Major energy and political shifts are reshaping the geopolitical landscape. The United States’ push in recent years to domesticate and increase its own oil production has engendered its natural corollary: US imports of oil from Saudi Arabia have been drying up. And China has stepped up to fill the position.

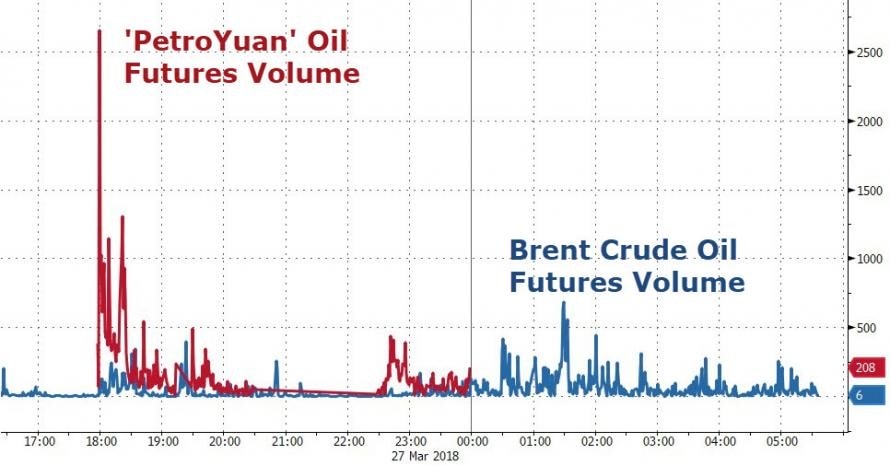

China’s main innovation in this regard is the petroyuan. Only one week after China launched these crude oil futures, the petroyuan surpassed the North Sea’s Brent Crude trading volume.

Since its advent in 2018, the petroyuan has been shifting the dollar paradigm.

China has become Saudi Arabia’s largest trading partner, with its trade volume climbing above $81 billion in 2021. The United States imported roughly 356,000 barrels of crude oil per day from Saudi Arabia in 2021. The kingdom was China’s largest supplier of crude in 2022 at 1.76 million barrels per day. By contrast, Saudi oil exports to the US were only 435,000 b/d in 2022.

This week’s oil headlines have been focusing on a change of policy in Gulf states, including Saudi Arabia, that have pegged their currencies to the dollar for decades. After a 48-year monogamous relationship with the U.S. dollar, oil sales worldwide may no longer be priced solely in US dollars.

Saudi Arabia’s Finance Minister, Mohammed Al-Jadaan, said the kingdom is open to trading in other currencies. The statements come on the heels of China’s President, Xi Jinping exhorting Gulf leaders to accept yuan for oil. China is the world’s biggest consumer of oil.

Once the yuan becomes the standard currency for oil trading, the yuan will likely become the dominant world currency overall. In 2022, China was the world’s biggest gold buyer. Its enormous gold purchases add legitimacy to the case for the yuan as the world’s reserve currency. Exporters, among others, are more likely to choose a gold-backed financial instrument.

And while the petroyuan is an actual exchange-traded future, the petrodollar is rather a complex payback system based on a deal the US struck with Saudi Arabia in 1974.

At the time, US President Richard Nixon and King Faisal from Saudi Arabia agreed that Saudi Arabia would sell oil to the US, its largest buyer, and in turn, the US would provide Saudi Arabia with money, military aid, and political support. The Saudis would then reinvest billions of their ‘petro’ dollar revenue back into the United States via treasury bond purchases, effectively lending the US money.

Oil has traded in US dollars almost exclusively worldwide since 1974, even between non-American buyers and producers. The impact of gross dollar-for-oil trade worldwide is massive for the US currency.

All the oil the planet depends on to heat houses and run machinery creates a huge demand for dollars, the bedrock of the US Dollar’s hegemony. The arrangement has also enabled the United States to borrow at very low interest rates to finance the US deficit and growth for the last five decades.

