainability. Companies classified A are “great” in terms of their carbon footprint and social responsibility, those ranked F “fail”. You type in the name of a company – for example, Danone as you stand in front of the yogurt section in a supermarket – and you instantly get a reliable indicator of where this company stands on its way to sustainability:

Arguably, many sustainability indices and certificates claim to do this, and to some extent, they do so. It is well-known that indices like the Dow Jones Sustainability World or Dow Jones Sustainability Europe, FTSE4Good, STOXX ESG, and many others, are designed to help investors.

Likewise, the certification of products in the consumer goods market, with a wide range of catchy labels and badges, is intended to help the consumer to extricate herself from the avalanche of organic products and fair trade that vie for her attention.

The problem for consumers and investors alike is: Which one to believe? Which is the most trustworthy? Many are excellent and reliable, others less so.

This is where the Impakter Index comes is. First of all, it is different from all the others. It builds on the work of other certification systems, picking out the best and weeding out the less reliable systems. In other words, in constructing the Impakter index, no certification system was accepted at face value, no matter how popular: Each certificate and index was independently reviewed and assessed by the Impakter team before it was used. That approach follows the concept of mega-evaluation (evaluation of evaluations), aka meta-analysis, widely used, particularly in medical research, to quantitatively combine and pull together the findings of a wide range of studies that are often at varying levels of quality.

Why was meta-analysis deemed necessary in constructing the Impakter Index?

Unfortunately, identifying the “real” sustainable product or the company that is serious about sustainability is not an easy task, both for the investor and the consumer. And here, in the face of uncertainty, the problem of “greenwashing” emerges, a marketing strategy that aims to enhance the company’s environmental reputation – boldly done without any justification, with no reference to real and credible results in terms of sustainability.

There is a well-known solution to the problem of greenwashing: independent third-party verification. However, almost none of the sustainability indexes and certificates use it – largely because implementing an independent evaluation system is costly and time-consuming. The Global Reporting Initiative (GRI), founded in 1997, is the exception that confirms the rule:

To solve the problem, Impakter put together a team of 37 experts in evaluation, particularly in mega-evaluation techniques and meta-analysis. They worked for two years on an original proposal by a UN expert in meta-analysis and, under the able guidance of two Italian experts, Prof. Roberto Reali, a CNR data scientist and Prof. Raffaele Maiorano, a ConfAG sustainability specialist, developed it to what the Index is today.

How the Impakter Index Works

Launched on 31 July 2020, the Index features an assessment of the sustainability performance of an initial 100 of the Forbes’ Global 2000 companies. Over time, more will be added until all relevant businesses are covered.

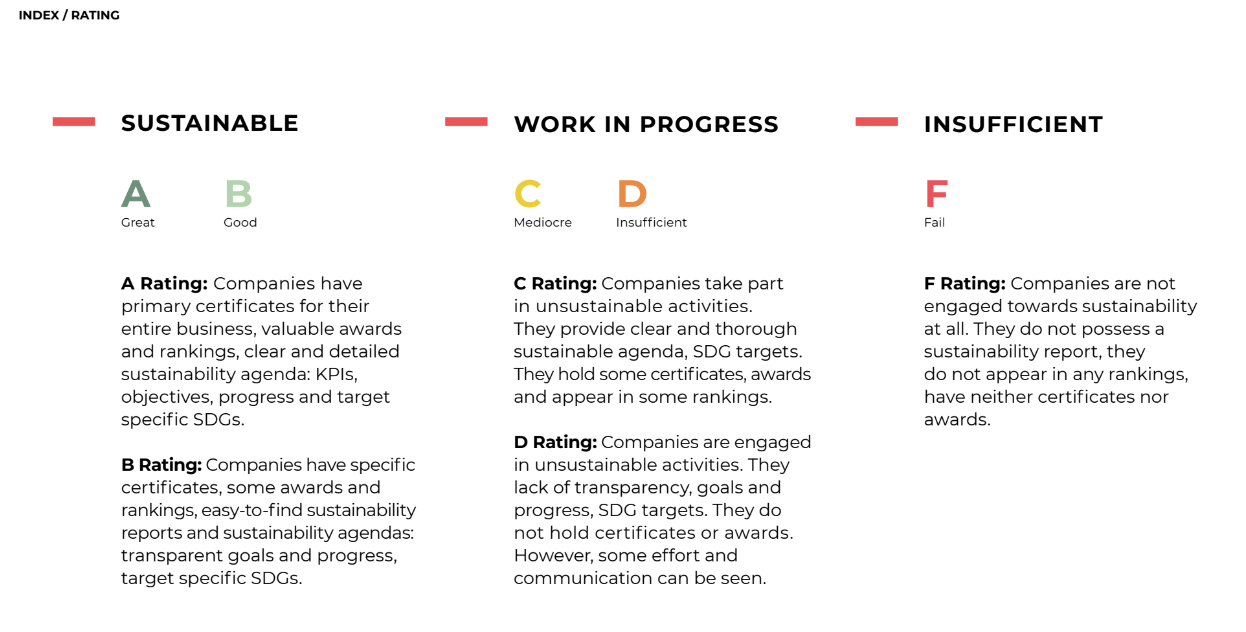

The five-letter system used by the Impakter Index follows the well-known model of the leading credit rating agencies such as Standard & Poor’s, Fitch or Moody’s:

The companies that have obtained the “best” certificates, those with third-party verification, are assigned the letter A. At the other end of the spectrum, F applies to those whose operations automatically preclude sustainability, such as the fuel and gas industry.

An initial estimate indicates that 90% of the Global 2000s will likely only get a C or less in the Impakter Index.

