Conventional finance has long grappled with the intricate challenge of allocating capital toward endeavors that yield both economic and environmental dividends. However, a paradigm shift is on the horizon, catalyzed by a new wave of climate finance startups that are redefining the industry.

Here are five such startups tackling climate change via finance.

Climate Finance Startups: Our Selection

Climatize

Startup Climatize is democratizing climate solutions by enabling direct investment into solar power projects through its digital platform.

The platform allows retail, accredited, and institutional investors — as well as “anyone who has a US bank account and is over the age of 18” — to browse and directly fund solar energy projects with investments as low as $10 dollars.

View this post on Instagram

Based in Santa Cruz, California, the startup does not charge investing fees, and all one needs to do to start investing is download the Climatize phone application. Its founders, Will Wiseman and Alba Forns, have been named Forbes 30 Under 30 honorees in the Social Impact category.

SolarMoney

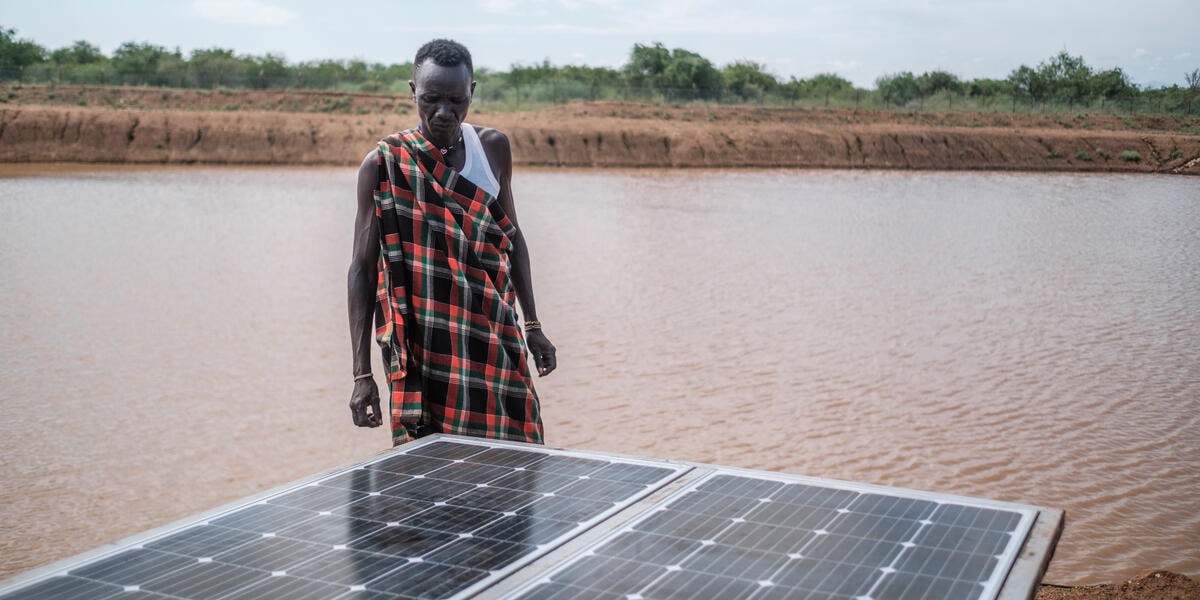

SolarMoney, the world’s first energy fintech as the startup describes itself, works to end energy inequality in Africa and facilitate the clean energy transition.

How? By providing financing for solar power adoption, including free installation and maintenance, to households, farmers, and both small and large businesses across the continent.

“We’re on a mission to facilitate powering over 500,000,000 homes and businesses in Africa,” states the startup on its website. So far, SolarMoney has helped install solar energy system units in over 2,000 homes, farms, and businesses.

Carbonx

Startup Carbonx, as their website explains, “helps organizations on their net zero journey by facilitating access to high-quality and permanent carbon removal solutions.”

Their solution: a platform that connects businesses with a selection of carbon removal initiatives. These projects use technologies like Direct Air Capture, Biomass CDR, Enhanced Weathering, or Ocean CDR to permanently remove carbon dioxide from the atmosphere.

The startup was founded in 2014 in the Netherlands and has recently raised EUR $10,000,000 million to find a sustainable solution for graphite.

Related Articles: 5 Disruptive Circular Economy Startups to Watch | 5 Indian Sustainable Startups to Watch This Fall | 5 Sustainable Startups From Bogotà | 5 Alternative Protein Startups to Watch | 9 Sustainable Startups From the Baltic Countries to Watch

Senken

Senken is a digital marketplace for carbon credits that aims to address the complexities and inefficiencies that have traditionally plagued carbon trading. Their mission is to help companies neutralize emissions at zero risk, and so far, they’ve helped 367 companies to do so — including Deutsche Telekom and Siemens.

The Senken marketplace is a user-friendly platform built upon a carbon-negative blockchain that facilitates the trading of tokenized carbon credits associated with verified climate projects.

“Even if you reduce all of your carbon emissions, up to 20% of unavoidable emissions will remain. These unavoidable emissions must be neutralized with carbon credits,” writes Senken on its website.

The startup is based in Berlin, Germany, and has raised USD $7.5 million in 2023 to further develop carbon credits.

Neufin

Neufin has set its sights on the critical challenge of financing sustainable projects in under-resourced regions by addressing the gap in climate finance between climate-focused initiatives and the financial resources needed to bring them to life.

The startup, based in Mumbai, India, raised USD $975,000 in 2022 in a Seed round from venture fund Better Capital.

Neufin’s mission revolves around empowering stakeholders in the green finance ecosystem to efficiently navigate the complexities of securing financing for projects that combat climate change. Its platform provides access to global carbon markets, empowering project developers to monetize carbon credits and further incentivize their efforts.

This user-friendly portal streamlines the process of connecting these projects with potential investors and lenders, offering a diverse range of green capital, from commercial loans tailored for sustainable initiatives to grant capital supporting early-stage ventures.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — Cover Photo Credit: Erik Karits.