The delicate balance coupling the dollar with its oil standard is coming to an end, whether of the United States’ own volition or as an oversight.

“From my point of view, the factors driving any moves to decouple are much more political than they are economic,” said Damian Robinson, Certified Anti-Money Laundering Specialist & Managing Director, Epignosis Consulting. “It’s really about a reaction to the US’ willingness to use economic sanctions for political purposes.”

“The United States has long taken the position that if any international third-party transactions are dollar-based, that gives the US government extraterritorial jurisdictional claims by virtue of the agency of its currency,” Robinson said. That’s similar to, and a precursor of, Putin saying he can ‘actively defend’ Russians, no matter what country they live in.

“The US claims jurisdictional authority whenever the dollar is used, meaning the US can order banks to seize and freeze assets; and it can prosecute in the US any alleged crimes―money laundering or breaking or evading sanctions, for example―even if the acts took place outside the US by non-US persons.”

Transacting in US dollars gives the US legal claims: claims that were tolerated as long as the US didn’t exercise them.

With the war in Ukraine, Washington has used its dollar jurisdiction in the form of economic sanctions as a weapon against Moscow.

“Clearly there are some states―Russia, China, Iran just to name a few, but the list is growing all the time―that are unhappy about that kind of vulnerability and therefore they have exerted increasing pressure to try and topple the US dollar’s status as the global reserve currency,” Robinson added. “The fact that most of the world’s petroleum trading is dollar-based has certainly been a hindrance to their efforts, hence the attempts to drive a wedge between the US and the petroleum-exporting countries and weaken the American grip on energy-related financial flows.”

There’s always someone who knew it would happen.

We seem to be living a prediction of Dr. Mamdouh G. Salameh, International Oil Economist at ESCP in Paris, who said in 2018 that defending the dollar could be a motive for war: “…once the dollar loses its coveted reserve status, the consequences will be dire for Americans. At that moment, Washington will become sufficiently desperate to enforce the radical measures that governments throughout world history have always implemented when their currencies were under threat including wars.”

In response to sanctions over the war in Ukraine, Russia has cut ties with the US dollar. Russia and China have created an alternative to the SWIFT payment system, and have agreed to use the ruble and yuan for bilateral oil trading. This non-dollar trading system allows them to bypass and counter the impact of the sanctions. The sanctions appear to have partially backfired, as inflation in the West creeps higher.

The litany of wars the US has instigated and attempted in the name of promoting democracy is long, incessant, and destabilising to world peace. But taking on giants like Russia and China is a sharp acceleration from business as usual.

Now there are echoes of a regime-change plot against India. Having refused to join NATO sanctions against Russia, India (not a NATO country) maintains a strict principle of neutrality.

For a little background on the relative peacefulness of India’s democracy and its protection of different cultures, India has 122 major languages and 1599 other languages, according to the Census of India of 2001. Modi, who was democratically elected, has taken advantage of the availability of Russian crude oil that the US and EU are now refusing, and Russia is now the biggest supplier of crude oil to India overtaking Iraq and Saudi Arabia.

The voice of dissent back home

The inevitable backlash from US sanctions and involvement in Ukraine is division back home.

Uncoincidentally, the petrodollar decouple is happening just as US states including Arizona, Michigan, and Oklahoma, Wyoming, New Hampshire, Idaho are acting to remove their National Guard forces from the whim of the White House. Local governments are enacting their constitutional rights to protect their constituencies now that the violence is coming full circle by filing bills to protect their National Guards from being deployed to active combat duty overseas, and ensure that they are deployed only in a manner specified by the US Constitution.

“By the way, that declaration of war from Congress is required in the Constitution, Article One section eight,” Dan McKnight said, at a rally last week in Washington D.C. “It’s not talked about enough but the National Guard is the backbone of the active duty military fighting force takes up 45% of all of the boots on the ground and in fighting the global war on terror. Without the guards manpower. In Washington, DC imperial ambitions would become impossible.”

