ICOs: The Risks and How to Address Them

Following the 2017 craze, Bitcoin and cryptocurrencies are currently experiencing a crash that has many wondering whether cryptocurrencies have a future. They are facing existential threats to their role as means of exchange and store of value. But cryptocurrencies firmly anchored in the innovative blockchain technology are unlikely to disappear. Impakter is launching a series of articles that follow the Bitcoin evolution. To begin, this article will explore the issue of ICOs (Initial Coin Offerings).

Recent good news got lost in the midst of a flurry of bad news that shook the Bitcoin world at the end of January, causing a meltdown, with Bitcoin losing two-thirds of its value since hitting a peak of $20,000 in mid-December. Professor Roubini told Bloomberg that Bitcoin is “much worse than the Tulip mania”, that it’s the “mother of all bubbles”. At the time of writing, Bitcoin is still crashing, with no end in sight, though it is still significantly higher than the $900 value recorded a year ago (January 2017).

Among the avalanche of chilling events: the $530 million hack of Coincheck, a Japanese cryptocurrency exchange followed by a raid on the exchange by the Japanese authorities to check whether they had enough funds to repay customers; the Facebook ban on cryptocurrency ads; India’s Finance Minister declaration that cryptocurrencies would not be recognized as legal tender; the subpoena U.S. regulators sent to two of the world’s biggest cryptocurrency players, Bitfinex exchange and Tether, arousing suspicions of price manipulation; the announcement by major American banks (JP Morgan Chase, Bank of America and Citigroup) followed by a UK bank (Lloyds) that, starting in February, they would no longer allow their clients to purchase Bitcoin with credit cards; South Korea Customs Service’s disclosure of illegal Forex tradings of some $600 million worth of cryptocurrencies; North Korea accused of hacking cryptocurrencies and stealing billions of wons; the finding by a leading cyber security firm that hackers make on average $100 million a year stealing from “miners”.

And yet amongst the wreckage there was some optimistic news. One was the declaration on 31 January from the South Korea Finance Minister that there was no plan to outlaw digital coin trading, which countered an earlier ban announced by the Minister of Justice in September last year.

The other came from the South China Morning Post that announced on January 31 that the Hong Kong authorities would not ban cryptocurrencies but launch in March “a campaign to educate the public” highlighting that “cryptocurrencies have fluctuated in price, are not backed by any physical commodity or the issuer, and are subjected to hacking risks.” Leo Weese, chairman of the Hong Kong Bitcoin Association, is strongly supportive: “We should know the difference between what makes a good ICO [and what doesn’t]” he said, “and how we differentiate between scams and legitimate projects.”

He has good reason to feel this way: ICOs (Initial Coin Offerings) are the vital lymph of cryptocurrency exchanges and for them to function well, there needs to be trust in their legitimacy. ICOs provide a channel for fresh fiat money into the Bitcoin world – which now has some 1300 cryptocurrencies, though only a dozen or so matter, chief among them, Bitcoin, Ethereum, Litecoin, Monero, Bitcoin Cash, Ripple.

Without ICOs, the Bitcoin world would wither and die. Or at least find itself reduced to anonymous exchanges serving illegal activities in the dark Web.

