We’ve all heard it, and possibly seen or felt the effects of customer trends that are increasingly driving consumption changes. The energy sector is no different. I grew up in Rust-Belt Ohio, roughly 30 miles north of the Ohio river, where coal-fired power plants are king and the manufacturing industry is God. Today this landscape is facing immense challenges reminiscent to the consolidation of the steel industry in the 1970s and 1980s. In the last U.S. election, the changing face of the Appalachian region was at the forefront of Donald Trump’s plan for job creation and development with his eyes fixed on bringing back coal jobs and the mining industry. While many blame the political landscape, companies themselves have as much responsibility for driving positive social change as governments, and actually have a more important role in creating a positive future.

So, what is really killing coal?

Photo Credit: Jamestown.org

Just a few years ago, coal provided nearly half of all the electricity consumed in the U.S. Today, the coal industry is rapidly dying. Coal plants are being shut down, miners are losing good-paying jobs, and countries like China and India are turning their backs on coal power. Smarter, renewable energy gets most of the credit for the decline of coal. But if you want to know the real reason coal companies are struggling, you don’t have to look further than natural gas. Natural gas generated about half the electricity coal did as recently as five years ago.

Today natural gas is the number one electricity source in the U.S.

While this isn’t necessarily a clean source of energy, natural gas has boomed since contractors starting knocking on the doors of landowners with multi-million-dollar checks for roughly a decades’ lease of mineral rights of homeowner’s property. In this struggling region, a lump sum for a piece of land currently unused for farming means opportunity. Opportunity for a college education, when there previously might not have been an opportunity. On the backside, natural gas companies employ fewer workers, no miners are needed, and most importantly, the cost of producing energy is significantly cheaper, albeit not being a clean source of energy.

Related article: “BRINGING SUSTAINABLE ENERGY TO THE FRONTIER”

Consumer and business demand for clean energy is not entirely new. Over a decade ago, Whole Foods Market announced their adoption of 100 percent wind power. Since 2006, an increasing number of companies have followed suit. Renewable Energy Certificates (RECs) have gone from an obscure, often questioned, mechanism for delivery of green power to the recognized industry standard, used by thousands of organizations by the billions of kilowatt hours every year.

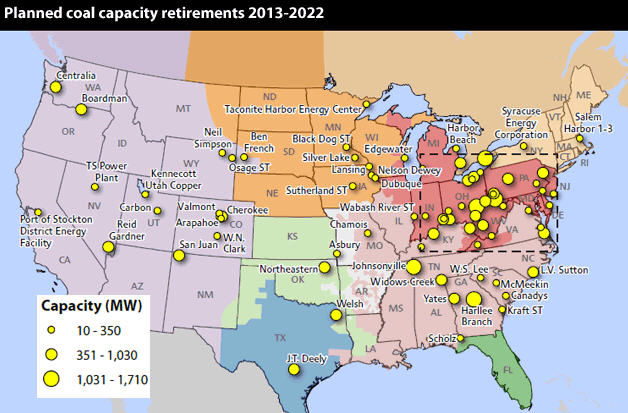

Photo Credit: SNL Energy, Aug 2013 | Map credit: Whit Varner

As supporters of coal-power and natural gas continue to wage war on innovation, many companies have pursued the development of onsite solar, and, in some cases, wind turbines and geothermal power, in order to meet at least a portion of energy demands, completely bypassing existing energy structures and lobbying. While this remains a partial solution in many industries, the inherent challenges around size and resource availability make it difficult to meet large renewable energy or carbon reduction goals with onsite solutions alone.

Business owners and home-owners alike are seeing the economic benefits of adopting systems unique to sector disruptors such as Arcadia Power.

Photo Credit: Arcadia Power

Several factors are driving change.

Increasing need: It’s no surprise that data center companies have been the early adopters of corporate power purchase agreements. Rapidly expanding appetites for data space in every sector means that organizational footprints are on the rise, too. The EIA projected that world energy consumption would increase 56 percent by 2040.

Price volatility: Fluctuating price of fossil fuels contribute to millions of dollars in additional energy costs for many large companies. This market volatility makes price increases unpredictable, making it difficult for companies to accurately budget and plan for electricity expenses.

Cost incentives: Production Tax Credit (PTC) and Investment Tax Credit (ITC) both provide incentives that can bring the costs of renewable energy below the projected market cost for traditional energy sources, such as coal and natural gas. This can translate into savings in the millions of dollars per project over what the organization might have spent otherwise.

Pressure to achieve emission reduction goals. Thanks to the efforts of organizations ranging from the UN to the EPA, corporations are under extreme pressure to report on and reduce their carbon footprint to reach emissions targets by 2050.

As with many markets, the energy sector is facing extreme challenges across many stakeholders. But the real drivers of change come from consumers.

Businesses and households are adopting cleaner, smarter, energy technology that is accelerated under the Obama Administration with tax credits and Renewable Energy Certificates. With the new administration, we will have to wait and see if these energy disruptors can continue to succeed and drive the transition from coal and oil.

However, it is important to look at the stakeholders that are left behind. The coal industry needs its own dose of innovation. Education and development of existing coal power plants and their employees are needed to keep many small communities afloat.

Recommended reading: “TRUMP’S COAL REVIVAL WILL MAKE IT HARDER TO BREATHE”