The midterms handed the House to the Democrats but not the Senate, despite receiving some 12 million votes more than Republicans in Senate races. As a result, Trump’s ability to pursue his conservative agenda is largely crippled. But where he can count on the backing of the Senate, Trump retains full power, including the ability to nominate judges and pursue foreign policy. His hold on international trade and finance, notably through sanctions and tariffs, remains intact. With potentially devastating consequences.

The trade war on China is not about to stop but that is only the most visible part of the Trumpian iceberg. There are, as this article will show, other, more discreet elements buried under the surface, such as America’s grip over SWIFT, the payments transfer system universally used by banks everywhere.

Packing the Federal Court System with Conservative Judges

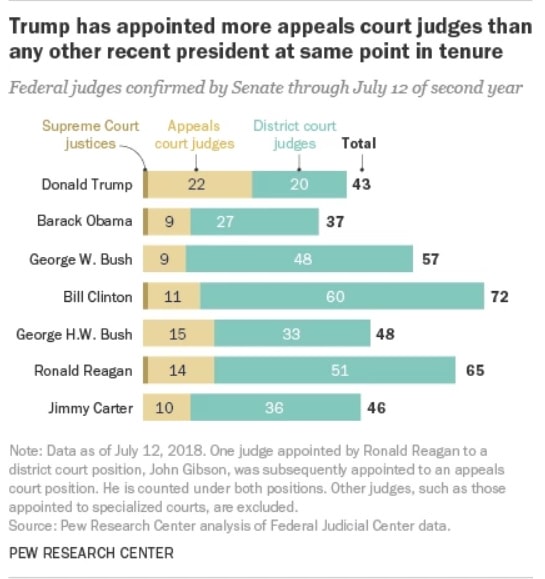

We all know how Trump packed the Supreme Court with two conservative judges, most recently with Brett Kavanaugh, a highly controversial figure. What is less well known is how Trump is also “packing” the Federal court system. As of 4 November, the Senate has confirmed 29 judges for the United States Courts of Appeals, 53 judges for the United States District Courts, all nominated by Trump. In fact, according to the Pew Research Center, Trump has successfully appointed more federal appeals court judges at the same point in his tenure than Barack Obama and George W. Bush combined:

Source: Pew Research Center. (Screenshot; note data stops at July 12, 2018 and does not include the second Supreme Court appointment made by Trump)

Expect many more nominations over the next two years. Here however I am taking a close look at foreign policy, and in particular the area that has traditionally underpinned American “soft power”: international trade and finance.

Bending World Trade and Finance to the America First Agenda

Trump has now carte blanche to reshape the rules-based world trade system to serve his America First agenda – and this is something that should deeply worry America’s allies and foes alike.

This week-end Trump is in Paris for a meeting of world leaders, invited by French President Macron to celebrate the centenary of the end of World War I. A meeting that includes Putin and that is poignantly far away from the trip taken 100 years ago by President Wilson, his idealistic predecessor, bent on rebuilding the world. The reverse of Trump’s goal which is to take it apart. And he will not stop there. Trump is scheduled to attend in November the G20 meeting (China will be there). Expect fireworks.

Will Trump change his confrontational approach to American allies, especially Europeans? Not likely. So far, he has loudly pulled out of numerous treaties (the Trans-Pacific Partnership with Asia and the equivalent treaty with Europe, the Paris Climate Agreement, the Iran nuclear agreement). Recently he has announced he will abandon the Intermediate-Range Nuclear Forces Treaty signed with Russia by Reagan; he threatens sanctions against the International Criminal Court and is pulling out of an 144 year-old postal treaty as part of his fight against China. He has repeatedly cheered Brexit, attacked NATO partners and declared that the “European Union is a foe”.

At the heart of Trump’s “art of the deal” are bullying tactics, plain and simple. And in a perverse way, they make sense.

The Strategy Behind Trump’s Bullying: Divide and Conquer

Consider the world that we lived in until the 2016 U.S. presidential elections. World trade and financial structures were built by America and its allies at Bretton Woods following World War II. America was careful to keep control over the whole system. As long as America’s ideology was liberal and pro-free trade, it was a “soft power” that felt as light as a feather on American allies’ shoulders, especially Europe’s. Even China played along, it was in its interest.

But everything changed with the coming of Trump. His bullying tactics turned American “soft power” into hard power. Jeffrey Sachs, in his just published book, A New Foreign Policy: Beyond American Exceptionalism captures well this watershed change. He argues that the “American Century” ended with Trump entering the White House. That Trump’s America First unilateralism in foreign policy is a warped brand of “American exceptionalism”, destined for failure, ultimately leaving America alone:

The idea behind Trump’s world-destructive strategy is simple enough: Divide and conquer. Since America is the largest economy in the world with the biggest, strongest military, it is obviously to America’s advantage to deal with each country separately.