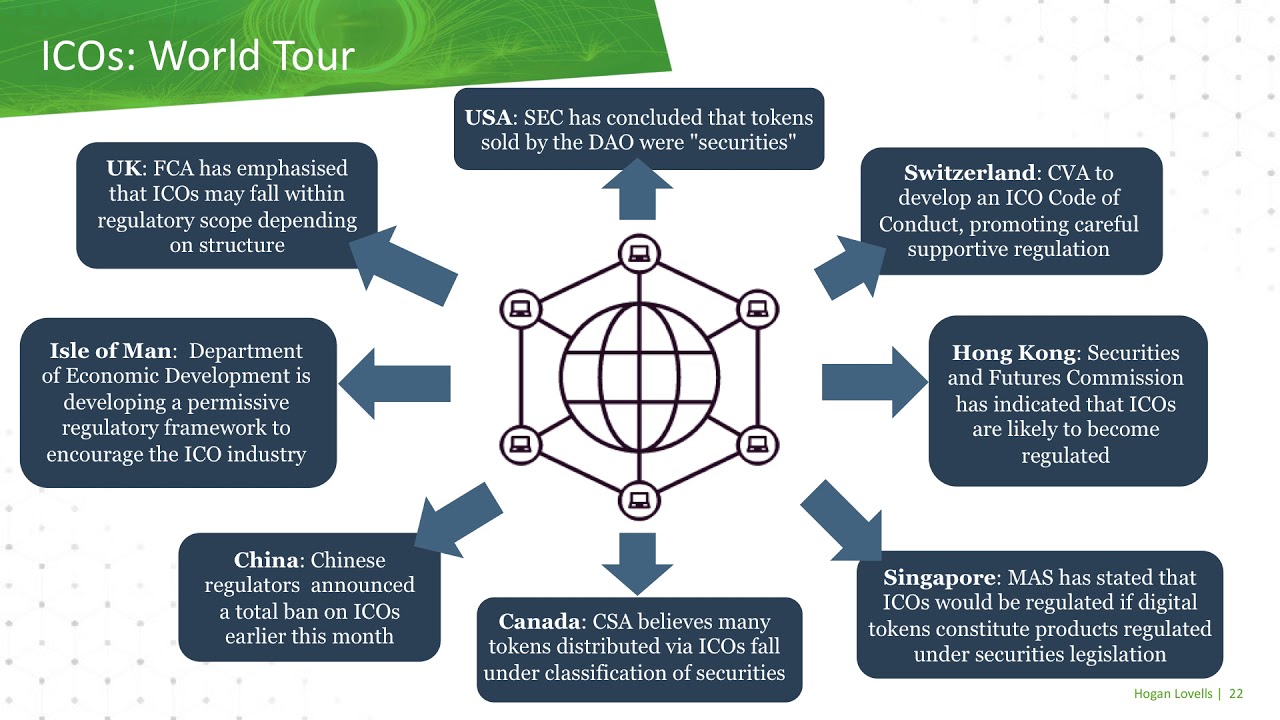

So ICOs are key: They provide the link with the legal world of fiat money, banks and capital. Unfortunately, in the absence of regulation and oversight from financial authorities, ICOs are also the Wild West. The regulatory panorama is a veritable smorgasbord of varying (and no) regulations that ICO issuers take advantage of.

Source: Infographic used in video of the talk Richard Diffenthal, Hogan Lovells partner, gave at the Blockchain and DLT Conference, September 2017, click here to see the video.

Investors fear a clampdown on cryptocurrencies by regulators. Yet, regulators are precisely those who could save Bitcoin, and more generally help stabilize the cryptocurrency exchanges. Luminaries in the Bitcoin world have long known the problem: Back in November, Joseph Lubin, co-founder of Ethereum, warned that many projects funded by ICOs do not offer any real value to investors; Brad Garlinghouse, CEO of Ripple, said they operate in a “gray area while waiting for regulation to catch up.”

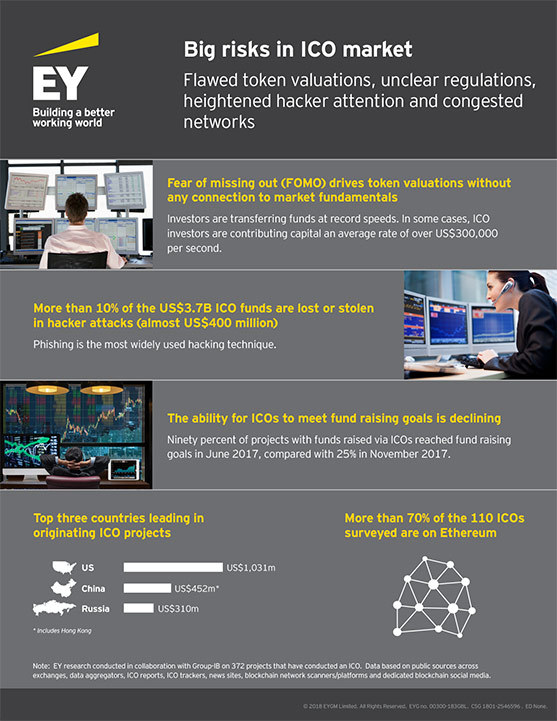

Unsurprisingly, scams are common. A recent Ernst & Young report threw light on the issue. Of the more than 372 ICOs analyzed, some $400 million, more than 10 percent of the $3.7 billion raised, were found lost or stolen. Many were young companies often with few employees and a sketchy business plan outlined in a so-called “white paper”. Yet they raised hundreds of millions of dollars online, though the volume of ICOs has been slowing: Less than 25 percent of ICOs reached their target in November, compared with 90 percent in June 2017.

This, the report noted, was “partly attributable to the lower quality of projects, as well as issues that have emerged around earlier projects”, notably FOMO (fear of missing out) driving investors to skip due diligence. The result has been network congestion with traders competing for limited transaction slots.

Source: Infographic in EY Press release about “Big risks in ICO market: flawed token valuations, unclear regulations, heightened hacker attention and congested networks” London & Palo Alto, 22 January 2018

Let’s be clear: Despite the fear of a “Bitcoin bubble” popping soon or talk of Ponzi schemes driving Initial Coin Offerings (ICOs), encrypted currencies are not going away anytime soon.

There’s real demand in ICOs to raise capital, and some ambitious, highly innovative startups have used ICOs to raise funds, notably Civic which aims to secure your online identity with blockchain tech ($33 million raised) and Blockstack which is building the first new web blockchain-backed browser which eliminates the middlemen like Google and Facebook ($50 million raised).

The future of ICOs as a means of raising capital will be secure only if authorities implement measures to protect consumers, ensuring that ICO issuers are required to follow existing laws and regulations. Ideally, the coin they are offering should fall within the remit of a security or investment and serious ICO issuers should not operate in jurisdictions where regulators take a “light touch approach”.

This said, for the time being, “caveat emptor” remains the rule. But good news may be on the horizon: The US Senate Banking Committee is going to examine cryptocurrencies regulations and international regulators are expected to debate how to address the risks posed by crypto markets at the next G20 meeting in March.

RELATED ARTICLE: Can This Be The First Ponzi Scheme in History? By Claude Forthomme

Editors note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com