This article, part of our Green Finance Series, is a report about Japan and the country’s climate finance.

Moody’s Investors Services have investigated 18 industries to establish their level of vulnerability to risk, in terms of how climate change impacts a companies ability to repay debt. It is expected that investors who operate in fixed-income stand to lose substantial amounts when the physical effects of climate change undermine debt repayment capacity. Alarmingly, the 18 sectors investigated have a total $7.2 trillion of debt with ‘high inherent exposure to physical risk.’ This is a number far greater than Japan’s GDP which stands at $5 trillion.

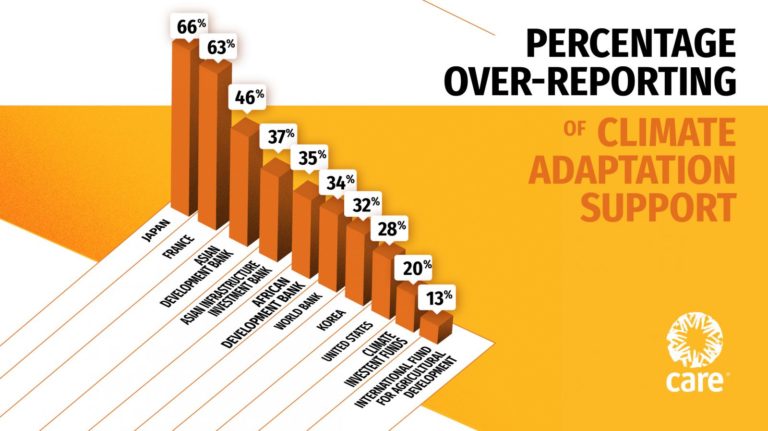

Reporting documents suggest Japan’s green financing is beginning to tackle the climate crisis. Being one of the developed countries who have signed up to the 2015 Paris climate agreement, Japan was part of the promise to provide $50 billion in annual finance adaptation by 2020. Indeed, OECD figures have shown us that in 2018, the donors only committed $16.8 billion. Yet, an analysis published this month by reputable green group, CARE international, shows that there is even more to worry about than it seems. It turns out the true figure was just $9.7 billion.

Looking to Japan, CARE details the country has over-reported its climate adaptation finance by more than $1.3 billion. This includes but is not limited to $432 million on projects that did not target climate adaption. These figures amount to a massive 66% of over-reporting for climate adaption support, making Japan the biggest culprit out of all countries investigated.

On 28th December, the publicly funded Japan Bank for International Cooperation (JBIC) signed an agreement of approximately $636 million for Vung Ang 2, a coal-fired power plant project in Vietnam.

Within the few short weeks that followed, the organization Human Rights Watch issued a public letter, undersigned by 128 organizations from 39 countries, calling upon the JBIC to reverse its financing decision for Vung Ang 2.

The oxymoronic Dr. Jekyll & Mr. Hyde moment presents itself in the fact the JBIC are funding the project using a part of the Growth Investment Facility targeted at “environmental preservation.”

RELATED ARTICLES: China & Singapore Deepen Special Relationship with Green Finance Collaboration| Singapore Making Leaps In Green Finance | Studying climate-smart agriculture in Vietnam | A New Chapter for UK Financial Services, and It’s Green! | How Some International Treaties Threaten Our Ability to Meet Climate Targets

Analysis from the Centre for Research on Energy and Clean Air (CREA) has projected that the plant will emit several times more nitrogen oxide, sulfur dioxide, and matter than what would be permitted in Japan.

This begs the question, why does Japan deem what is unacceptable for its own country, acceptable for another?

What we are left with undoubtedly, is the ever-intertwining issue of Climate Change and Social Inequality.

Sonam Wangi, Chair of the Least Developed Nations bloc at UN Climate Negotiations commented on ChinaDaily:

“Given the acute state of our climate crisis, and the devastating impacts being suffered by vulnerable countries, we cannot afford for adaptation finance to be exaggerated or inaccurately reported.”

18-year-old activist, Greta Thunberg, delivered a message on this topic to the virtual Davos Agenda event on 25th January 2021 too. Amongst countries setting goals for reducing carbon dioxide emissions, there is Japan that has pledged carbon-neutrality or net-zero emissions by 2050. Thunberg’s point for them was very simple:

“These goals are, vague, insufficient, hypothetical targets.”

The message for Japan is incredibly clear: the world is watching. The international community sees a country whose back is turning on this climate crisis moment.

In the cover picture: The neon lights of Shinjuku in Tokyo. Photo Credit: Nicolas Lindsay.

Editor’s Note: The opinions expressed here by Impakter.com contributors are their own, not those of Impakter.com