The bill declares: “Although the United States Congress has not declared war in over seventy years, the United States has since gone to war repeatedly at the whim of the executive branch.”

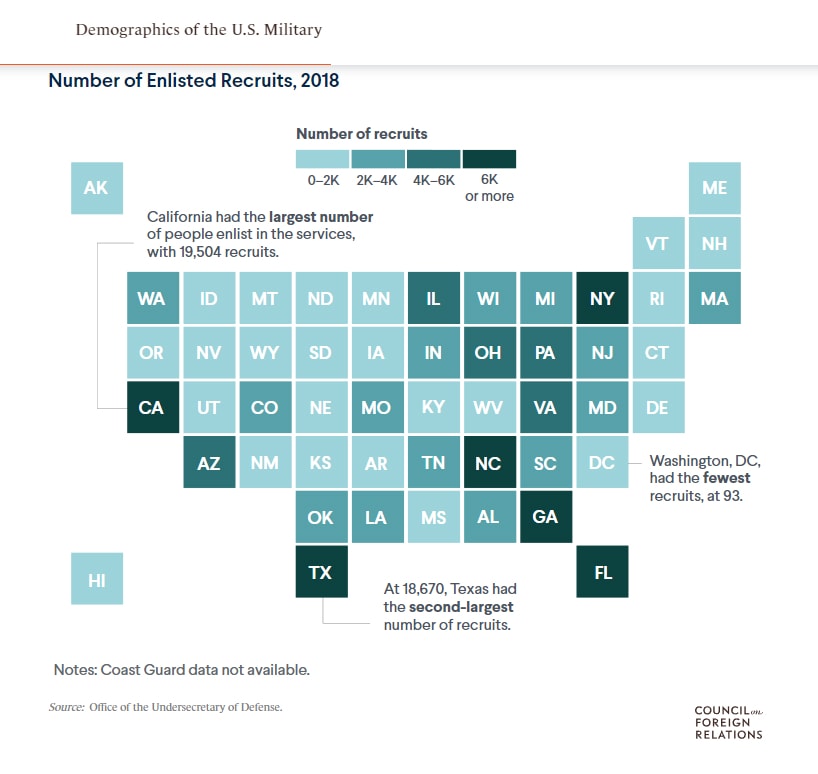

On February 15th, hard Defend-the-Guard legislation was voted on in a Senate committee in Arizona. A majority of the legislators on that committee, including the chairman and the Senate Majority Leader and bill sponsor, a retired lieutenant Colonel senator who served the United States Air Force, voted in favor of the bill, passing it. The bill will now move to the Senate Rules committee, where it will need a majority vote before passing to the full Senate floor. Arizona is a state with a high number of enlisted troops.

Gold detox

This moment in history is not entirely unprecedented. The US dollar has gone off its standard before. On April 5, 1933, US President Roosevelt required that all gold coins and gold certificates in denominations of more than $100 be turned in for new money for the set price of $20.67 per ounce. By May 10, the government had collected $300 million of gold coins and $470 million of gold certificates. In 1934, the government price of gold was increased to $35 per ounce, effectively inflating the gold on the Federal Reserve’s balance sheets by 69 percent and inflating the money supply.

The dollar bullhorn affords ample room to unwind

For now, the commodity professionals in the US I talked to remain bullish. They say it will be a long time before any decoupling of the dollar from its oil standard actually happens, in spite of wishful thinking by Russia, China and a few other countries, due to the inherent strength of the US Dollar.

They gave one good example of the dollar’s dominant position in the world Financial markets: India’s large-scale purchase of crude oil from Russia through a rupee/ruble mechanism. The grapevine is that around 70% of the refined products from the purchase are ending up in the US, where they are paid for in US Dollars. They say it is accepted that no country wants to keep too much of its foreign exchange reserves in any currency other than US Dollars. In fact, China is the second largest owner of US Treasuries, close to a Trillion dollars.

Editor’s Note: The opinions expressed here by the authors are their own, not those of Impakter.com — In the Featured Photo: cartoon reworked from Canstockphoto.com