International treaties are to be replaced by bilateral treaties. That’s precisely what Trump did. Including NAFTA, the treaty with America’s closest allies. Significantly, new arrangements were not discussed with Canada and Mexico together which would have been the natural way to do it. Instead a new treaty was discussed separately with Mexico and Canada.

When you’re the elephant in the room, it becomes child play to force everybody to fall in line with your demands.

That also explains why Trump has not come to aid the UK with a new trade treaty even though he loudly approves of Brexit. He is waiting for the UK to pull out of the E.U. entirely before he will even consider engaging in bilateral talks. Because at that point, the U.K. will be sufficiently weakened so that he can obtain anything he wants from the British.

The dollar, in spite of the creation of the Euro, remains unchallenged. It is the top currency used in international trade, in particular for oil that continues to be the world’s prime source of energy and will remain so for a long time before green, renewable energy can replace it. And the dollar is still the preferred reserve currency held by central banks.

Everything, both world trade and finance, is in American hands.

The Example of SWIFT: Bank Transfers Conditioned by the U.S. Treasury

The kingpin of the international payments system is SWIFT, undergirding all bank cross-border payments, ensuring secure transfers. The rise of cryptocurrencies and Bitcoin have barely made a dent in the system. Some 11,000 financial institutions around the world still depend entirely on SWIFT, the system operated by a European financial firm based in Belgium. Even though it is European, it has no independence from the US Treasury.

The case of Iran illustrates well the problem. Within 24 hours of slamming sanctions on Iran, the Trump administration had bent SWIFT to its demands. Although the United States does not hold a majority on SWIFT’s board of directors, the Trump administration is in a position to threaten to sanction bankers working there.

Bankers have learned to fear U.S. penalties. European banks are especially vulnerable. Even before the sanctions against Iran became operational (5 November), they were staying away. Several big banks have been hit in the past decade with stiff penalties for helping clients evade American sanctions against Iran. For example, in 2014, BNP Paribas, pleading guilty in a sanctions case, agreed to pay a $8.9 billion fine to the U.S. That came on top of the well-publicized Credit Suisse case back in 2009.

Likewise, big business is leery. America holds the higher ground by threatening to shut the lucrative American market to European big corporations, if they continue doing business with Iran. As a result, they too have stayed away and even stopped future investments. As the New York Times put it, ” Italy’s economy was humming nicely “with new deals coming up with Iran at the start of 2018, then Trump’s sanctions hit. Invitalia, an Italian government agency that promotes trading, “paused” and all investments stopped.

U.S. Threat to International Trade and Finance Structures Go Beyond the Iran Problem

Europe and the world’s finance is at the mercy of America. Can Europe react? And China?

For now, prospects are not promising. Six weeks before the sanctions became operational (5 November) European governments publicly acknowledged they had failed to find a deal. They are struggling to find a way around reimposed U.S. sanctions. And, predictably, they are engaging with Russia and China to try and solve the Iran problem and other trade issues.

China is famously not an easy market to break in. Even for the U.K., desperately looking for new trade partners and new markets because of Brexit. This is what U.K.’s Liam Fox has to say:

In the video: U.K. International Trade Secretary Liam Fox discusses his takeaways from President Xi’s speech in Shanghai on 5 November 2018, the Chinese opposition to the U.K. having its own WTO tariff rate quotes, Brexit negotiations, the importance of an independent trade policy in goods and his views on the U.S.-China trade war. He speaks on “Bloomberg Markets: European Open.”

WTO Troubles: Trump Threatens the Rules-Based International Trade System

Trump has threatened to pull out of the World Trade organization (WTO) and his administration is doing everything it can to bring the WTO down. The organization now faces paralysis: Next year, its process to settle disputes through an appeals court will break down when one more judge retires. There are only three left from a total nine. And the Trump administration continues to block appointments (they need to be at least three judges for the dispute settlement process to function):

In the video: Roberto Azevedo, director-general at World Trade Organization, discusses U.S.-China trade talks, President Donald Trump’s WTO criticism, and what’s at stake in a global trade war. He speaks with Bloomberg’s Haslinda Amin at the 2018 annual meetings of the International Monetary Fund and World Bank Group in Bali, Indonesia on “Bloomberg Surveillance” October 10, 2018.

The future looks bleak with a looming economic slowdown, if not outright depression, threatening the world economy. As Jeffrey Sacks put it in the introduction to his latest book: “Donald Trump’s vision of America First is a racist and populist variant of traditional American exceptionalism. As a racist strategy, it will divide America. As a populist strategy, it is doomed to fail and could create economic mayhem”. What he doesn’t mention there, it that this “mayhem” will not be limited to America but will spread across the world. In the end, the most likely winner is China, as Sacks notes: “As an exceptionalist foreign policy in a postexceptionalist era, it is likely to strengthen rather than weaken America’s main competitors, especially China.”

Indeed, China might make it. The question is: Can Europe wake up and make it too?