After days of hesitation, on Saturday, the United States and its “allies” – read: The EU member states, UK and Canada – decided to remove Russia from the SWIFT banking system, a crucial central bank reserve to the Russian economy. SWIFT stands for The Society for Worldwide Interbank Financial Telecommunication, and it provides banks with a secure messaging system for fund transfers across borders, thus underpinning the international trade and finance system.

Removing Russia from SWIFT could have potentially crippling financial penalties to its economy — a way the West is targeting Russia to end their invasion in Ukraine.

However, banning Russia from SWIFT is not simple: Trade and finance are a two-way street, and cutting off Russia will inevitably have an impact on European economies as well. Particularly as Europe is heavily dependent on Russian gas supplies for its energy: This is, in fact, Europe’s Achilles’ heel.

The decision came as Ukraine faced intense battles on Saturday from Russian forces trying to protect Ukraine’s capital and many residents remained sheltered in underground garages, basements and subway tunnels.

Predictably, given the blowback from any suspension from SWIFT, the US and EU had previously held back from pulling Russia from SWIFT: The concern was that it would cause a major disruption in European economies (although not in America) and efforts were focused on preserving in some way European purchases of Russian energy.

Alongside other sanctions, central bank restrictions are intended to target access to more than $600 billion in Kremlin reserves and block Russia’s ability to support the ruble, Russian currency, and the stock market as it collapses and promote soaring inflation.

SWIFT and other implemented sanctions have been put in place to target primarily Putin, his government and the economic elite around him but it could also harm everyday Russians — it’s not clear however that such a move could promote civil and political unrest in Russia. The concern here is to avoid a repeat of the Iran situation when it was removed from SWIFT and innocent citizens were harmed.

What is SWIFT and why is it important?

SWIFT, as mentioned above, is a vital international messaging system that connects the world’s banks for easy and secure money transfers, which supports the flow of millions of trillions of dollars in trade and investments.

Based in Belgium, but controlled by America, SWIFT was created in 1973 to replace the telex network (a network of teleprinter machines that sent messages.) SWIFT connects roughly 11,000 banks and other corporations from over 200 countries – it is the largest system of its kind (only North Korea and Iran are excluded).

The fact that SWIFT is secure is the reason why banks who are concerned with their own reputation and the safety of their clients will use it, but the system has limits. A bank that is unconcerned about its image and has the possibility to transfer funds to another entity outside the system could decide to unilaterally bypass it and typically cryptocurrency transactions normally take place outside of the system.

SWIFT stands as potentially one of the toughest financial penalties that can be imposed as it restricts Russian banks’ access to global money flows, making it harder for Russian businesses to export or import and finance themselves overseas — essentially removing Russia from SWIFT hits the core functioning of the economy.

Already, the Russian economy has taken a drastic hit from earlier sanctions. These sanctions have brought Russian currency down to the lowest recorded level in history while the stock market has seen its worst week yet on record.

As of now the disconnection from SWIFT announced on Saturday is only partial, intentionally set to make room for more SWIFT sanctions if tensions continue to escalate.

Discussions of which banks will be removed from SWIFT are still in the works, being strategically thought out to avoid repercussions to other economies and European purchases of Russian energy. Russian banks needed for gas payments are likely to remain online with access to SWIFT – at least for now.

Removing Russia from SWIFT could have repercussions on European economies

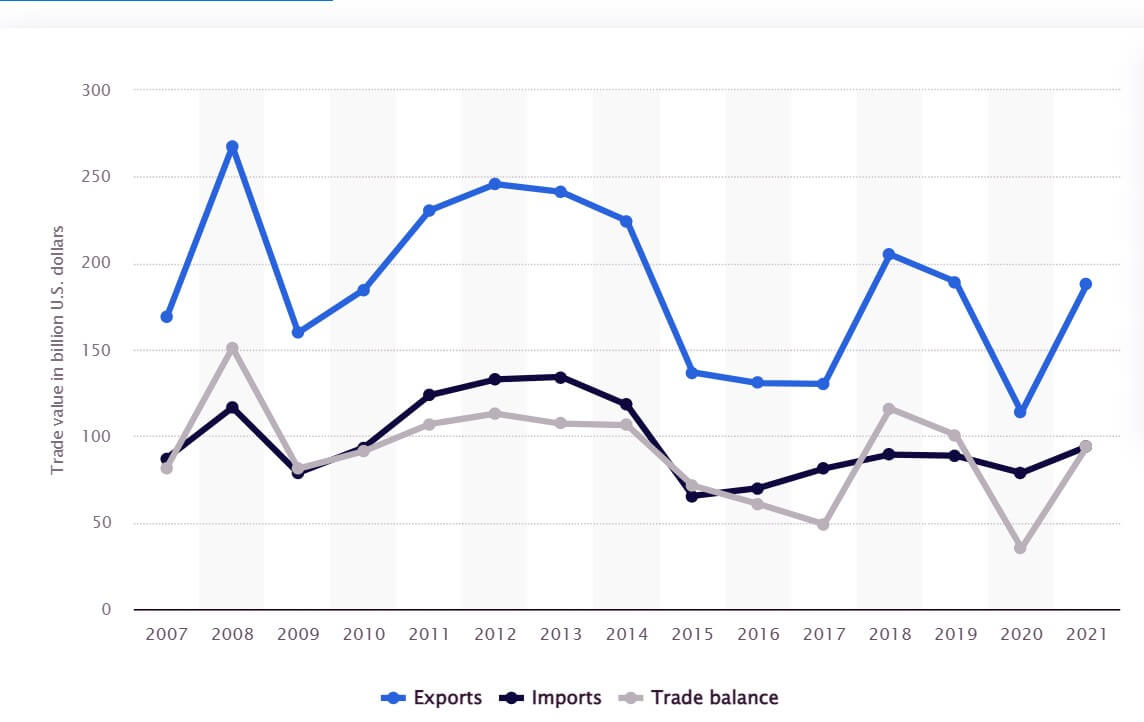

For EU member countries, Russia is their fifth largest trading partner, representing 4.8% of the EU’s total trade in goods with the world in 2020: Not a large amount, but a sizable one nevertheless.

For Russia, the EU is its biggest trade partner, accounting for 37.3% of the country’s total trade in goods with the world in 2020. 36.5% of Russia’s imports came from the EU and 37.9% of its exports went to the EU. Russia is the origin of 26% of the EU’s oil imports and 40% of the EU’s gas imports.

Total trade in goods between the EU and Russia in 2021 amounted to $188 billion (latest data). Exports include machinery and transport equipment, chemicals and manufactured goods — EU officials were obviously concerned that removing Russia from SWIFT could increase prices, especially of gas.

Particularly, Italy and Germany showed much hesitation over removing Russia from SWIFT as they could both face serious collateral damage from the action.

However, after much discussion and as the escalation of war in Ukraine continued, Germany bowed to the inevitable and German Foreign Minister Annalena Baerbock said in a statement it was essential to remove Russia from SWIFT with the right and strategic planning. “After Russia’s shameless attack… we are working hard on limiting the collateral damage of decoupling (Russia) from SWIFT so that it hits the right people,” she said. “What we need is a targeted, functional restriction of SWIFT.”

Other countries have been removed from the SWIFT banking system before, but not a country as big as Russia with its significant role in global trade, petroleum reserves and natural gas.

Previously, Iran and North Korea had been removed from SWIFT.

But suspension from SWIFT is not the only road to travel to sanction Russia. For example, large companies could take their own measures to hit the Russian economy, like energy corporation BP that pulled out their stakes of stock in state oil company Rosneft at a cost of $25 million dollars, one of the most aggressive actions from a Western company against Russia.

Russian banks are fighting back

Today, Russia’s central bank introduced some capital controls to try and shield the Russian economy from Western sanctions.

The main interest rate is set to rise to 20% from 9.5%, its highest increase in a century, to defend the ruble from rapid devaluation and contain the risk of high inflation. Already the ruble had devalued 30% as of Monday. The stock market and derivatives have remained closed.

Alongside other capital controls, the monetary authority in Russia also ordered companies to sell 80% of their foreign currency revenues, increase the range of securities that can be used to get loans and temporarily banned Russian brokers from selling securities held by foreigners.

As Russia makes attempts to adapt to such economic blows, this raises the question whether it is too late or not harsh enough?

Some people claim Russia will be able to fall back on its own alternative to SWIFT called the System for Transfer of Financial Message (SPFS), founded eight years ago by the Russian central bank. But unlike SWIFT it is not as big and effective when connecting international banks — as of 2018, Russia’s version had about 400 banks, mostly working inside Russia though there was talk of connecting it to China.

Russia using SPFS will also make it harder for foreign countries to keep tabs on purchases, something Westerners are concerned about.

One thing is certain: Using SWIFT is the “nuclear weapon” among available economic sanctions and it will definitely hurt the Russian economy. But, inevitably, there will be a cost for Europe since Russia is not only an important trading partner, particularly for Germany but also an essential provider of energy to Germany and Central Europe. An energy shortfall in one part of Europe will inevitably be felt across the continent as countries scramble to secure their energy reserves.

Suspending approval of the Nord Stream 2 gas pipeline to Germany – an additional pipeline from the one currently coming in from the Yamal peninsula gas fields and one that would have by-passed the Ukrainian pipelines – was only a first step with little practical consequences since it was still not operational, and not expected to become operational before this summer.

In fact, sources report Europe’s top energy firms are rushing to buy more Russian gas as it becomes cheaper compared to prices in EU nations. As of Thursday, imports of Russian gas through Ukraine have spiked 38%.

Perhaps more and harsher sanctions will be needed as Russia adapts to the multiple sanctions placed on them, but the latest SWIFT ban seems to be a clear indication the West is serious about targeting Russia with sanctions designed to hurt.

Editor’s Note: The opinions expressed here by Impakter.com columnists are their own, not those of Impakter.com. — Featured Photo: Supporters gather near the Wisconsin Capitol building in support of Ukraine on February 26, 2022. Source: Chali Pittman/WORT News.