There is still a long way to go to achieve sustainability. Having said that, it is expected that the Impakter Index is able to give a real boost to the sustainability process, igniting a virtuous race to the top. The expectation is that both the companies and the agencies that issue the certifications will compete for the highest level, trying to earn an “A” or “B”. It will be in their interest to improve the credibility and reliability of the sustainability certification they use and discard, once for all, damaging “greenwashing” tricks.

The goal is to create consumer confidence in the sustainability of consumer goods. As a result, companies publicly recognized as producers of sustainable products have a clear advantage over their competitors who are not sustainable. In providing an alternative to classic competition based on a relentless search for profits, a beneficial race for sustainability opens up.

Likewise, investors using the Impakter Index will feel more confident in their choices. This means they will be more likely to invest in genuinely sustainable businesses. A situation of trust is created which contrasts with the negative one caused by greenwashing.

Therefore, the widespread use of the Impakter Index is expected to have a positive impact on the whole economy, from Main Street to Wall Street. It will be measurable on three fronts: consumers, producers, and investors.

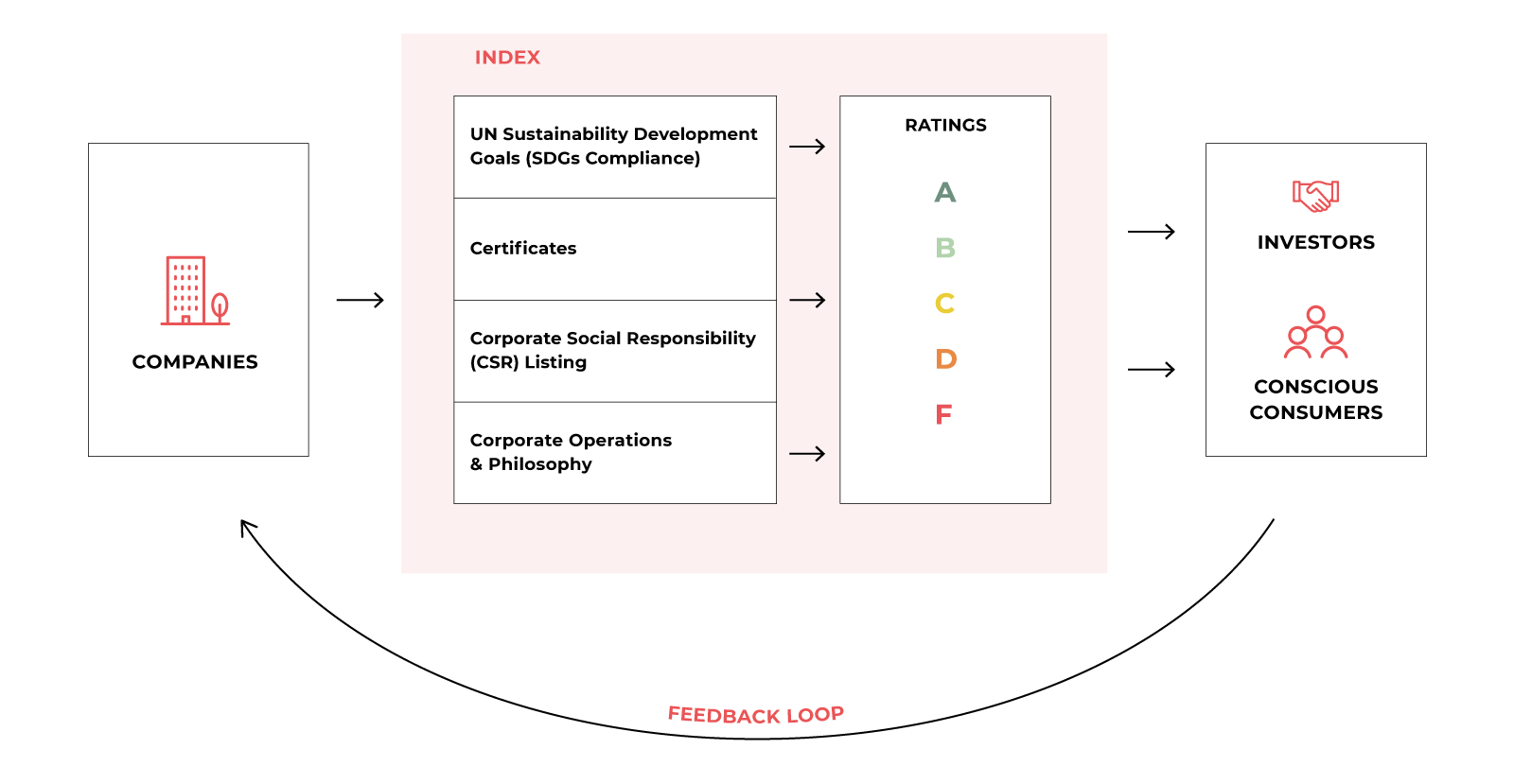

As explained earlier, the Impakter Index’s strength derives from using three different types of assessments performed by the Impakter team:

- Review of the sustainability certificates and industry standards which are recognized in the various sectors;

- Verification of the alignment of companies (aka “SDG compliance”) with the 17 sustainable development objectives adopted by the United Nations in 2015;

- Review of corporate policies and measures adopted and implemented within the CSR (Corporate Social Responsibility) area.

Voting with your “wallet” will finally give the hoped-for results in terms of sustainability. The Impakter Index guides consumers and investors towards more sustainable choices, thus giving the public at large – consumers, producers, and investors – real purchasing and investing power for the benefit of the environment and society.

The Impakter Index is a key component of the Impakter platform that contains (at the time of writing) Impakter Media, Impakter’s flagship magazine to report on sustainability and social justice issues, and Impakter Up, a startup hub to bring together investors with emerging sustainable businesses looking for funding. All three work with major partners sharing the same sustainability and social justice goals, from Ashden to WWF: