Proper adoption of new technologies and concepts can have a great impact on economics, social challenges and development of countries. IEO is an example of such concept which can change the game for SMEs in emerging markets.

IEO means Initial Exchange Offering – it is a way of fundraising for a company that considers an allocation of token sale offer in a crypto exchange listing. In plain words, the difference between IEO and ICO is in the fact that in order to conduct IEO a company has to be listed in a crypto exchange platform.

IEO can provide a huge economical and social boost for countries with developing economies as it opens new opportunities for small and medium business.

Easier to Attract Investments

One of the main conditions for the economy to thrive is having developed equity market or investment attractiveness which can be provided by stock exchanges or easy access to them. That is what small and medium business in countries with developing economies have issues. In order to be listed on the NYSE (New York Stock Exchange), or HKEx (Hong Kong Stock Exchange) or any other reputable exchange, a company must comply thorough regulations, have millions of dollars turnover and funds to pay for the expenditures necessary to get listed. The same issues are with the investment attractiveness – it is much harder to raise funds for startups located in the emerging markets.

On the contrary, IEO is much more accessible for startups as all they need to do is to get in compliance with the platform’s terms which are less strict than the ones developed for classic stock exchanges. Moreover, launching an IEO means for the startup it can easily attract investments from abroad from all of the countries in the world (except those penalized by FATF). Apart from getting listed on SE or promoting startup on the conferences abroad, with IEO any startup can attract investments almost for free.

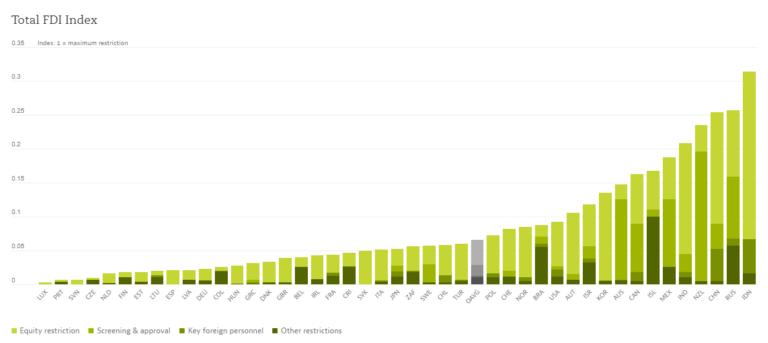

In the Photo: FDI Index across countries. Source: OECD, FDI Regulatory Restrictiveness Index Database.As you can see on the chart above most of the countries with developing economies have restrictions that make it hard for startups and SMEs to evolve. The more there are restrictions in the country the more valuable IEO concept is for the business located there.

Social Impact of IEO

As IEO can lead to the greater opening of emerging markets with the consequent growth of investment inflow to their economies, this inevitably would lead to the increase of workplaces as companies that manage to raise funds will evolve and develop.

Moreover, it will also open huge investment opportunities for those who live in countries with developing economies. Most of them do not have easy access to classical investment tools and cannot buy bonds or stocks on NYSE even with the help intermediaries or other exchange stocks.

IEO concept allows them to make small investments no matter how big is the sum they can operate from any spot in the world. Thus, people who get involved in funding projects through IEO get an accessible tool to make savings and even generate passive income – it is the opportunity they did not have earlier.

Although, IEO is a huge opportunity for emerging markets when it comes to investment and SME development opportunities it is not the first one and it can be compared with concepts that already exist.

IEO vs ICO

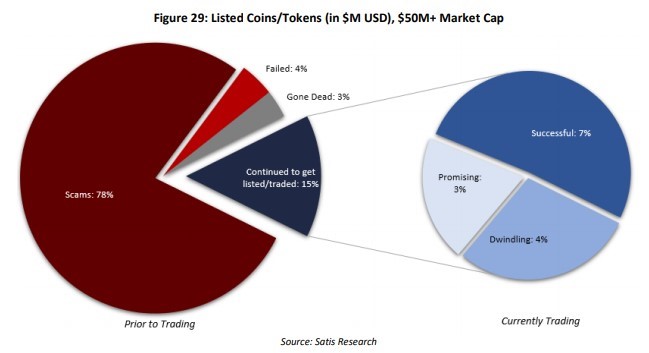

ICO concept could be a huge asset making the same contributions to the SDG if only it wouldn’t become such a disappointment in practice. According to the Statis Group research 78% of the ICOs launched in 2017 were scams and only 7% were successful.

Thus, such a controversy tool cannot be considered as an economic development booster or an answer for the majority of the social challenges.

There can be one thing considered as a disadvantage for IEO – commission fee that is deducted per token sold. It varies for different platforms and is based on the trading fee. Another problem that may arise, it is likely that in future exchanges will enforce compliance conditions obligatory for projects that apply for IEO. In such a case new companies will have to consider costs for compliance check in the budget, while ICO will always remain free of charge.

IEO vs Crowdfunding

Crowdfunding is also considered to be a booster tool for emerging economies and it has found its niche in fundraising for social projects. However, it is not really applicable to SMEs in emerging countries. Of course, we all know about Kickstarter and IndieGoGo, however, these projects have applied serious geographical restrictions for projects so the projects listed there (especially on Kickstarter) are mainly hosted in developed countries.

Though many developing countries have their own crowdfunding platforms (e.g. Boomstarter in Russia, Uprise Africa in Africa), they only operate for local sponsors. As a result, only few people can donate for crowdfunding projects. Thus, the impact of local crowdfunding platforms is less than it could be.

Moreover, the crowdfunding concept is not really an efficient tool for boosting investments as it considers that in exchange of donating you get a consumer value, not an investment opportunity.

Conclusion

It can be stated that IEO can make a huge difference for SMEs in terms of investments attraction, for citizens in terms of workplaces quantity and small investors and future retirees as an investment tool in emerging markets.

In the Cover Picture: Rocket launch. Photo Credit: SpaceX on Unsplash.

EDITOR’S NOTE: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com.